The Tax Cuts and Jobs Act of 2017 (TCJA) changed the landscape of the municipal market in several ways, as the buying behavior of both P&C and life companies altered their allocations to the asset class. P&C companies shied away from increasing the amount of tax-exempt municipals they owned, in some cases reducing holdings. Life insurance companies used the increase in taxable supply to complement longer-duration corporate allocations.

In the past four plus years, relative value has diminished across investment-grade fixed-income sectors. However, Conning notes that segments of the broader $4 trillion municipal bond market offer insurers opportunities not only for diversification but to also to enhance portfolio yield and improve aggregate credit quality.

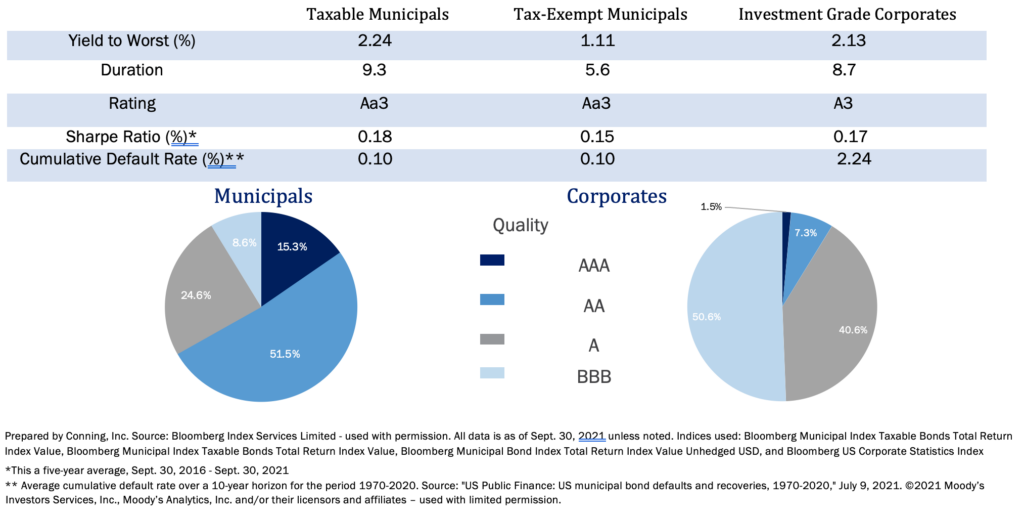

The municipal market has a larger percentage of securities rated A- or better than the corporate market, and they often offer higher yields than corporate debt of similar quality and duration. Municipal securities, particularly taxable deals, will typically have a longer duration and a lower history of defaults than corporates (see Figure 1).

Figure 1 Municipal vs Corporate Bonds

Starting high level and then homing in on a specialized subsector, Conning has identified four municipal market segments that could offer value to an insurer’s portfolio: taxable municipals, not-for-profits institutions, lower-coupon tax-exempt securities and tax-exempt mortgage securities (TEMS).

1. Taxable Municipals

The less mainstream taxable municipal market offers insurers more opportunities to invest in longer-duration, higher-quality securities that, on average, offer greater yields than corporate debt of similar tenor and quality.

