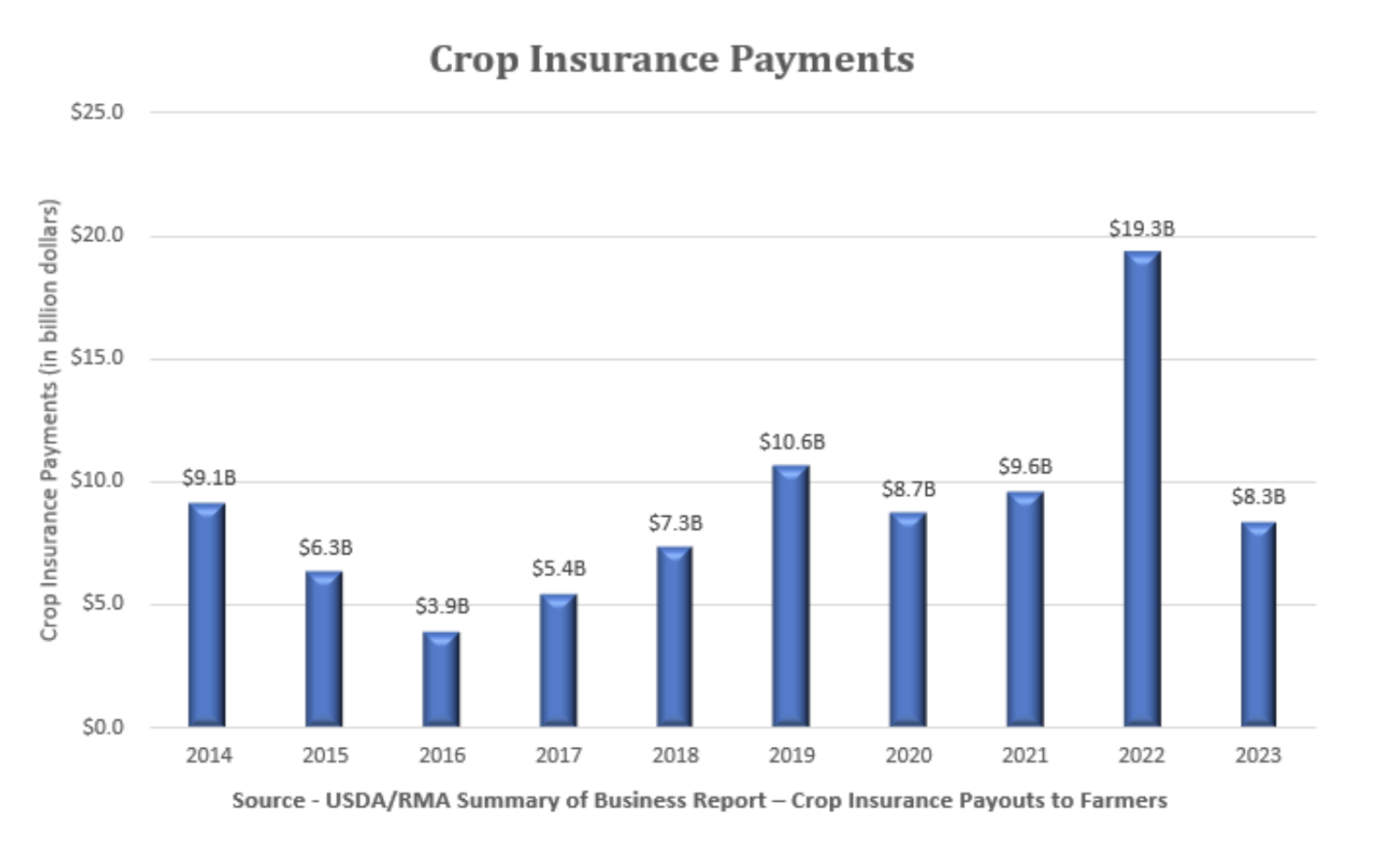

Business owners are often asked, “What keeps you up at night”? Depending on the business, their responses are numerous. In agriculture, weather is often the response. Farmers and agribusinesses worry about weather and the increasing frequency and severity of weather events that cause billions of dollars of crop damage and economic loss annually. Farmers alone have incurred on average just under $9 billion in annual loss recoveries over the last 10 years.

