Insurance Thought Leadership

Let’s start with the Southern California wildfires, as long as Nearmap was so involved in helping carriers respond and as long as the disaster is so on point for our Predict & Prevent focus this month. What did you see?

Dave Tobias

Interestingly, we had flown over the LA area, including the Palisades, on Jan. 1, just before the fires started on the seventh. This is part of our normal cadence, as we capture new imagery three to four times a year depending on the region.

We had planes in the air within five hours of the fire starting. We maintain a nearly 24/7 operations team outside Washington DC that monitors events, weather, and plane locations, and we were able to start streaming this imagery to insurance companies within hours after these flights.

We run AI analysis on every flight, and in catastrophes we conduct damage detection via AI. For wildfires, we're assessing total versus partial losses, though these fires typically resulted in total losses. While a hurricane typically moves through an area and is done, this fire kept spreading, and areas that were initially safe were later destroyed.

I happened to be in Hartford during the fires, meeting with some of our largest insurance customers. I witnessed firsthand how they were using our data. One top-five carrier had integrated our imagery and AI analysis into their mapping system, using it to guide their call center in contacting insureds who were evacuated. The reps were often the first to inform people about whether their homes had survived. These insurers went to great lengths to locate their customers, even searching social media platforms like Facebook and TikTok to reach them.

The human element really stood out to me. Insurance executives were reaching out after seeing my LinkedIn posts, asking me to check on their childhood homes or family members' properties. I found myself delivering news to about 20 people personally. It reinforced that, during a crisis, whether you're an insurer or insured, people want certainty. They need to know what's happening so they can start planning, regardless of the outcome. That's really one of the fundamental elements of insurance – providing certainty for people moving forward.

And in a catastrophe like this, resources become very constrained. Whether it's apartments, contractors to clear debris, or other services -- there's only so much available in the area. The sooner insured homeowners can start taking action, the better position they'll be in.

I heard this sentiment echoed by many insurers we work with. In cases of total loss, they could immediately process claims for policy limits because everything was gone. Seeing them use AI and aerial imagery to facilitate this process was remarkable -- it's the first time I've witnessed that kind of straight-through processing.

Insurance Thought Leadership

Based on your aerial imagery from January and earlier, what insights are insurance companies gathering to help homeowners and communities better protect themselves against fire damage?

Dave Tobias

Everyone has seen that one home that survived on the block because it had more robust building materials. But really, the easiest thing everybody can do, and the data makes it very clear, is have good defensible space around their buildings.

When you have hundred-mile-an-hour-plus winds and embers in the air, sometimes there's nothing that can be done. But you definitely see the homes that had good defensible space around them versus the ones that didn't -- their survivability went up quite a bit.

The nice thing about defensible space is it's something a homeowner can do as step one without a lot of investment. That's what I would call the base-level mitigation: Clear the shrubs, cut down some trees, use nonflammable plants.

Another issue I see, even in my neighborhood in Burlingame -- where wildfire isn't really a threat, except in the hills -- is what people put right next to their building. They put wood mulch literally touching the building because it looks nice. But it's kindling. Wood mulch is kindling. You might as well put a bunch of matchsticks up against your home.

We've all done it. My old home had it. But you're putting very flammable material right up against the structure.

These are things people can act on now as preventative measures. The Palisades, specifically, everybody knew was a wildfire danger zone. There's a lot of negative press about insurers canceling policies ahead of the fire, like they knew the fire was coming. The reality is the insurers and everybody else knew this was a wildfire zone for a long time.

Insurance is just math at the end of the day. If you can charge enough premium, you can insure anything, but the regulatory environment in California makes it difficult to charge the right rate, so insuring properties in a highly dangerous wildfire zone is really expensive.

I think it's going to be interesting to see how the rebuild happens in some of these areas, and if some of these risk-mitigating factors change. There are plenty of great materials and building guides from IBHS (the Insurance Institute for Business and Home Safety) and others on fortified homes for wildfire. I'm hopeful, but it's not going to change the fact that these areas will continue to be arid and have high winds.

Insurance Thought Leadership

How can insurance companies better encourage homeowners to maintain proper brush clearance year after year, especially given the mixed success of community efforts like those in the Palisades?

Dave Tobias

When you have houses in close proximity to each other, if some homeowners maintain their property while others don't, it diminishes the value of community protection. We need to create better incentives for people to maintain their properties.

There's the inherent carrot-and-stick approach. Doing certain things might bring down your insurance rates. We see some states implementing programs, like with fortified homes and fortified roofs. In areas that experience massive hail events annually, where people need new roofs every year, some states provide rebates or funding to insurers or homeowners to install more sustainable roofs that meet specific fortified standards.

But we need to start implementing these sorts of programs now. These events aren't going to stop happening, and people are going to continue living in these areas.

While some homeowners will take initiative on their own, my hope is that we'll develop a more cohesive strategy around prediction and prevention at the state level, and maybe someday even at the federal level. That's really the only way some of these areas will remain insurable.

Insurance Thought Leadership

What if you used your aerial images to show homeowners how their properties compare with their neighbors’, similar to how utility companies share data on how my energy usage compares with similar homes in my neighborhood?