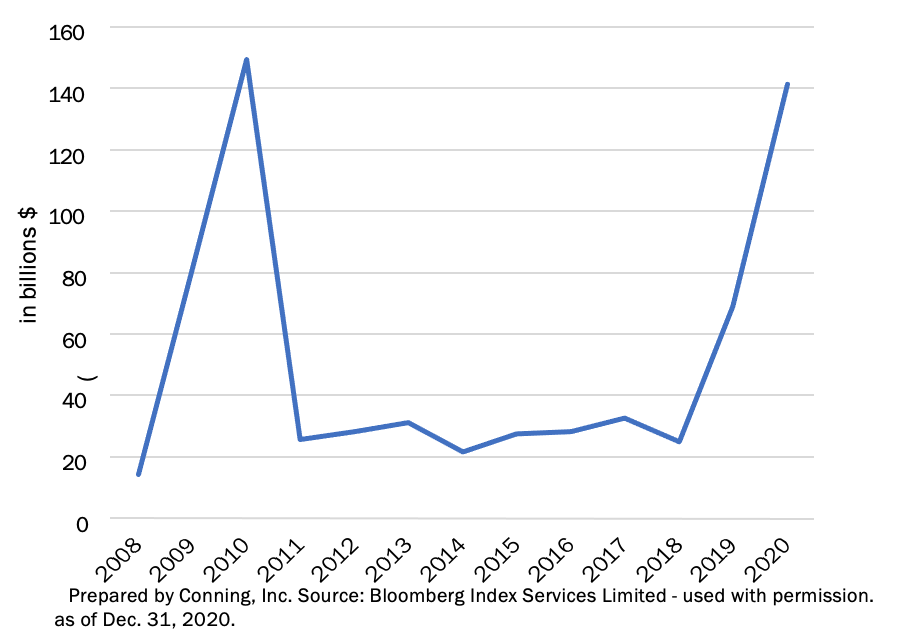

The taxable municipal market grew out of 1986 legislation that limited issuance of tax-exempt bonds, and issuance has spiked twice in the interim. When the tax-exempt market seized up amid the financial crisis in 2008, municipal issuers turned to Build America Bonds (BABs), which were issued as taxable securities but provided municipal issuers a direct 35% federal subsidy (see Figure 2). The second spike resulted from the aforementioned TCJA passage, which ended the advance refunding of tax-exempt debt with other tax-exempt debt, effectively reducing new tax-exempt issuance and driving up taxable issuance.

Figure 2: Taxable Municipal Issuance 2008-2020

Insurers with concerns regarding the dwindling supply of higher-quality corporate debt issuers may find taxable municipal securities an effective alternative. In addition, the National Association of Insurance Commissioners (NAIC) has adopted new risk-based capital (RBC) bond factors for year-end 2021, and the larger amount of higher quality debt available in the municipal market offer insurers more options to potentially address RBC concerns.

The taxable municipal market today features more robust liquidity, and demand from domestic as well as foreign investors has increased at a rapid rate. According to Municipal Securities Rulemaking Board, total municipal trading volume in 2020 was $1.93 trillion, with $371 billion, or nearly 20%, being taxable. The federal government’s current focus on an infrastructure bill may lead to additional opportunities, including the possible return of a financing program like BABs with a subsidized interest component. Reintroduction of such a program could see issuance of $150 billion to $180 billion in the first year alone.

2. Not-for-Profit Institutions

Debt issued by not-for-profit entities such as hospitals and higher education institutions via the corporate bond market rather than the municipal market offers insurers diversification and greater spreads than comparably rated investment-grade corporate debt.

Known as “corporate CUSIP taxables,” this growing class of securities is a sub-class of municipal bonds that utilize a corporate CUSIP identifier. Issuers decide whether to issue via the corporate or municipal market based on financial considerations, such as the use of funds, funding costs, depth of investor pools, and ease of registration, and typically access the corporate bond market to issue longer-dated structures. While these issuers come to market with corporate CUSIPS, they are issued by a municipal syndicate, traded off municipal trade desks and covered internally by Conning’s municipal research analysts.

See also: Death, Taxes and Life Insurance Trusts

Hospitals and higher education institutions combine for more than 80% of this market’s issuance and offer insurers opportunities to expand their investable universe from a pool of higher quality debt than traditional corporates. One recent example demonstrates the type of opportunities available. Conning was able to invest in a new issue 20-year debt of an A1/AA- rated healthcare institution at 90 basis points over Treasuries, a significant pickup to similarly rated corporate debt in that part of the curve. Conning initiated internal coverage of the credit with a Low AA rating and Stable outlook based on a strong market position and financial metrics that held up during the pandemic. The credit also has a successful growth strategy which made us confident in the institution’s long-term prospects.

