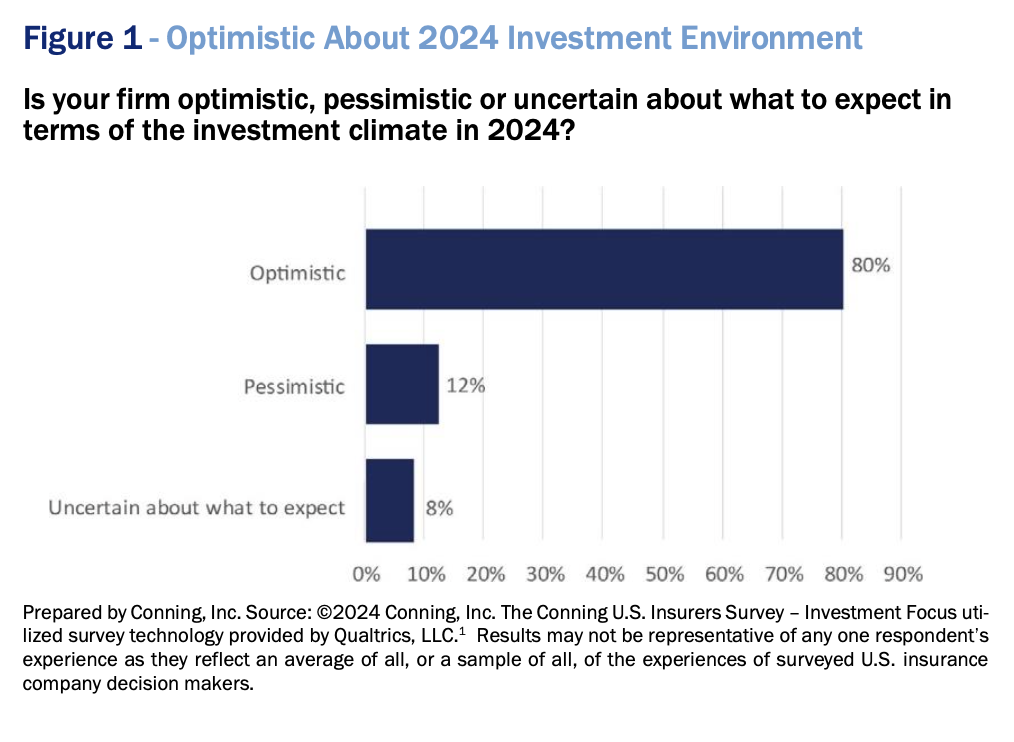

U.S. insurers appear to be optimistic about investment conditions for 2024 (see Figure 1) and expect to take on more investment risk, according to a recent survey of 300 investment decision makers in the U.S. insurance industry commissioned by Conning.

And while insurers expect their investment risk tolerance may rise, higher yields in traditional public market fixed-income sec- tors have made those one of the larger areas of expected portfolio increases. Other sectors that insurers expect to allocate more to include private equity, private credit and private placements, and real assets including infrastructure and real estate.

