Long-range forecasts don’t all agree on the weather or

how we label it, but another winter of extreme cold may be upon much of the nation. I’m personally convinced one is because even where I live, in Tennessee, my dog, Max, is vocally rejecting his outdoor house at night -- and that doesn’t usually happen until January. While Max and I, having lived in the South all our lives, may be wimps when it comes to the cold, conditions are clearly calling for an alternate plan. And that brings me to today’s topic: From a workers' comp and safety perspective, did last year’s polar vortex provide any important lessons?

Slips and falls

Slips, trips and falls, according to OSHA, contribute to 15% of all workplace fatalities -- second only to motor vehicle accidents. WorkCompWire recently reported that

nearly one-third of all workers' comp claims in the Midwest last year were because of slips and falls on ice and snow, doubling the rate of the previous year.

This data, from the Accident Fund and United Heartland, represents only five states, so I don’t want to say we have a national trend -- but I am eager to see 2013-2014 data from the

Bureau of Labor Statistics or other major sources. Would it be surprising if percentages were even higher in areas where extreme winter weather is rare?

While it will be another year before the first “polar vortex” slips and falls from late 2013 show up on experience mods, I thought it would be interesting to set up a few scenarios and with the help of

ModMaster illustrate how an increase in these accidents might affect an employer’s experience mod and premium.

The cost in terms of mod points – and increased premium

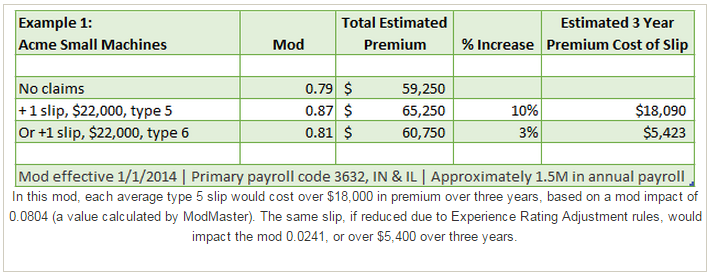

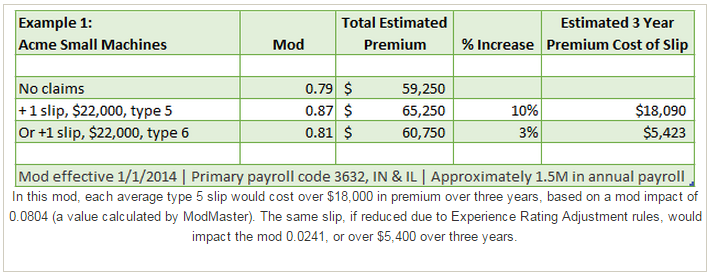

For the following scenarios, I assumed an average slip and fall on the ice would cost $22,000, which is in range of varied statistics I found on the web. Of course, an actual slip-and-fall expense could vary from very little to tens of thousands of dollars, depending on complications and time away from work. As you see below, whether the loss is kept as a medical-only loss or involves indemnity makes quite a difference – although, in actuality, an indemnity claim is probably going to be quite a bit higher than $22,000. As a reminder,

in most states, medical-only losses are reduced by 70% because of the experience rating adjustment (ERA) rule of the experience rating formula.

For the first scenario, let’s imagine a relatively small machine shop with about $1.5 million in annual payroll. This company’s minimum mod is 0.79, and the manual premium is $75,000. As you can see below, a single average slip and fall would increase the mod by 8 points (on a scale of 100) and increase the premium by 10% – unless the claim is kept medical-only, in which case the impact would be only 3 mod points and about 3% of the premium.

