After billions of dollars of underwriting losses in commercial auto, insurers can bend the curve toward profits.

A strong economy does not translate to commercial insurance profits. After

eight consecutive years of underwriting losses, commercial automotive insurers are shouting, “Enough is enough!” Today, these insurers are in a strong position to right the ship and turn those losses into profits.

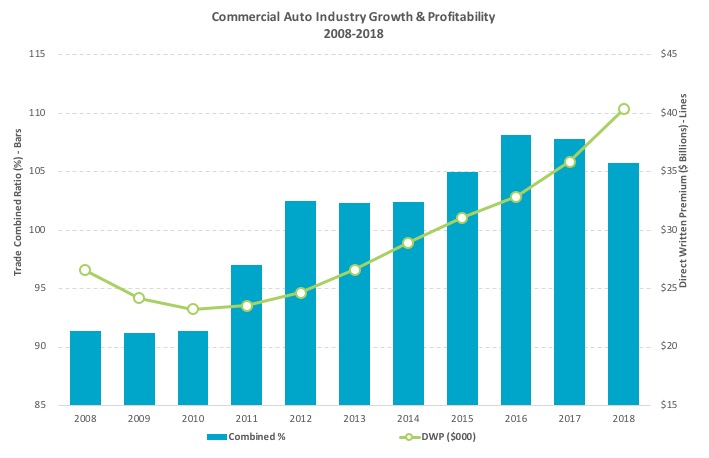

While written premiums have increased 64% from 2012-2018, the industry continues to experience significant profitability challenges, having booked more than $11 billion in underwriting losses during that same period, according to BestLink Industry data from A.M. Best. Trade combined ratios have been deteriorating in recent years and peaked at 108.1% in 2016 before improving marginally to 107.8% in 2017 and 105.8% in 2018.

[caption id="attachment_37131" align="alignnone" width="570"]

©A.M. Best – used with permission[/caption]

Changes in risk exposure are pressuring insurers to improve pricing and underwriting effectiveness. As macroeconomic fundamentals remain strong, drivers are logging more miles and fleets are steadily growing, resulting in a shortage of experienced drivers, according to the Truck Driver Shortage Analysis conducted by ATA. With increases in exposure due to more miles driven, less-experienced drivers on the road and a rise in distracted driving incidents, it can be difficult to see how we can return to profitability anytime soon.

Choose a Smarter Path to Profitability

Despite these challenges, you can break the money-losing cycle of losses and create profit within your commercial auto book. A simple option is to increase base rates and risk alienating current and prospective clients. Alternatively, you can work more surgically, while improving your underwriting returns by using more data, information and technology.

See also: Cyber Insurance Needs Automated Security

There are a number of ways to improve your underwriting and pricing decision-making process and reclaim commercial auto profits:

- Reduce your MVR expense — Don’t waste money ordering MVRs to determine if a driver has a violation on his or her record. TransUnion’s internal data shows that 72% of drivers have a clean driving record. To validate driving histories, use court record data first and only order MVRs on the drivers who warrant it. Court record data is readily available for a fraction of the cost of MVRs.

- Use new driver information for fleet underwriting — Aggregated driver information and non-adjudicated violation data are available to help insurers improve underwriting and pricing. For example, according to TransUnion’s aggregated results based on an internal study, we have seen insurers realize up to a 200% improvement in loss ratio lift by using new driver information. Look for ways to use more data to build smarter predictive models for fleet driver underwriting.

- Include vehicle history in underwriting — Every vehicle has a different story. For example, two five-year-old trucks, same make and model, may have different histories. One may have a branded title, while the other may have a single owner and no damage. Vehicle histories are predictive of future losses, and incorporating this data into your underwriting process can provide benefit. Adopt aggressive portfolio management techniques. Monitor, identify and mitigate changes in risk. Profits are gained by narrow margins in commercial auto insurance, and changes in risk can be one of your biggest portfolio exposures. Today’s advanced portfolio management techniques are more available and affordable than you may think.

