Where’s the distribution disruption?

When I started working in the insurance industry in 2015, I (regrettably) used the word “disruption” a lot. I was making a career shift from capital markets into a buzzy, fairly new space called “fintech,” and I became excited about the massive total addressable market (TAM) and archaic user experience (UX) in insurance. Insurance felt like a maximally unsexy, almost contrarian way to bet on the continued digitization of financial services. I was convinced that this meant radically changing and reinventing distribution.

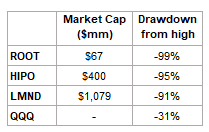

A common narrative among industry outsiders at the time (like me) was that direct and fully online channels would inevitably displace traditional agent distribution. This turned out to be pretty naive and way off the ball. In the years that followed, we’ve seen a classic investment cycle rapidly play out, as insurtech surged and evolved into a consensus venture opportunity space. For a while, people even stopped asking me why I work in insurance. Insurtech attracted over $14 billion in private capital in 2021 alone, before macro turned and a spate of unsuccessful exits and broken IPOs crushed insurance investor enthusiasm along with revenue multiples.

Sources: Bloomberg Finance; Yahoo Finance (1/11/2023)

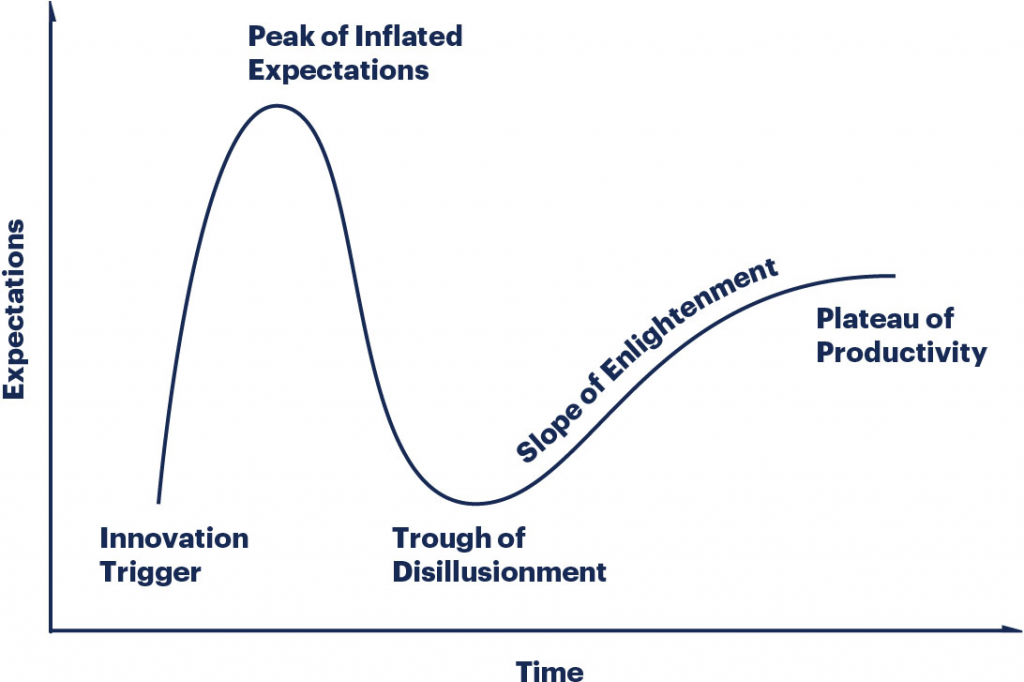

Today, as insurance investors learn from past mistakes, it’s worth thinking about which assumptions were wrong and how expectations evolved. I find it instructive to refer to the Gartner Hype Cycle (below), which plots evolving excitement levels and innovation themes over time. After parabolic growth and a steep descent to disillusionment, the valley we’re in today offers a great vantage point for retrospection and redirection. There are lots of valuable lessons to glean.

Source: Gartner

Some of the takeaways are macro and relevant across consumer fintech generally (e.g., growth at all costs isn’t great in a rising rate environment!). Other lessons, however, are specific to insurtech business models and therefore relevant as we look to the future. For example:

- Unvalidated underwriting frameworks drove large losses

- Lifeterm value (LTV) was stubbornly low, as cross-selling proved to be difficult and customer loyalty to insurtechs remained low

- High customer acquisition costs (CACs) worsened as the market became more crowded

- Customers turned out not to get super-excited about purchasing insurance products (especially the non-compulsory ones), even with a modern UX

See also: How to Prevent Agent Gaming

Another important learning (and the one I will focus on in this post) is that legacy distribution is much more resilient than insurtech enthusiasts (again, like me) anticipated. The core hypothesis that digitization would massively displace legacy/agent distribution did not bear out, and the disruptive potential of new channels was overestimated. The dynamic of legacy channels remaining relevant is something we’ve also seen in other categories — like retail, where there was a resurgence of focus on physical retail and omnichannel strategies after a head fake of e-commerce acceleration. Similarly, insurance agents continue to play an important role in distribution, and firmly coexist alongside the digital channels that emerged.

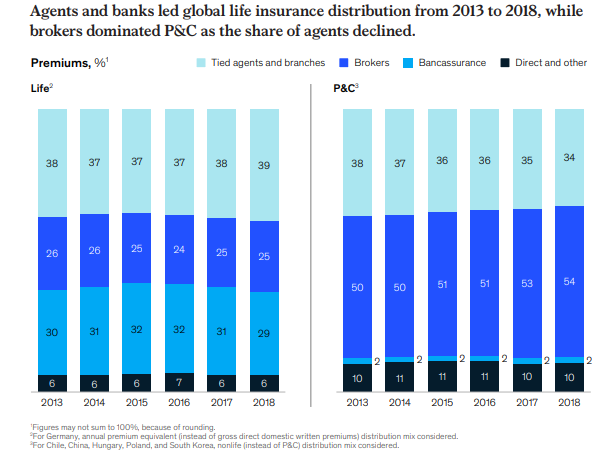

So much has changed in insurance over the past decade as digital innovation enabled new customer experiences, better price discovery and vastly more use of data. But one thing that’s hardly budged? The share of premiums through direct channels. Ninety percent of P&C products continue to be placed through agents, brokers and branches, and the number of independent P&C agents in the U.S. actually increased by roughly 10% from 2020 to 2022. Across P&C and commercial lines, the share of premiums owned by agencies increased between 2017 and 2021. So much for the disappearance of the insurance agent. Despite massive investment in new channels and years of COVID-related business interruptions, agent and broker distribution remains as relevant as ever.

Source: McKinsey

Ultimately, the call for the disruption and eventual disappearance of agents turned out to be wrong on two key fronts. First, it underestimated the centrality of the agency value proposition to purchaser habits and preferences. As we’ve said before at Equal, the business of insurance distribution is fundamentally built on relationships — and those relationships are crucial to customer purchasing decisions. In a 2021 survey of insurance purchasers conducted by Nationwide, 88% said they value having an agent to call, and more than 50% still value having an agent in physical proximity. Far from going extinct, independent agents and brokers remain the most important links in the complex and fragmented chain of insurance distribution channels.

Predictions also overemphasized the extent to which digitization would be a force for disintermediation. New technology turned out to improve agent and broker distribution more than threaten it. A 2021 survey of independent agents found that the majority are concerned about the disruptive potential of new technology, and yet virtually all respondents also said that new digital tools have made their job easier. McKinsey similarly reports that >60% of insurtechs operate within the traditional value chain, as opposed to prioritizing industry disruption.

See also: 4 Ways to Improve Agent Experience

Staying Power in a Changed Game

Agents, brokers and advisers will continue to play an important role in distribution. But it’s simultaneously true that the playbook for running and growing an enduring agency business has changed as a result of digitization. Consumers have made it clear that they want access to trusted agents with whom they maintain a relationship; but they are also increasingly demanding the convenience of virtual service and modern, digital user experiences. An overwhelming majority of insurance purchasers say they want personalized advice and products, yet >60% also prefer the flexibility to interact across communication channels. The data resoundingly shows that failure to deliver on consumer preferences has a sharp impact on topline performance.

Agents have demonstrated impressive staying power over the past decade, but even if the channel remains dominant overall, profits and growth will disproportionately go to the agencies that adopt digital best practices. As BCG put it, agents who “get by on charm…are a vanishing breed” and instead, top agents in the future will rely on “digital channels and AI-based insights.” Agents who fail to adapt will have their lunch eaten by agents who do.

For agencies willing to adopt digital best practices, there are clear advantages. A 2021 study conducted by Liberty Mutual and Safeco found that agencies that ranked in the top one-third on digital adoption experienced 70% higher revenue growth compared with the other two-thirds of agencies. And beyond topline growth, there is an equally compelling opportunity for agencies to leverage technology to increase their profitability. Legacy workflows are uncompetitive compared with data-driven and automated processes. The data is clear that cross-selling effectiveness, customer satisfaction and agent productivity can all be readily addressed and improved via technology.

The insurance space will continue to rapidly evolve–the secular trends catalyzing more digitization, more effective risk transfer and frictionless purchasing experiences are well in motion. While the thesis of digital-only distribution fundamentally failed, I have more conviction than ever that the age of digital transformation in insurance is here.

This article first appeared here. It is the first in a series of posts about digitization in insurance agencies and brokerages. Subsequent posts will explore technology applications, business model innovation and investment opportunities emerging from digitization of the agency stack.