3. Lower-Coupon Tax-Exempts

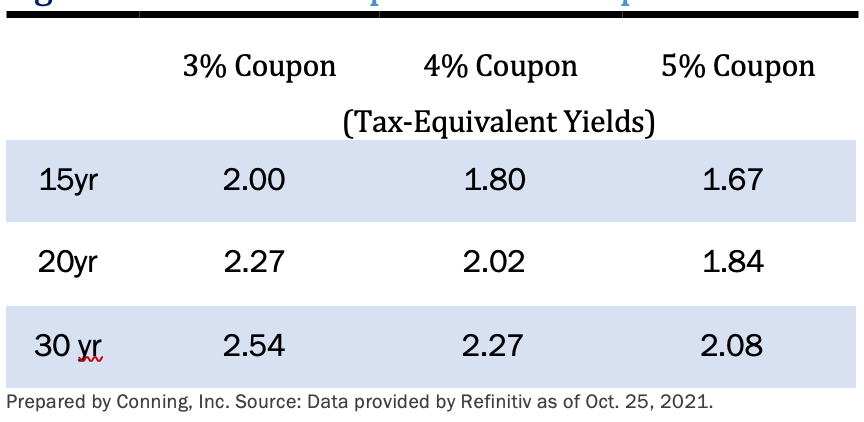

Tax-exempt municipals issued with coupons below 5% offer investors to take advantage of yield differentials which affect retail and not institutional investors known as the "down in coupon" trade. For example, in the current market, the average 3% coupon currently offers around 35 basis points of additional yield over 5% coupons in the 15-20-year part of the curve (see Figure 3).

Figure 3: "Down in Coupon" Yield Comparison

This opportunity comes about because of a change in tax laws 30 years ago that was aimed not at institutions but at the largest holders of municipal bonds: retail investors. Conclusion Despite the dramatic changes in the U.S. municipal capital markets during the past four years, insurers should not ignore the sector altogether. There are pockets of the municipal market that may offer relative value in a market where value can be hard to find. Conning encourages insurers to keep their eyes open for select opportunities in both the taxable and tax-exempt municipal markets. Our experience reminds us that markets are always evolving, and our goal is to help insurers take advantage of unique opportunities as they arise and help clients build portfolio investment solutions to address their business needs.

A provision of the Revenue Reconciliation Act of 1993 focused on retail investors’ purchases of municipal bonds at a “discount” (a formula determines the minimum discounted purchase price). The new law decreed that, if a “discount” security was eventually sold, transferred, or redeemed, the accrual of that discount would be taxed as ordinary income rather than at the holder’s capital gains tax rate.

This law change does not affect insurers, which pay the same tax rate for both ordinary income and capital gains. However, individuals in the highest tax bracket could be faced with more than double the tax liability for these securities (the 35% rate for ordinary income versus the 15% for capital gains) should they sell them before maturity. The additional yield is intended to compensate the retail investors for the potentially higher tax liability, but insurers can take advantage of the higher yields when presented. With Conning’s deep experience in the municipal bond market, we can identify and assess these opportunities on a security-by-security basis.

4. Tax-Exempt Mortgage Securities (TEMS)

A narrow but potential opportunity to enhance yield and diversification also exists in tax-exempt mortgage securities (TEMS).

TEMS are long-dated debt issued by the housing finance authorities from two state housing agencies: Utah and Idaho (the latter no longer issuing new debt). The securities are structured as mortgage-backed securities with cash flows mapped to a specific Ginnie Mae pool. Each monthly series of issuance is secured separately from previous offerings and must be evaluated on a deal-by-deal basis. The first TEMS issuance was in May 2014 and to date there has been $2.66 billion with the average monthly issuance over the past 12 months of $43.3 million.

See also: Self-Insured Retention vs. Collateral – What is the True Cost of Risk?

These securities are slightly more expensive than if the underlying GNMA collateral were purchased directly, but investors are compensated as most income received is tax-free, thus at times offering relative value to Ginnie Mae MBS and other tax-exempt alternatives. As the debt is backed by mortgages, it offers insurers diversification and an amortizing structure with a much shorter duration profile, albeit with refinancing risk.

Conning has long experience with the underwriters of these securities and municipal traders collaborate with our MBS desk to assess relative value on each offering. Our recommendation to clients who find this subsector attractive is to participate not just in one deal but a number over time, redeploying cash flow from prepayments to maintain a target TEMS allocation in a portfolio over time.

Conclusion

Despite the dramatic changes in the U.S. municipal capital markets during the past four years, insurers should not ignore the sector altogether. There are pockets of the municipal market that may offer relative value in a market where value can be hard to find. Conning encourages insurers to keep their eyes open for select opportunities in both the taxable and tax-exempt municipal markets. Our experience reminds us that markets are always evolving, and our goal is to help insurers take advantage of unique opportunities as they arise and help clients build portfolio investment solutions to address their business needs.