- Reward companies engaged in preventing distracted drivers — Distracted driving is a growing factor in trucking accidents and fatalities. Truce Software and other similar devices mitigate against distracted driving. Provide policy incentives encouraging clients to adopt technology and programs that help reduce distracted driving.

- Require telematics program participation — Electronically monitoring driver safety and behavior enables you to encourage better driving habits. Monitoring can benefit your customers and enable you to better understand the risk within a fleet. Make telematics a standard requirement for writing a policy.

- Enhance your fraud prevention strategy — The best defense against fraud is to stay on offense. Insurers face fraud throughout the entire policy lifecycle, from the initial application to the claims process. The majority of insurers believe fraud contributed at least five percentage points to their combined ratio, according to a recent Forrester Consulting study. Fraudsters continue to evolve, and so should your fraud strategy.

See also: Underwriters Need Some Power Tools

As you can see, despite the challenges associated with profitability, there are ways commercial auto insurers can bend the loss curve toward profit. By leveraging more comprehensive data, information and technology, you can give your underwriting business a fighting chance and say, “Enough!” to underwriting losses.

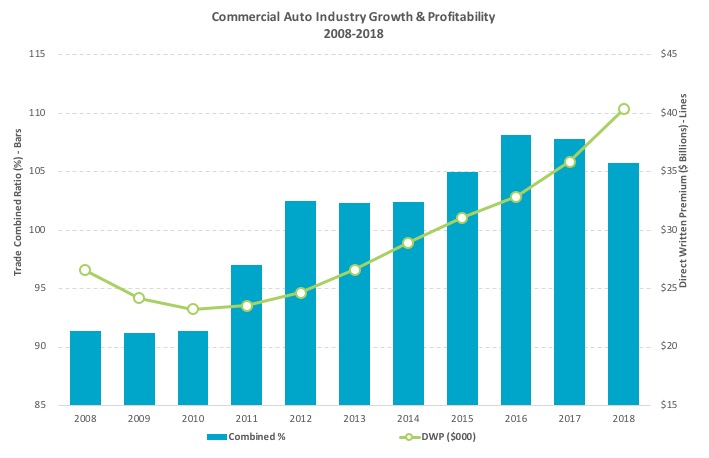

©A.M. Best – used with permission[/caption]

Changes in risk exposure are pressuring insurers to improve pricing and underwriting effectiveness. As macroeconomic fundamentals remain strong, drivers are logging more miles and fleets are steadily growing, resulting in a shortage of experienced drivers, according to the Truck Driver Shortage Analysis conducted by ATA. With increases in exposure due to more miles driven, less-experienced drivers on the road and a rise in distracted driving incidents, it can be difficult to see how we can return to profitability anytime soon.

Choose a Smarter Path to Profitability

Despite these challenges, you can break the money-losing cycle of losses and create profit within your commercial auto book. A simple option is to increase base rates and risk alienating current and prospective clients. Alternatively, you can work more surgically, while improving your underwriting returns by using more data, information and technology.

See also: Cyber Insurance Needs Automated Security

There are a number of ways to improve your underwriting and pricing decision-making process and reclaim commercial auto profits:

©A.M. Best – used with permission[/caption]

Changes in risk exposure are pressuring insurers to improve pricing and underwriting effectiveness. As macroeconomic fundamentals remain strong, drivers are logging more miles and fleets are steadily growing, resulting in a shortage of experienced drivers, according to the Truck Driver Shortage Analysis conducted by ATA. With increases in exposure due to more miles driven, less-experienced drivers on the road and a rise in distracted driving incidents, it can be difficult to see how we can return to profitability anytime soon.

Choose a Smarter Path to Profitability

Despite these challenges, you can break the money-losing cycle of losses and create profit within your commercial auto book. A simple option is to increase base rates and risk alienating current and prospective clients. Alternatively, you can work more surgically, while improving your underwriting returns by using more data, information and technology.

See also: Cyber Insurance Needs Automated Security

There are a number of ways to improve your underwriting and pricing decision-making process and reclaim commercial auto profits: