KEY TAKEAWAY:

--What's needed is a radical rethink of what is possible. How do we use the home's existing shutoff valve, thereby eliminating the need for the redundant shutoff valve in cut-the-pipe solutions? How do we detect water flow from outside the pipe, thereby eliminating the need for cutting the pipe to insert a flow meter?

----------

There are a wide variety of home water leak mitigation solutions available today, and yet none of these products is widely deployed, and home water leak losses continue to increase. The reason? Except in certain special cases, insurers are not seeing a compelling return on investment.

The return on investment for a water leak mitigation system is primarily determined by two factors: the total cost of the solution (i.e., device cost plus installation and monitoring cost) and its overall effectiveness in reducing claim payouts (i.e., percentage reduction in claim indemnity).

Total cost for a specific water leak mitigation product is relatively easy to determine. Effectiveness is much less clear. However, water leak mitigation products differ dramatically in effectiveness based on a single functional difference: Does the product automatically shut off the water in the event of a leak, or does it only warn the homeowner of a possible leak?

Everyone knows at least one home water leak horror story (in many cases, the stories are personal!). A backed-up toilet, a burst washing machine hose, a busted water heater – the list is seemingly endless. However, if you stop and think about these stories, virtually all of them share a trait: The occupants were either asleep or out of the house when the leak occurred.

For this reason, insurers have found that water leak loss mitigation solutions that automatically shut off the water are far more effective in reducing claims than systems that only warn homeowners of a possible leak. (It can be many hours or even days before homeowners who are away or asleep act on, or even become aware of, a leak warning). Limited published reports from insurers suggest that the effectiveness of products with automatic shutoff capability are 60% to 80% effective in reducing claim payouts, while products that only warn are 15% to 35% effective.

