2022 proved to be a very disappointing year for markets and insurance portfolios despite its promising start. It was the worst bond market ever and one of the worst in history for equities.

Two large surprises were key: the severe economic fallout from COVID lockdowns in China and the war in Ukraine. The non-surprises were U.S. fiscal and regulatory policies, particularly regarding stimulative spending and restrictive energy policy.

We had expected the U.S. economy to muddle through 2022 to a soft landing with modest inflation. However, the collective impact of all these negative factors proved too much, and we find ourselves with skittish markets -- and possibly peering into an economic downturn in 2023.

Growth Outlook Facing Inflation Challenge

International Monetary Fund (IMF) projections continue to show a stark weakening growth trend across all regions. Its projection for 2023 global growth is 2.7%, less than half of the 6% reported in 2021, reflecting barely 5% for Asia (dominated by China), a meager ½ of 1% for Europe and the U.K., and only 1% in the U.S.

Core inflation readings remain stubbornly high, and that is after adjusting for the impact of damaged food and energy supply chains as a result of the Russo-Ukrainian war. Negative real rates persist in markets around the globe, an unsustainable condition if we are to avoid contraction.

U.S. Federal Reserve (Fed) Chair Jerome Powell has said he will tighten monetary policy until it is "sufficiently restrictive" to tame inflation because the central bank's obligation to keep prices stable is "essential" in his view. The all-important terminal rate -- where tightening stops and recovery can begin -- is the level where the fed funds rate exceeds the inflation rate. Our current best guess is that these two rates cross sometime in the first half of 2023, somewhere above 5%.

There is currently a negative 70 basis-point yield difference between the 10-year Treasury note and three-month Treasury bill, the widest inversion in two decades (see Figure 1). While arguments persist as to whether this inversion is a cause or an effect of recession, its historically high correlation to recessions is undeniable.

The fed funds rate rose 425 basis points in 2022, with more increases expected in the next two years. This has provided continuing support for the U.S. dollar, which is good for U.S. consumers as it helps keep import prices low and eases the impact of inflation, but it's not good for U.S. exports and non-U.S. economies with dollar-based liabilities.

The dollar's strength has been a significant factor in the performance of U.S. assets relative to other global markets. Should the dollar cool, some of that support will likely fade.

See also: How to Plug Gaps in the Market

A Quality Bias as Earnings Slip

Spreads moved tighter across most sectors in the second half of November 2022, though we see them as still relatively attractive. We believe high-yield valuations do not currently reflect the risks associated with a global slowdown and still-elevated levels of inflation.

The opportunities where we see potential value for insurance portfolios are consistent with a laddered curve call; asset-backed securities (ABS), collateralized loan obligations (CLOs) and non-agency mortgage-backed securities (MBS) are shorter in duration, while agency MBS and corporate bonds provide good intermediate options, and taxable municipals as well as some corporate names may be able to round out the long end of the curve.