While farmers and agribusinesses share a threat from drought, excessive moisture, windstorm and other weather events, their risk management strategies for managing weather risk are notably different. Why? Let’s start with a brief risk management 101 discussion.

See also: Property Underwriting for Extreme Weather

When managing risk, we have three choices. We can avoid the risk, retain the risk or transfer the risk through insurance.

1. Avoiding the risk is frequently not an option, as it is at the heart of why the farmer and agribusiness exist (i.e., farmers grow a crop, and agribusinesses sell a product or service to a farmer).

2. Retaining the risk is a choice but requires a comprehensive understanding of the risk and consequences for each agribusiness organization.

3. Transferring risk, particularly when catastrophic exposure exists, is customary for commercial enterprises. Insurance, used as a risk transfer or for risk sharing, is a fundamental economic tool used by most businesses to secure capital and to protect against catastrophic economic loss, including weather that can devastate a business.

Farmers and ranchers extensively leverage the federally subsidized Federal Crop Insurance Program to protect their production and revenues from loss due to weather events.

Agribusinesses, on the other hand, retain significant risk exposure for their own lost revenues caused when farmers and ranchers don’t purchase their products and services due to weather-related crop loss.

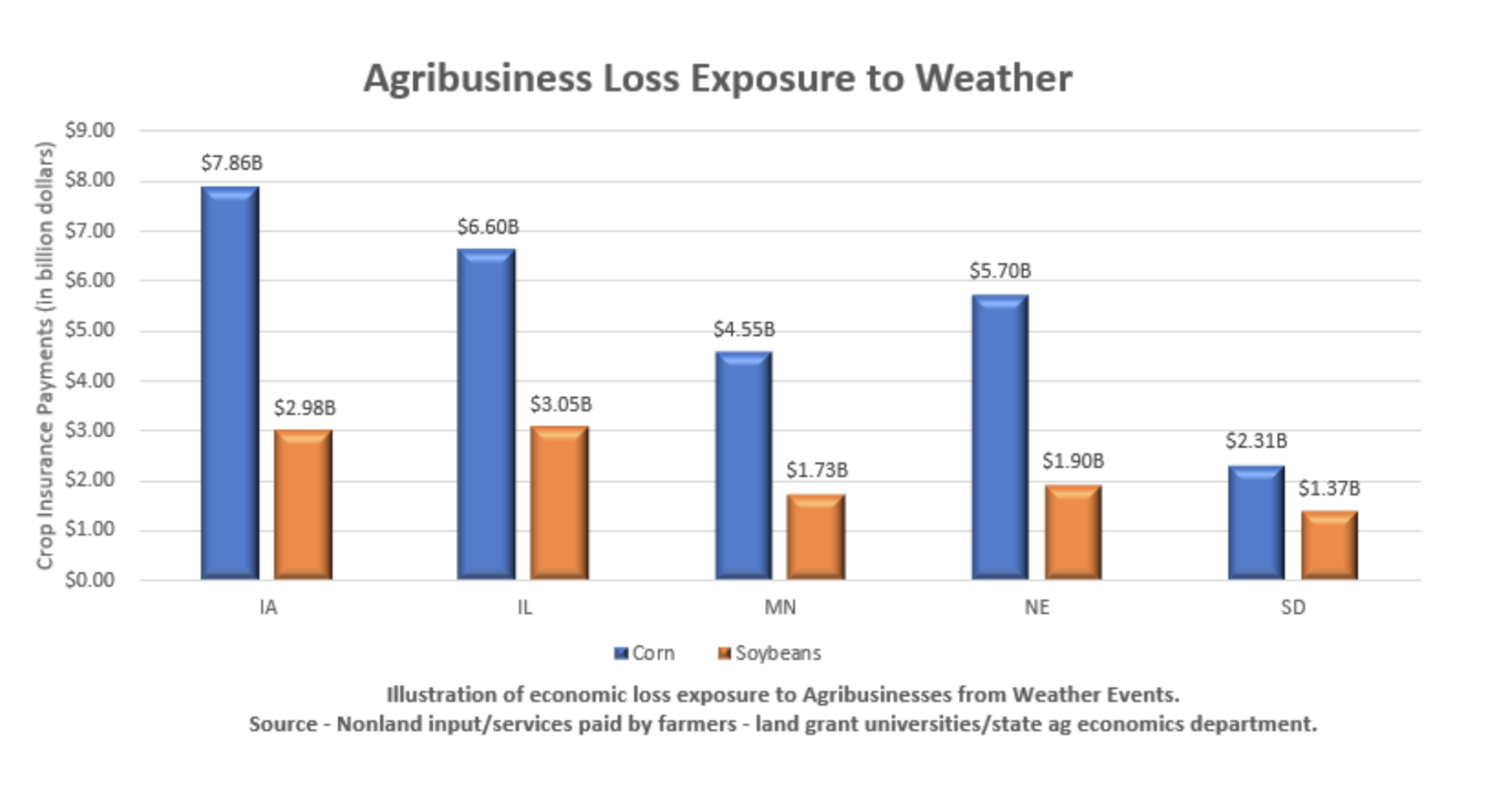

Farmers and agribusinesses share exposure to catastrophic weather events, but their risk management strategies are quite different. Moreover, agribusinesses face concentrated exposure for potential loss of their product and service revenues for corn and soybean crops in just five of the largest corn- and soybean-producing states. These five contiguous states represent roughly 60% of corn and 40% of soybean production.

So how do agribusinesses manage weather risk? Agribusinesses can partially manage catastrophic weather exposure through geographic diversification. Geographic spread of products and services can help to reduce the impact of a significant weather event. But is that enough?

See also: Risk Management for Agriculture

Recent weather events, such as in 2019 when over 20 million acres of prevent plant occurred across portions of the Midwest, or 2020 when a “derecho” storm damaged crops along a 50-mile-wide path from South Dakota through Ohio, created significant loss to agribusinesses from loss of input sales, replant guarantees and excessive usage of rental equipment. Because the derecho hit the Midwestern states, this single weather event created catastrophic loss to even large agribusinesses selling products and services to farmers and ranchers. Additionally, these types of events create significant risk to lenders’ revenues and balance sheets when they have exposure to operating and business loans to affected agribusinesses.