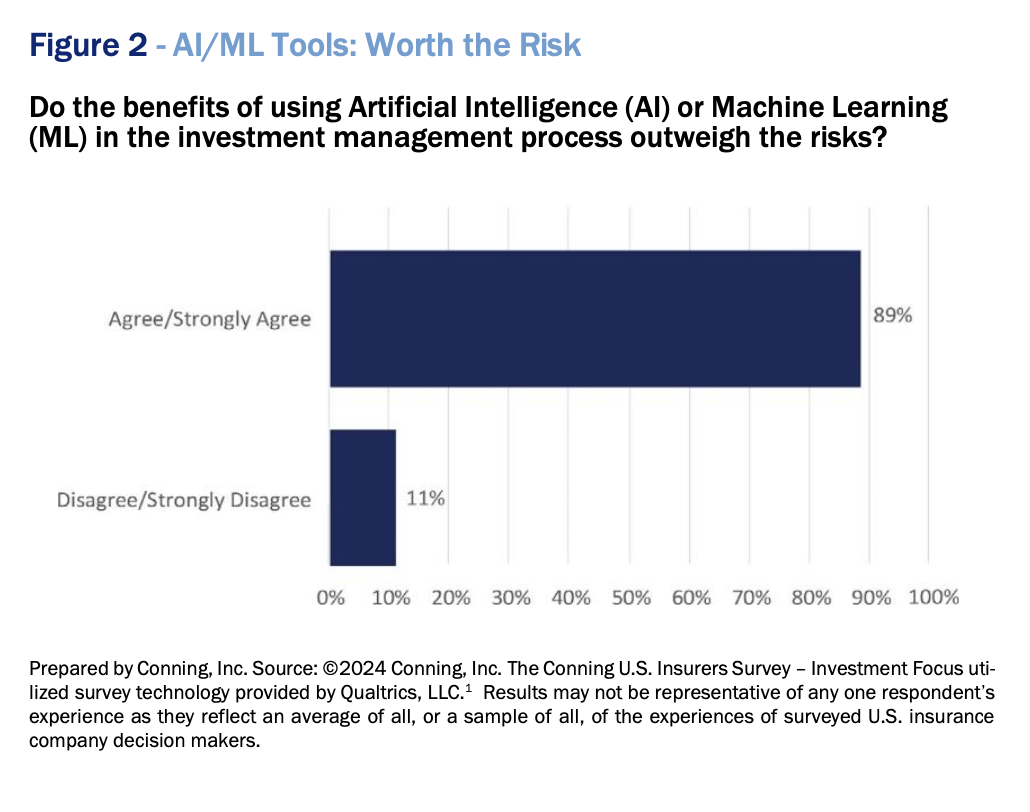

Insurers also said that, despite their concerns about use of artificial intelligence (AI) and machine learning (ML) tools in the investment process, they believe the benefits of the technology outweigh the risks (see Figure 2) and have already begun to incorporate the tools into their investment processes.

The responses suggest U.S. insurers remain resilient and ready to embrace new challenges following a year of significant inflation, falling bond portfolio values as interest rates rose and the rapid growth of AI technologies. (The survey was conducted prior to the U.S. Federal Reserve’s December outlook suggesting multiple interest rate cuts in 2024.)

The growing complexity of managing insurance portfolios may also lead more insurers to consider outsourcing some or all investment duties, and the survey probed insurers’ considerations in these decisions.

See also: Building an Effective Risk Culture

Optimism Is High – But Inflation Remains Top Concern

Survey respondents showed significant optimism about the 2024 investment environment.

Across all company sizes and sectors, “optimistic” was the leading sentiment versus “pessimistic” – in most cases by significant margins. Insurers managing assets internally (about half of our respondents) were more optimistic than those that outsourced some or all of their assets (86% to 73%) while those outsourcing were more pessimistic (18% to 7%). Very few respondents were “unsure what to expect”; the largest “unsure” group (20%) was insurers with less than $500 million of assets.

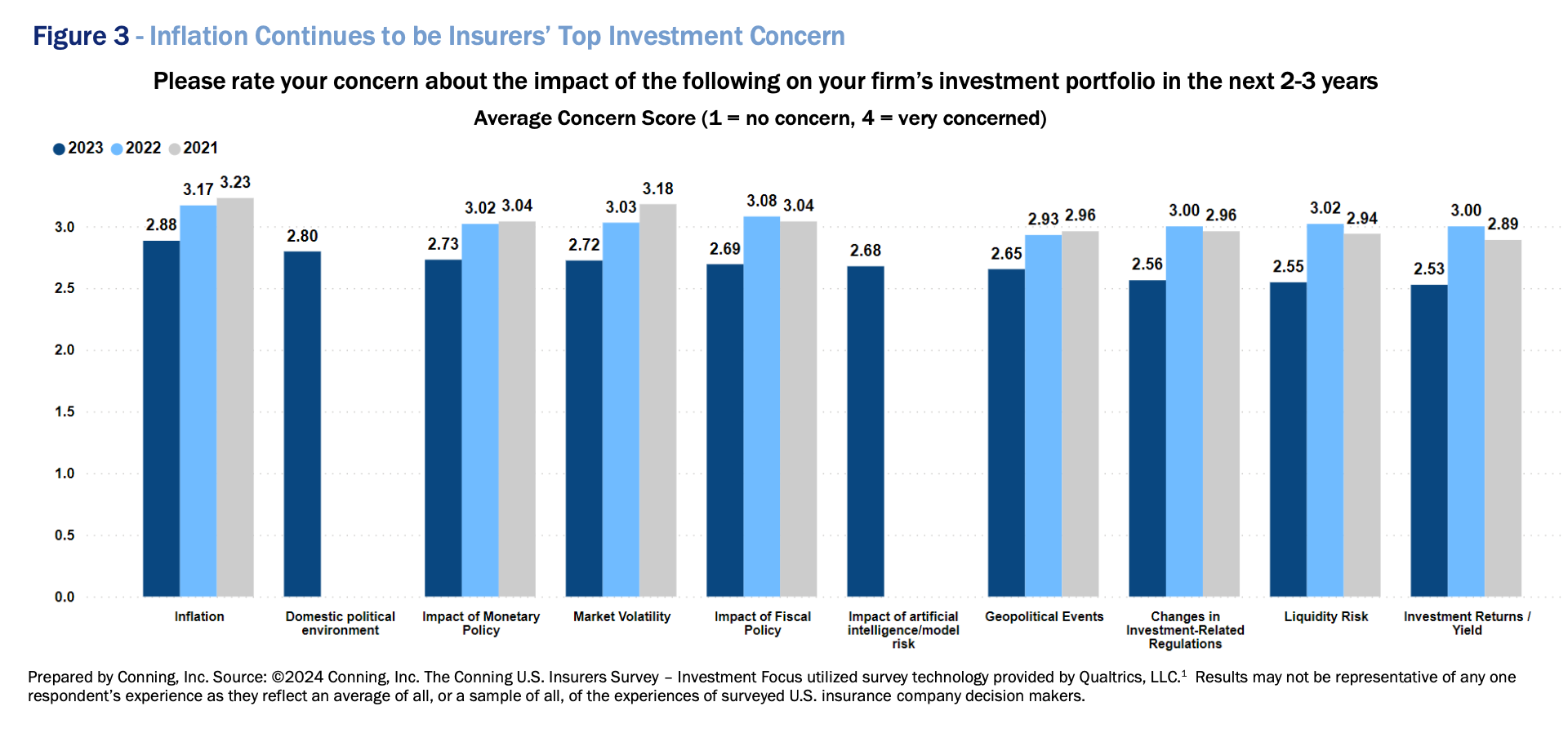

Inflation remained the top portfolio concern in the next two to three years, consistent with our two previous surveys (see Figure 3), but its relative level of concern has been declining. Market volatility remained a leading concern. The impact of monetary policy reappeared as a top concern in 2023, not surprising given how interest rates rose significantly during the year. It is also a prescient response given the recent news that rates may soon head in the opposite direction. Fiscal policy remains another high-ranking area of concern among insurers, given the significant level of federal and local government spending, as well as the potential for policy changes in a presidential election year.

Meanwhile, investment yields, regulatory changes and geopolitical concerns have been consistently among the lowest of insurers’ worries during the past three annual surveys. These issues may signal troubles ahead for insurers but appear less of a concern than events with more immediate portfolio impact.

Domestic politics and AI were added to Conning’s latest survey as potential concern responses. Domestic politics was the second-most important concern to insurers, while impact of AI was sixth.

See also: From Risk Transfer to Risk Prevention

Adding to Risk

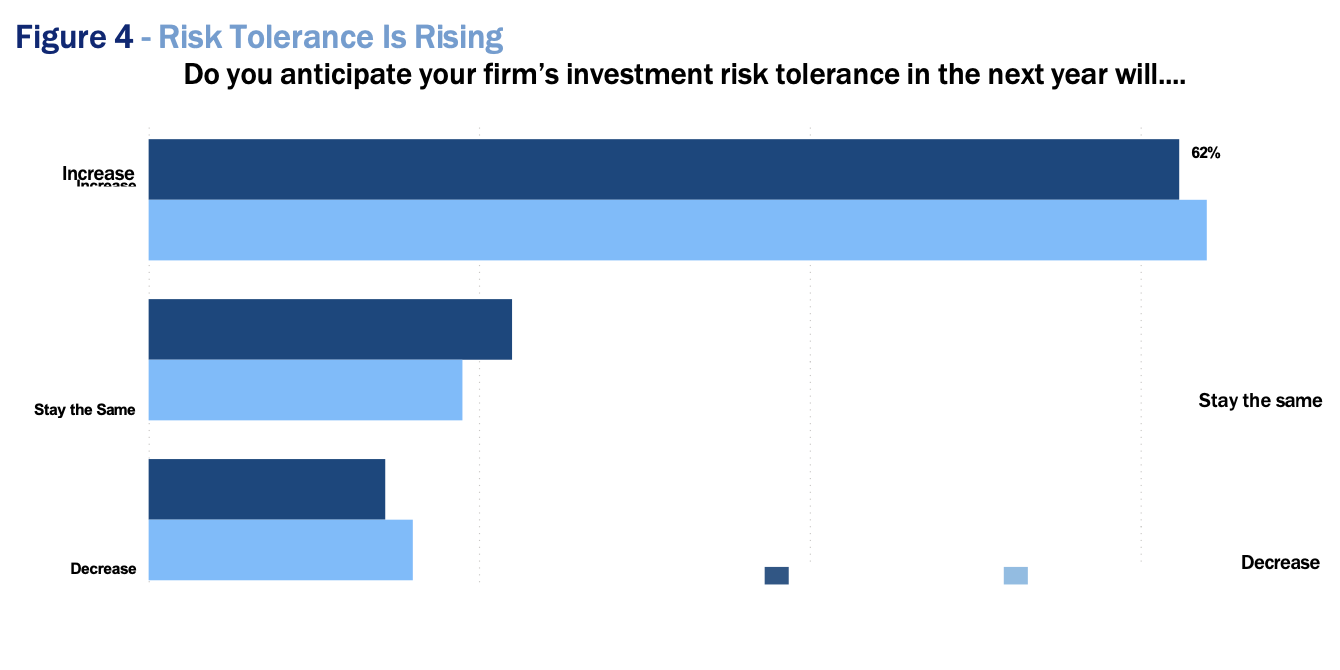

Insurers also strongly believe their investment risk will rise during 2024 (see Figure 4). Their risk expectations generally rose with the insurer’s asset base, although firms with $5 billion to $10 billion in assets were most in agreement with the sentiment.

Firms outsourcing asset management had lower expectations for rising risk in their portfolios versus firms that manage assets internally (57% versus 68%) but as noted previously expressed less optimism about the investment environment (73% versus 86%).