For the first time in 2024, insurance company quarterly and annual financial statements started separating pet insurance from the rest of the inland marine premium and loss data. Because several pet insurers offer no other additional coverages that are considered inland marine, prior statement data for these identified insurers can provide insight on pet insurance.

Pet owners have been dramatically increasing purchases of pet health insurance over the last several years. Through the first three quarters of 2024, pet insurance premium came to just over $3.4 billion, meaning the full-year total could be over $4 billion—possibly even $4.5 billion. Based on reporting from the North American Pet Health Insurance Association (NAPHIA), pet health insurance premium more than doubled in the five-year period to 2023, to $3.9 billion from $1.6 billion, with at least 20% growth per year.

The loss ratio for pet insurance through the first nine months of 2024 was higher than for the rest of inland marine insurance, due possibly to growing demand for insurance to help cover rising veterinary costs. Including pet insurance, the inland marine line's loss ratio for the period remained in the post-pandemic 44%-to-49% range.

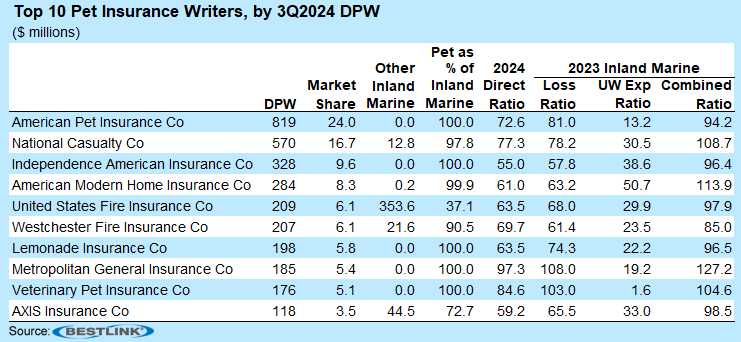

The top 10 pet insurers account for 90% of the pet insurance market, making it a highly concentrated market. At the group level, the market is even more concentrated, because National Casualty (No. 2) and Veterinary Pet Insurance (No. 9) are both part of the Nationwide Property & Casualty Group. American Pet Insurance is the No.1 U.S. pet insurer, with $819 million in direct premium through third-quarter 2024.

Five of the top 10 write no other inland marine coverage, and for two other companies in the top 10, pet insurance accounted for more than 97% of the inland marine premiums. This concentration provides credible insight into the historical underwriting performance of their pet health coverage. Direct combined ratios are mixed, with close to an equal number on either side of the 100.0 breakeven point.

Inland Marine Outlook

For the rest of the inland marine market, results have been very consistent over the past 10 years, with 2020 being an anomaly owing to the pandemic. Event cancellation and travel insurance are two of the catch-all classes captured under the inland marine line of business, and the business line has its roots covering goods in transit, a good measure of which is the U.S. Freight Transportation Services Index.

A rising index indicates that more goods are in transit, which suggests a growing need for insurance to cover those goods. The index has fluctuated moderately the last five years, except for the severe drop early in the COVID pandemic and the subsequent rebound when operations restarted. Even if the amount of goods in transit remains flat, sustained inflationary pressures on the value of those goods could result in higher premium.

Transportation Safety Administration checkpoints at airports also can indicate the amount of travel in the U.S. and provide insight into premium volume specific to trip cancellation. During 2020, when travel was limited due to COVID restrictions, TSA throughput dropped substantially. Total inland marine direct premium written (DPW) thus experienced its only decline since at least 2011, and possibly even before that. For the first time in 2024, TSA throughput exceeded pre-pandemic levels, signaling that travel is back to normal and supporting the likelihood that trip cancellation coverage will increase for the year.

Overall, inland marine remains profitable, outperforming the entire property/casualty insurance industry by a wide margin and doing so with steady growth, buoyed by growing construction and increasing travel. The line's direct loss ratio was more than 20 points better than that of the property/casualty industry in 2023 and has been worse than the P/C industry's only once in the past 14 years—in 2020, when contingency claims (i.e., event and travel cancellations) spiked due to the pandemic shutdowns.

Given that pet insurance accounts for about 10% of inland marine insurance and pet insurance results have been only marginally profitable, inland marine results excluding pet insurance are even more favorable.