So, while farmers and ranchers have crop insurance to manage their risk, what insurance alternatives exist for agribusinesses? Until recently, very few insurance options existed to protect agribusinesses’ revenue from weather-related losses on their farmer and rancher product and service sales. There are currently two types of insurance products to protect agribusiness revenues and balance sheet risk – parametric and basis risk insurance.

Parametric insurance (or index-based insurance) provides coverage on a predetermined weather event vs indemnifying for actual loss occurred by the insured. The para metric insurance policy insures a policyholder against the occurrence of a predefined event by paying a set amount to all insureds in the covered area, regardless of whether an actual l oss occurred to an insured. The advantage of this type of insurance is the simplicity of the program and the generally lower cost. The disadvantage is that some insureds who did not suffer any loss may be paid because the predetermined event occurred. On the other hand, some insureds who suffered loss may not be paid, because the specific, predetermined event did not occur. This type of policy, under the Federal Crop Insurance Program, is known as an index policy. An example is the pasture, rangeland and forage insurance policy.

The other type of insurance is “basis risk” insurance. Each field location is insured specifically. and the amount of coverage, perils insured against and damage assessment occurs at the field level. This type of insurance matches specific risk exposure and loss payments to an insured’s specific location for actual loss incurred. This type of policy, under the Federal Crop Insurance Program, is known as an individual yield and revenue policy. Examples include the crop revenue coverage or revenue assurance policy. Basis risk insurance policies provide the best-alignment between risk exposure and coverage specific to the insured location and actual loss experience.

While few weather risk insurance options were historically available for agribusinesses, innovative technologies, more granular data and specialized risk management solutions are now available. Agribusinesses, like their farmer and rancher customers, now have new insurance tools to help manage the frequency and severity of weather event risk and protect their revenue and balance sheet exposures.