See also: Key Learnings From Winter Storms

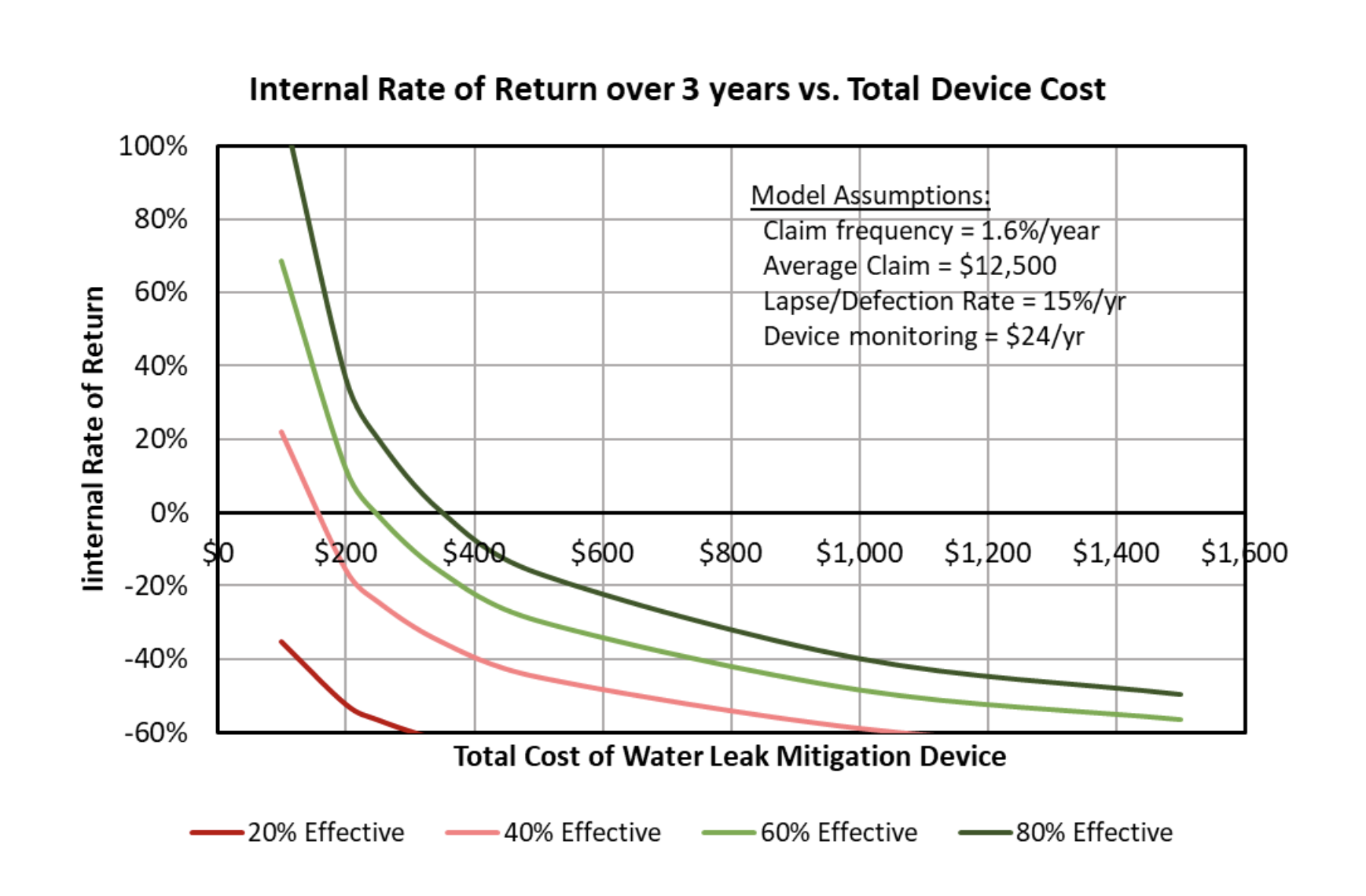

The chart below models how total cost and effectiveness affect the rate of return to an insurer for investment in a water leak mitigation product. (The model assumptions are based on reported U.S. industry-wide averages.)

A key observation from this model is that the rate of return for an investment in water leak mitigation product declines exponentially as total cost increases. However, while low total cost is obviously critical, lowest possible cost alone doesn’t yield positive returns; a $100 total cost product with 30% effectiveness generates negative returns.

The above model is simplistic and omits many details. Nevertheless, it’s easy to see why existing water leak mitigation products don’t make economic sense for the broad home insurance market. Products that warn only are less expensive ($100-$300 total cost), but given their limited effectiveness, they are unlikely to generate a reasonable return (the return for a $200 total cost, 40% effective device is negative).

Products with an automatic shutoff generally require cutting the main water pipe. For this reason, these products, while more effective, are much more expensive ($1,000-$2,500). Even with very optimistic assumptions (80% effectiveness, $600 total cost) the return for a cut-the-pipe automatic shutoff is negative.

One strategy that does work is to deploy cut-the-pipe automatic shutoffs in very-high-value homes that have a much higher average loss per claim. Chubb reports that their average water leak loss per claim is $50,000. With this average loss per claim, the model shows that a cut-the-pipe automatic shutoff with a $1,000 total cost and 70% effectiveness generates a three-year IRR of 19% – reasonable cost and effectiveness assumptions yield an attractive return for high-value homes.

See also: How to Minimize Fraud in Disaster Claims

Clearly, what is needed for mass market deployment of water leak mitigation devices is a breakthrough technology that combines the effectiveness of current cut-the-pipe automatic shutoffs with the low total cost of systems that warn only. The model shows a $250 total cost, 70% effective automatic shutoff installed in an average home (i.e. average loss/claim = $12,500) generates a three-year IRR of 10% -- about the same as a $1,200, 70% effective cut-the-pipe solution in homes with an average loss/claim of $50,000.

We need to reduce the cost of cut-the-pipe automatic shutoff functionality by at least a factor of five. How do we get there? We will not get there by reducing costs for cut-the-pipe solutions. The devices themselves are not susceptible to cost reduction because all components in contact with water must be strictly controlled so there is no possibility of contaminating home drinking water. Furthermore, the installation cost for cut-the-pipe solutions is increasing, not decreasing, because the hourly cost for plumbers is going up.

"Think Different" was Steve Job's approach to solving problems like these. What's needed is a radical rethink of what is possible. How do we use the home's existing shutoff valve, thereby eliminating the need for the redundant shutoff valve in cut-the-pipe solutions? How do we detect water flow from outside the pipe, thereby eliminating the need for cutting the pipe to insert a flow meter? One key insight is that the core loss mitigation functionality of cut-the-pipe solutions is to make sure that water doesn’t flow continuously for too long; measuring gallons-per-minute is irrelevant to loss mitigation.

Smart home and home security companies are constantly developing innovative new home IoT products. Why haven’t these companies recognized the need for innovation to address home water leak mitigation?

These companies develop products to sell to homeowners. Homeowners are motivated to buy today’s home IoT products for safety and convenience. Water leak mitigation products enhance neither safety nor convenience. Smart home and home security companies have learned from bitter experience that there is very little homeowner demand for water leak mitigation products.

Insurers have been waiting for the silver bullet to magically appear. They must recognize that the water damage innovation drought will end only if they take actions and adopt policies that promote investment in the development of innovative new products that generate positive returns for both the product developers and the insurers.