I started writing yet another article trying to convince risk managers to grow their quant competencies, to integrate risk analysis into decision-making processes and to use ranges instead of single-point planning, but then I thought, why bother? Why not show how risk analysis helps make better risk-based decisions instead?

After all, this is what Nassim Taleb teaches us. Skin in the game.

So I sent a message to the Russian risk management community asking who wants to join me to build a risk model for a typical life decision? Thirteen people responded, including some of the best risk managers in the country, and we set out to work.

We decided to solve an age-old problem – win the lottery. With help from Vose Software ModelRisk we set out to make history. (Not really: It's been done before. Still fun, though).

Here is some context:

- Lotteries are an excellent field for risk analysis because the probabilities and range of consequences are known

- In Russia, as in most countries, lotteries are strictly regulated. There is a rule: When a large amount accumulates, several times a year it is divided among all the winners. This is called roll-down.

- If no one takes the jackpot before or during the roll-down, then the whole super prize is divided among all other winners

- So the probability of winning is the same as usual, but the winnings for each combination can be significantly higher if no one wins the jackpot.

We set out to test our risk management skills in a game of chance.

June 8, 2019

Whatsup group created. Started collecting data from past games. Some of the best risk managers in the country joined the team, 15 in total: head of risk of a sovereign fund, head of risk of one of the largest mining companies, head of corporate finance from an oil and gas company, risk manager from a huge oil and gas company, head of risk of one of the largest telecoms, infosecurity professionals from Monolith and many others.

June 9, 2019

Placing small bets to do some empirical testing.

June 10, 2019

First draft model is ready…

June 11, 2019

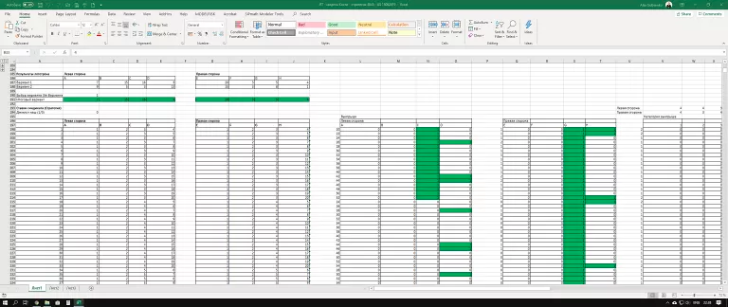

Created red team and blue team to simultaneously model potential strategies using two different approaches: bottom up and top down. Second model is created…

June 12, 2019

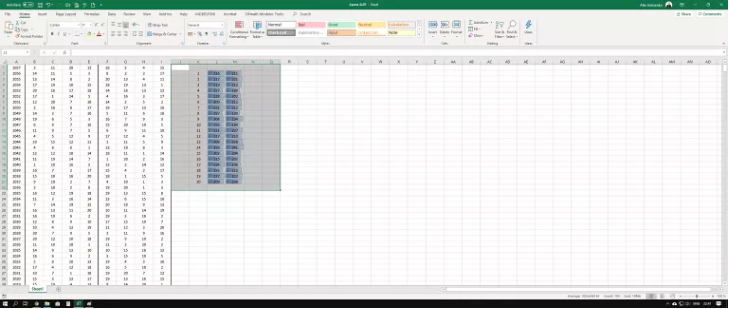

Testing if the lottery is fair, just in case we can game the system without much math. Yes, some numbers are more frequent than others, and there appears to be some correlation between different ball sets but not sufficient to produce a betting strategy. The conclusion – the lottery appears to be fair, so we will need to model various strategies.

June 13, 2019

Constantly updating red and blue models as we investigate and find more information about prize calculation, payment, tax implications and so on. The team is now genuinely excited. Running numerous simulations using free ModelRisk.

June 14, 2019

Did nothing, because all have to do actual work.

June 15, 2019

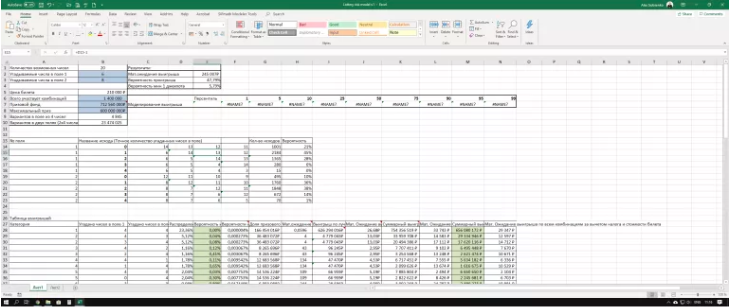

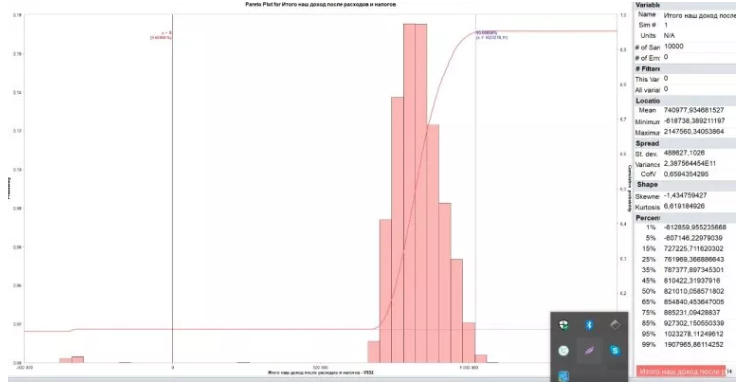

After running multiple simulations, we selected a low-risk, good-return strategy. Dozens more simulations later, here are the preliminary results, using very conservative assumptions:

- probability of loss 9.8%; worst-case scenario, we lose 60% of the money invested

- probability of winning 90%; 80% of the time, winnings would be between 50% and 100% of the amount invested, after taxes (this means there is a high possibility to double invested cash at relatively low risk)

- potential upside significantly higher than downside

Red and blue team models produced comparable results.

June 16, 2019

Started fundraising.

If we manage to collect more than the required budget, we decide to make two bets: one risk management bet (risk management strategy) and one speculative bet with much higher upside and as a result greater downside (risky strategy).

Full budget collected within just a few hours. Actually collected almost double the necessary amount and, as agreed, separated 50% of the funds into the second investment pool. Separate team set out to develop the risky strategy. While I was an active investor in the risk management strategy, I decided to play a role of a passive investor in the risky strategy and only invested 16% into the risky.

June 17, 2019

Continued to develop the model, improving estimates every time. Soon, we felt the financial risks were understood by the team members, and we needed to take care of other matters before the big day.

First, took care of legal and taxation risks. Drafted a legal agreement clearly stating the risks associated with the strategy, the distribution of funds and the responsibilities of team members. Each member signed. Agreed to have an independent treasurer.

Then started to deal with operational risks. Apparently transferring large sums of money, making large transactions and placing big bets is not plain vanilla and required multiple approvals, phone calls and even a Skype interview. Five team members in parallel were going through the approvals in case we needed multiple accounts to execute the strategy.

Probably the biggest risk was the ability of the lottery website to allow us to buy the tickets at the speed and volume necessary for our low-risk strategy. This turned out to be a huge issue, and we found an ingenious solution. The information security team at Monolith did something amazing to solve the problem, and I mean it, amazing. I have never seen anything like this. It’s a secret, unfortunately, because, you guessed it, we are going to use it again.

The strategy that the lottery company recommended for large bets is actually much riskier than the one we selected. How do we know that? Because we ran thousands of simulations and compared the results.

June 18, 2019

The lottery company changed the game rules slightly. Ironically, this slightly improved our 90% confidence interval and reduced the probability of loss. So, thank you, I guess.

More testing and final preparation. The list of lottery tickets waiting to be executed.

In the true sense of skin in the game, team members who worked on the actual model put up at least double the money of other team members.

June 19, 2019

8am. We were just about to make risk management history. A lot of money to be invested based on the model that we developed and had full trust in. I felt genuinely excited: Can proper risk management lead to better decisions? I am sure other team members were excited, too.

By about lunch time, the strategy was executed. We bought all the tickets. Now we just had to wait for the 10pm game. Don’t know about the others, but I couldn’t do any work all day. I couldn’t even sit still, let alone think clearly. Endorphins, dopamine, serotonin and more.

At 9:30pm, we did a team broadcast, showing the lottery game as well as our accounts to monitor the winnings, both for excitement purposes and as full disclosure.

Then came the winning numbers. Two team members actually managed to plug them into the model and calculate the expected winnings. We had the approximation before the lottery company did.

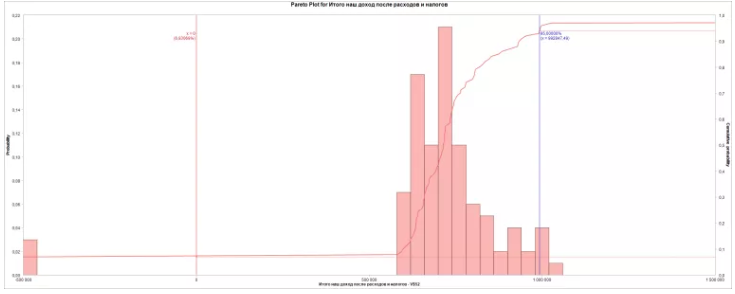

You guessed it: We won. Our actual return was close to 189% on the money invested after taxes (or 89% profit; remember, our estimate was 50% to 100% profit, so well within our model). We almost doubled our initial investment. Not bad for risk management. (Good luck solving this puzzle with a heat map.)

June 20, 2019

More excitement, model back-testing and lessons learned -- and, perhaps the most difficult part, explaining to non-quant risk management friends why, no, this was not luck; it was great decision making.

In fact, our final result was close to P50. We were actually unlucky, both because we didn’t get some of the high-ticket combinations and, more importantly because five other people did, significantly reducing our prize pool.

Let me repeat that: We were unlucky and still almost doubled our money.

June 21, 2019

Job well done!