Dave Tobias

Absolutely. The technology and data exists today. Insurers have a lot of this data -- they're buying from companies like us and others. When you log in to pay your insurance bill, you don't see this data that insurers have, at least I don't with my insurer. That's a big opportunity.

I think there's huge potential for sharing downstream preventative measures. Take defensible space. The AI can show your current defensible space profile and indicate that if you clear out specific zones, it will reduce your risk by a certain amount. The same applies to roof condition. We can monitor your roof and share that information with you as an insured, pointing out problems like missing shingles or staining that might need attention.

You can track issues over time, which is valuable because most people don't regularly inspect their roofs -- out of sight, out of mind. I think sharing more information downstream with agents and insureds would benefit everyone. That's a last-mile problem we hope to solve.

The concept of Predict & Prevent isn't new -- I and others have been talking about it for years. What's new is the technology to assist in it, like the information we can get from aerial imagery and how we've been able to unlock it with AI. But we're not doing anything to act yet. We need to add some level of action to that prevent step.

Insurance Thought Leadership

How do your hurricane monitoring and tracking methods differ from your wildfire surveillance?

Dave Tobias

With hurricanes, we typically know they're coming and can plan accordingly. Even before the hurricane hits, we can identify which properties will be most susceptible to damage.

The Predict & Prevent aspect is crucial. With hurricanes, you can see fascinating examples where two neighboring properties experience the same storm conditions -- identical wind speeds and everything -- yet one roof survives without a scratch while the other gets completely ripped off. This demonstrates how taking preventative action, like installing fortified roofs, can prevent hurricane disaster damage.

Insurance Thought Leadership

What is your approach to areas that aren't obviously at risk? How do you handle coverage in places like Kansas or Minnesota that may not seem like immediate priority zones?

Dave Tobias

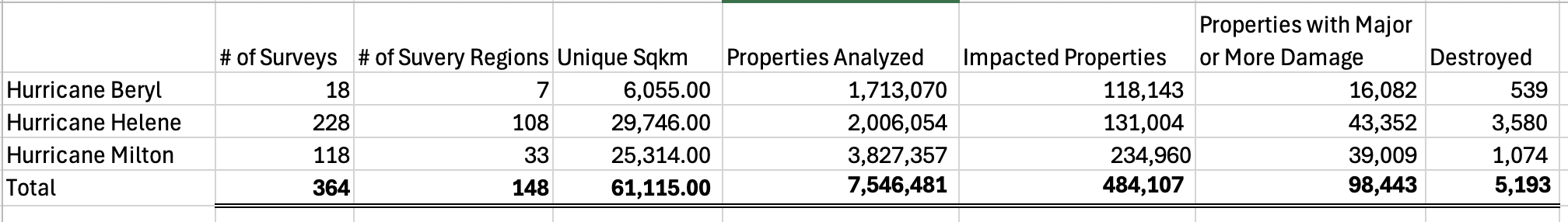

For our impact response, we'll fly anywhere. Milton and Helene hit some areas that weren't as populous, but we flew them. We flew 118 flights. We analyzed over 5 million buildings.

We can fly areas we've never flown before, and that still provides tremendous value to insurance companies. They're trying to triage and decide where to send their claims adjusters and get everything moving in the right direction. The sooner they can do that, the better for everybody.

I like to say that every carrier is a CAT carrier now, because every state has had at least one catastrophic-level peril that's starting to hit it. When I started in insurance, you would talk about certain carriers just dealing with catastrophic stuff in Florida and Louisiana, while others would say "we're in Colorado, we're not really a CAT carrier." But that's definitely changed because of the severity of these events, the frequency of these events, and where populations have moved to.

Insurance Thought Leadership

Looking ahead two to five years, where do you see your technology evolving in terms of predicting risk factors?

Dave Tobias

I think we're going to have to evolve, because otherwise too much of the country will become uninsurable. We're going to have to change the mindset and have insurance companies, insureds, and agents all partner together to maintain properties at an insurable level.

To achieve this, insurance companies need to share more information with the insureds. We need tools from companies like Nearmap to make that sharing easy and interactive, so insurers can easily assess the condition of their roof and defensible space profile and improve them. That's the only way to get closer to an equilibrium of rate to risk. Right now, in certain areas of the country -- Florida and California being extreme examples -- we don't have that equilibrium or anything close to it.

Five years from now, I think Predict & Prevent is going to be a cornerstone of insurance policy and framework.

Insurance Thought Leadership

Is there anything we haven't covered or any final thoughts you'd like to share?

Dave Tobias

Obviously, I'm biased, but I think not enough gets told about how proactive insurers were during the fires and how they were really trying to help people. They weren't just canceling policies and doing the things that the news has described. I think we need to tell the story of carriers who were tracking people down on TikTok just so they could be there to help.

I was talking to one carrier whose claims adjusters were sometimes spending three or four hours on the phone with insureds because they were being counselors. They were helping people figure out how to replace their pictures and other personal items. These companies were really going above and beyond.

Insurance Thought Leadership

That seems like a great note to end on. I’ll certainly try to do my part to spread the word.

Thank you for taking the time.

Dave Tobias

We love talking about this stuff, and there's so much to discuss.