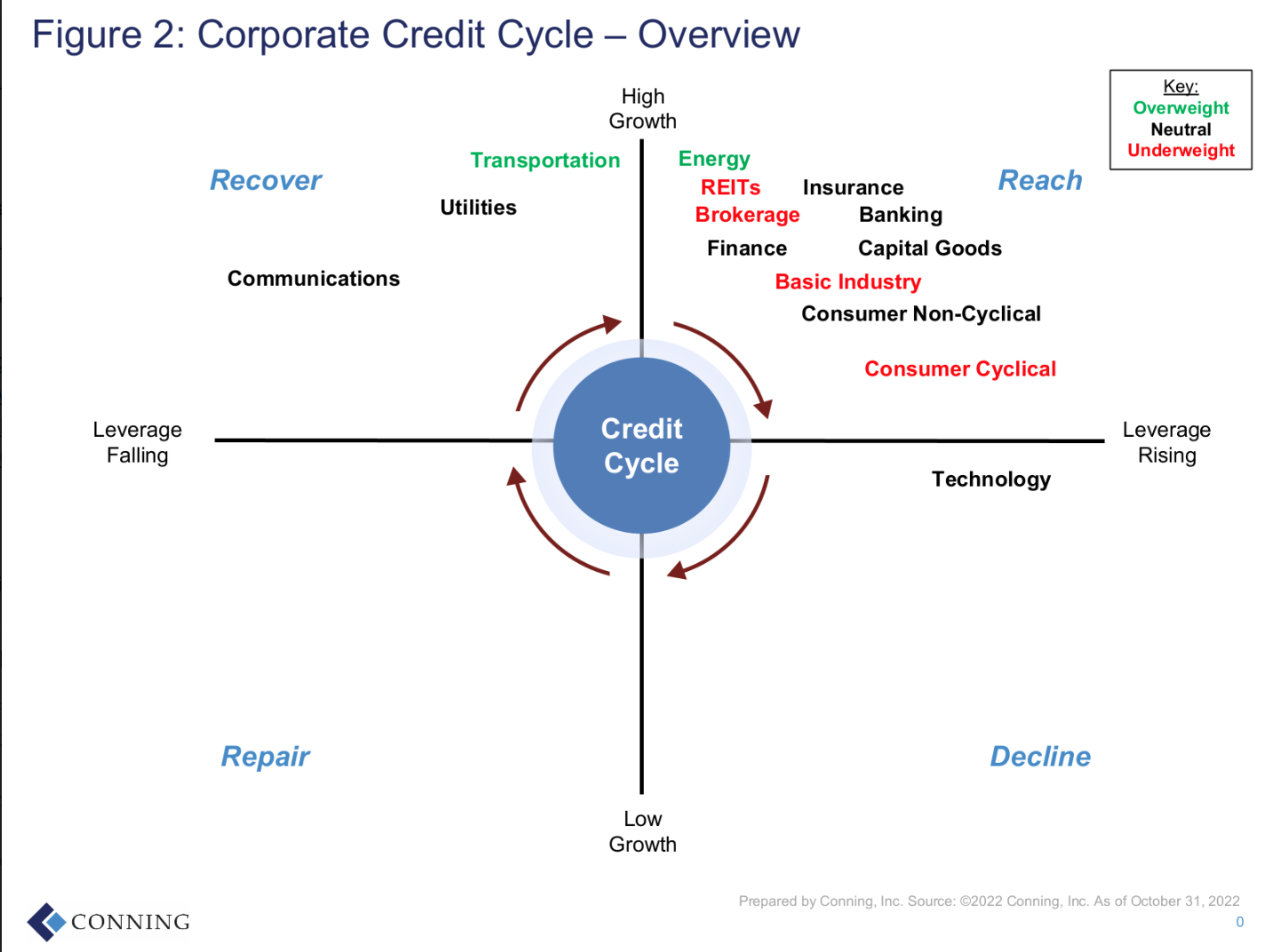

Conning believes we have moved into the latter stages of the credit cycle, which we refer to as the "reach" phase (see Figure 2). We have moved technology into the "decline" phase, an early indicator to be watchful for signs across the corporate universe. Banks are not yet seeing a rise in non-current loans, which suggests stability for the moment. We are seeing credit card delinquencies edging up a bit, and a few banks have modestly tightened standards.

In our view, this suggests investors may want to consider a bias toward quality because eventually we are likely to see more issuers move into the decline phase. The S&P 500 Index constituents are on track to post roughly 2% year-over-year profit growth for the third quarter. That would mark the slowest annual earnings growth since the third quarter of 2020, which was the height of the pandemic, a concerning signal for our 2023 outlook.

A review of consensus forecasts for 2023 suggests expectations of 5% annualized earnings growth. However, further downward revisions are likely as a recession looms and as increases in the fed funds rate, which always work with a lag, come home to roost.