The US P&C insurance industry faces many challenges as it struggles to get a handle on a changing economic, social and climate landscape. The list of perils seem to grow every year from the increasing frequency and severity of catastrophic and other weather related events to social inflation, population shifts and regulatory rate hurdles to expanding competitive pressures.

Carriers have little control over these external forces. Typically, they resort to using the conventional levers including extensive rate increases, dramatic changes to eligibility requirements and product changes that eliminate coverage. While these approaches can alleviate some carrier issues, the new truth is that they are not enough to make a positive impact for the business.

The industry is rife with stories of carriers going insolvent, soaring reinsurance costs and entire sections of the US having unprecedented struggles accessing basic insurance products. US insurers are in need of forward-thinking, data-driven solutions to help them grow profitably all while achieving adequate, fair underwriting practices and increasing accessibility.

One potential solution to the problem is advancing our knowledge of individual insureds and their needs.

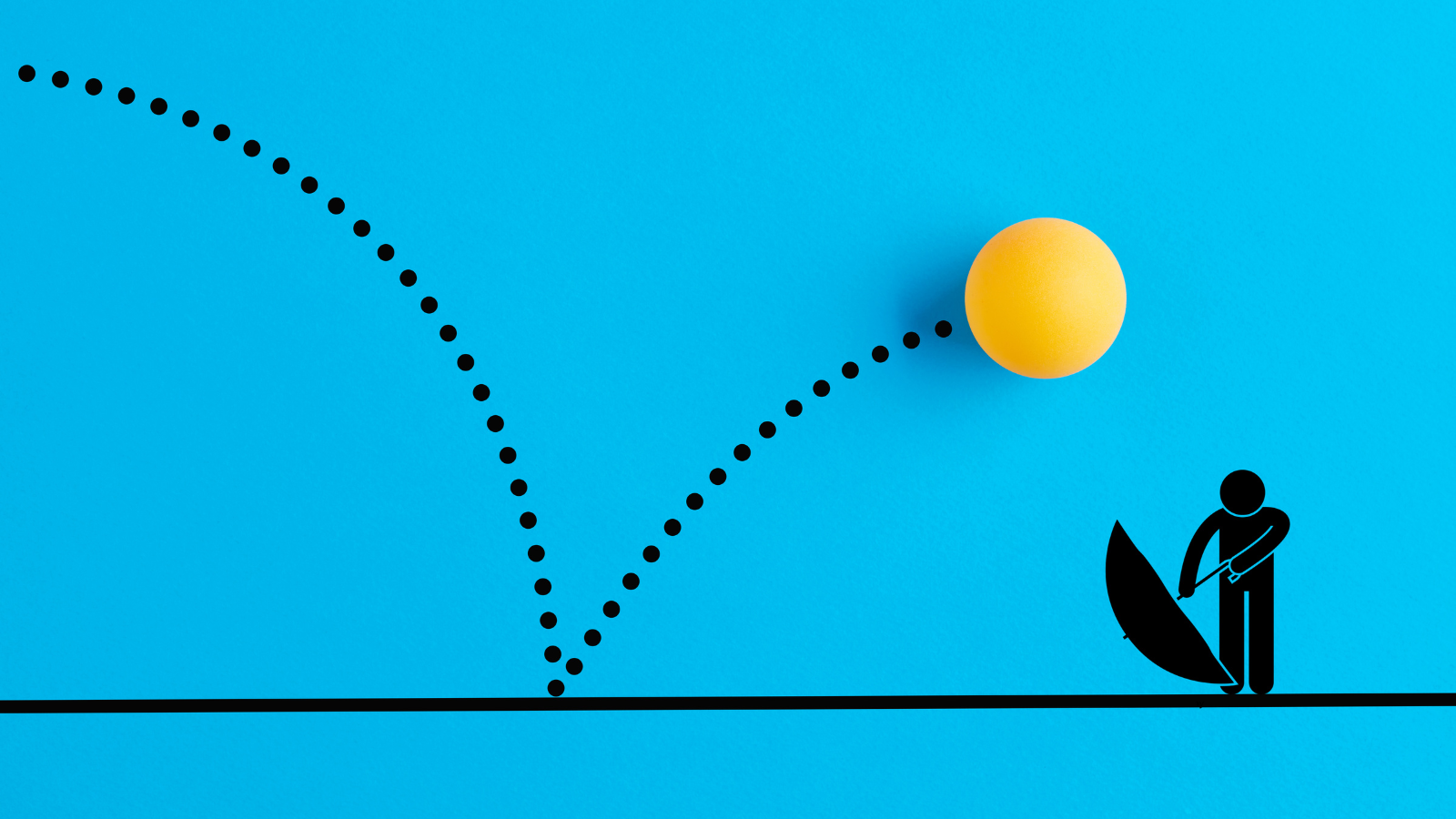

Understanding customer behavior and risk tendencies enables insurers to better predict outcomes and make targeted decisions that support profitable growth. Today, most carriers rely on predictive modeling to stay competitive. The industry recognizes the power of analytics in categorizing insureds into broad groups based on factors like credit scores, claim-free periods, and residential zip codes. However, advancements in technology have confirmed that the traditional variables are too broad, too bulky and do not provide the stratification we need to fairly and accurately assign risk.

Person-level behavioral insights involve a big data approach to evaluating an individual's propensity for some target variable based on their behaviors and actions. By using a vast amount of information including but not limited to a specific insured's interests, purchasing behaviors, media consumption, and associated brands, these newer and powerful AI models are able to more accurately predict frequency, severity, loss and other insurance related outcomes. Insurers will be better equipped with these insights to navigate market volatility, more accurately assign risk, avoid adverse selection, and achieve underwriting profitability and growth.

Of course, there are important questions pertaining to bias when assessing this level of information on an individual. With modern statistical techniques, these models must be built with stopgaps and intense scrutiny on their potentially disparate impacts to protected groups. Luckily, these techniques exist within the behavioral insight industry and have even been proven to improve the biases the insurance industry sees in its existing underwriting processes.

Overall the goal of integrating behavioral insights into modern insurance is to create a more targeted, profitable, available and less-biased product. As the industry evolves, carriers that embrace behavioral intelligence will be better equipped to face uncertainty, proactively respond to challenges, and secure their position in the market. In an era where the stakes are higher than ever, the ability to accurately assess and manage risk will distinguish the leaders from the laggards in the insurance industry.

About Devyn McNicoll, Pinpoint’s Head of Actuarial

| Devyn McNicoll a traditionally trained actuary with over 10 years of experience helping companies grow profitability in the P&C insurance space. She is an Associate of the Casualty Actuarial Society (ACAS), a Certified Specialist in Predictive Analytics (CSPA) and holds her Master’s degree in Statistics from North Carolina State University. She deeply values the role of data analytics and mathematics in the industry. Prior to Pinpoint, she was in an executive leadership role at an MGA offering Homeowners and Commercial Property products. She has extensive experience in actuarial pricing, reserving, filing, modeling and leadership at several large national insurance carriers. In 2023, she was one of two actuaries who represented the US in the Young Actuaries World Cup as a semi-finalist in the competition. |

Sponsored by ITL Partner: Pinpoint Predictive