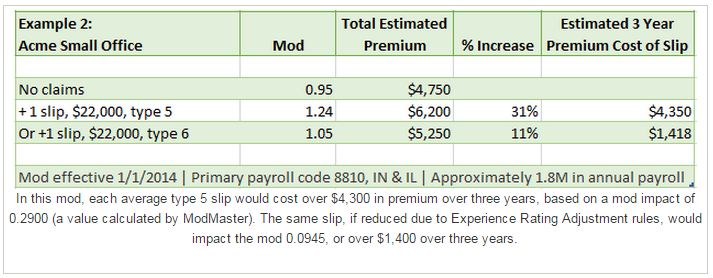

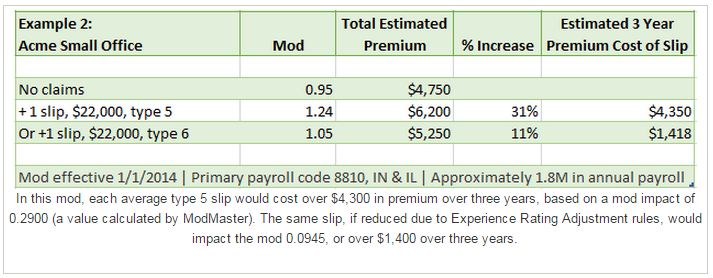

In a second scenario, let’s imagine another small company, one that consists of office workers. Because this company’s expected losses (not shown) are much less than in the first scenario, the company’s minimum mod isn’t as low as our first example. Furthermore, the impact of a single slip and fall is much more significant in terms of mod points. However, this company’s manual premium is only $5,000 -- so while the premium impact of the slip and fall may not seem too significant in dollars, the percentage increase of their premium is notable.

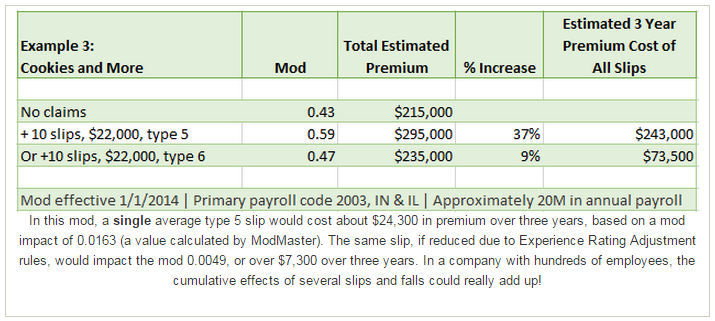

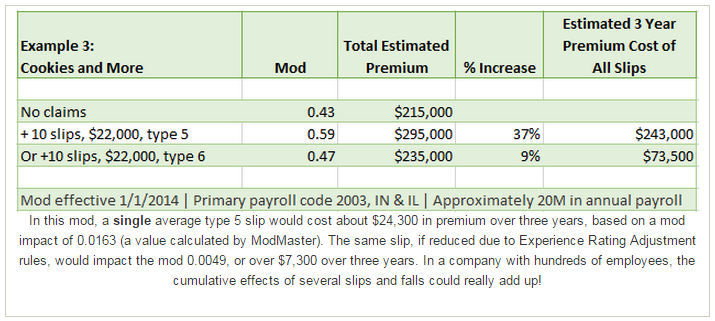

Finally, I wanted to see what kind of impact several slips and falls might have on a larger company. My mind is already on holiday baking, so let’s imagine a cookie factory of several hundred employees and about $20 million in annual payroll. Then let’s imagine that, during a particularly bad patch of weather, seven people slip and fall in the parking lot and three more slip and fall in an entryway that has become wet with melting ice. For this company, which has a minimum mod of 0.43 and a manual premium of $500,000, those 10 slips are still a hefty impact if they’re not held to type 6.

For the examples above, I’ve depicted companies whose workers are not primarily assigned to environmentally challenging conditions. Imagine the spike in injuries and cost for companies whose employees are exposed to

cold stress.

'The tip of the iceberg'

Slips and falls certainly aren’t the only winter issue. Workers' comp and insurance news and blogs are populated with lists and stories of all types. Consider just a couple:

1.

A recent story in Business Insurance concerns an employee injured when her employer gave her a ride in the floor of a company van during a snowstorm. While the employer was clearly trying to help out its employees, this employee is due benefits, a NY court ruled, because she was still on the clock, and the employer “took responsibility for the inherent risks of transporting its employees from the worksite.”

2. Although it’s not mentioned as a weather-related issue, it’s easy to imagine that a situation like

this wet floor case could have developed because of rain or snow. The moral of this particular story? A “wet floor” sign is a safety device that an employer must ensure is utilized, not just made available to custodians.

Regardless of the cause of any injury, a popular analogy in risk management is that the cost of workers’ compensation insurance is just the “

tip of the iceberg.” In addition to direct insurance, medical and indemnity costs, the full costs include administrative expenses, potentially significant impacts to a company’s productivity and the injured employee’s overall well-being. By the most conservative estimates, an average slip of $22,000 may actually cost twice that -- and by some estimates may approach $100,000 in total costs.

Summary

As the examples above show, the experience mod and cost impact of winter-related accidents are sure to vary considerably from one accident and one company to the next. Regardless of exact cost, the reported uptick in slips and falls on ice and snow should serve as a flare on a snowy roadside, reminding us that every company, regardless of its size or geographic location or the type of work it does, needs some level of preparation for extreme weather in terms of policy, operations and equipment. (

Broker Briefcase is a good resource to help.)

Even before I read the news about the increase in Midwestern slips and falls, a prevalence of winter-related slips and falls had stood out to me in loss runs that I occasionally see in the process of assisting clients. Have you seen evidence of this, as well? How are you helping your client or company understand the potential cost of just one winter weather loss, and to prepare as much as possible for avoiding or mitigating that loss?

I’d love to hear your thoughts in the comments below.

In a second scenario, let’s imagine another small company, one that consists of office workers. Because this company’s expected losses (not shown) are much less than in the first scenario, the company’s minimum mod isn’t as low as our first example. Furthermore, the impact of a single slip and fall is much more significant in terms of mod points. However, this company’s manual premium is only $5,000 -- so while the premium impact of the slip and fall may not seem too significant in dollars, the percentage increase of their premium is notable.

In a second scenario, let’s imagine another small company, one that consists of office workers. Because this company’s expected losses (not shown) are much less than in the first scenario, the company’s minimum mod isn’t as low as our first example. Furthermore, the impact of a single slip and fall is much more significant in terms of mod points. However, this company’s manual premium is only $5,000 -- so while the premium impact of the slip and fall may not seem too significant in dollars, the percentage increase of their premium is notable.

Finally, I wanted to see what kind of impact several slips and falls might have on a larger company. My mind is already on holiday baking, so let’s imagine a cookie factory of several hundred employees and about $20 million in annual payroll. Then let’s imagine that, during a particularly bad patch of weather, seven people slip and fall in the parking lot and three more slip and fall in an entryway that has become wet with melting ice. For this company, which has a minimum mod of 0.43 and a manual premium of $500,000, those 10 slips are still a hefty impact if they’re not held to type 6.

Finally, I wanted to see what kind of impact several slips and falls might have on a larger company. My mind is already on holiday baking, so let’s imagine a cookie factory of several hundred employees and about $20 million in annual payroll. Then let’s imagine that, during a particularly bad patch of weather, seven people slip and fall in the parking lot and three more slip and fall in an entryway that has become wet with melting ice. For this company, which has a minimum mod of 0.43 and a manual premium of $500,000, those 10 slips are still a hefty impact if they’re not held to type 6.

For the examples above, I’ve depicted companies whose workers are not primarily assigned to environmentally challenging conditions. Imagine the spike in injuries and cost for companies whose employees are exposed to cold stress.

'The tip of the iceberg'

Slips and falls certainly aren’t the only winter issue. Workers' comp and insurance news and blogs are populated with lists and stories of all types. Consider just a couple:

1. A recent story in Business Insurance concerns an employee injured when her employer gave her a ride in the floor of a company van during a snowstorm. While the employer was clearly trying to help out its employees, this employee is due benefits, a NY court ruled, because she was still on the clock, and the employer “took responsibility for the inherent risks of transporting its employees from the worksite.”

2. Although it’s not mentioned as a weather-related issue, it’s easy to imagine that a situation like this wet floor case could have developed because of rain or snow. The moral of this particular story? A “wet floor” sign is a safety device that an employer must ensure is utilized, not just made available to custodians.

Regardless of the cause of any injury, a popular analogy in risk management is that the cost of workers’ compensation insurance is just the “tip of the iceberg.” In addition to direct insurance, medical and indemnity costs, the full costs include administrative expenses, potentially significant impacts to a company’s productivity and the injured employee’s overall well-being. By the most conservative estimates, an average slip of $22,000 may actually cost twice that -- and by some estimates may approach $100,000 in total costs.

Summary

As the examples above show, the experience mod and cost impact of winter-related accidents are sure to vary considerably from one accident and one company to the next. Regardless of exact cost, the reported uptick in slips and falls on ice and snow should serve as a flare on a snowy roadside, reminding us that every company, regardless of its size or geographic location or the type of work it does, needs some level of preparation for extreme weather in terms of policy, operations and equipment. (Broker Briefcase is a good resource to help.)

Even before I read the news about the increase in Midwestern slips and falls, a prevalence of winter-related slips and falls had stood out to me in loss runs that I occasionally see in the process of assisting clients. Have you seen evidence of this, as well? How are you helping your client or company understand the potential cost of just one winter weather loss, and to prepare as much as possible for avoiding or mitigating that loss?

I’d love to hear your thoughts in the comments below.

For the examples above, I’ve depicted companies whose workers are not primarily assigned to environmentally challenging conditions. Imagine the spike in injuries and cost for companies whose employees are exposed to cold stress.

'The tip of the iceberg'

Slips and falls certainly aren’t the only winter issue. Workers' comp and insurance news and blogs are populated with lists and stories of all types. Consider just a couple:

1. A recent story in Business Insurance concerns an employee injured when her employer gave her a ride in the floor of a company van during a snowstorm. While the employer was clearly trying to help out its employees, this employee is due benefits, a NY court ruled, because she was still on the clock, and the employer “took responsibility for the inherent risks of transporting its employees from the worksite.”

2. Although it’s not mentioned as a weather-related issue, it’s easy to imagine that a situation like this wet floor case could have developed because of rain or snow. The moral of this particular story? A “wet floor” sign is a safety device that an employer must ensure is utilized, not just made available to custodians.

Regardless of the cause of any injury, a popular analogy in risk management is that the cost of workers’ compensation insurance is just the “tip of the iceberg.” In addition to direct insurance, medical and indemnity costs, the full costs include administrative expenses, potentially significant impacts to a company’s productivity and the injured employee’s overall well-being. By the most conservative estimates, an average slip of $22,000 may actually cost twice that -- and by some estimates may approach $100,000 in total costs.

Summary

As the examples above show, the experience mod and cost impact of winter-related accidents are sure to vary considerably from one accident and one company to the next. Regardless of exact cost, the reported uptick in slips and falls on ice and snow should serve as a flare on a snowy roadside, reminding us that every company, regardless of its size or geographic location or the type of work it does, needs some level of preparation for extreme weather in terms of policy, operations and equipment. (Broker Briefcase is a good resource to help.)

Even before I read the news about the increase in Midwestern slips and falls, a prevalence of winter-related slips and falls had stood out to me in loss runs that I occasionally see in the process of assisting clients. Have you seen evidence of this, as well? How are you helping your client or company understand the potential cost of just one winter weather loss, and to prepare as much as possible for avoiding or mitigating that loss?

I’d love to hear your thoughts in the comments below.