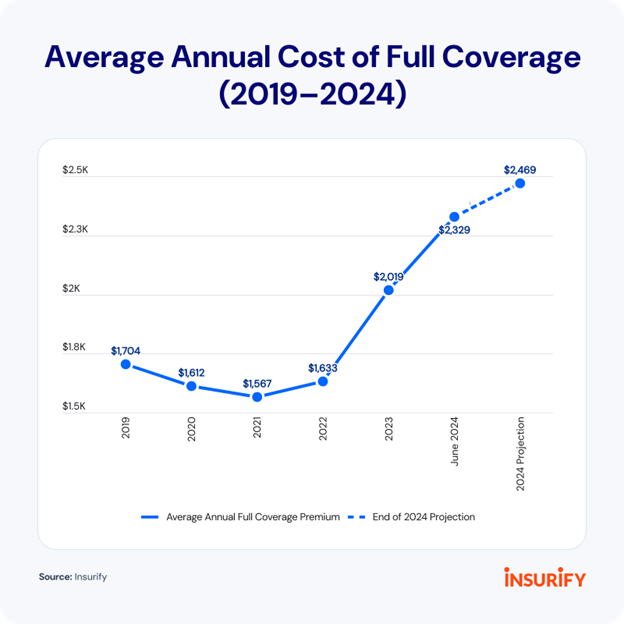

Car insurance rates have soared in post-COVID years, and despite many insurance industry experts predicting slower rate increases in 2024, data from the first half of the year shows a 15% increase in full-coverage premiums. Industry analysts project a total 22% increase in 2024.

Rate increases in 2024 are largely a continuation from 2023, a year that saw full-coverage premiums rise by 24% in response to insurers' record underwriting losses ($33.1 billion) in 2022. Underwriting losses decreased in 2023 but were still $17 billion.

Additionally, legislative changes in states such as South Carolina and Maryland have increased insurers' financial responsibility, leading them to charge higher premiums. In California, which froze insurance rates during the COVID-19 pandemic, some insurers are requesting double-digit increases as they struggle to return to profitability, while others are exiting the state entirely.

Other Key Findings:

- The average annual full-coverage premium now costs $2,329.

- California, Missouri and Minnesota could see car insurance costs increase by more than 50% in 2024.

- Maryland has the highest car insurance costs in the U.S., with an average full-coverage rate of $3,400 annually. New Hampshire drivers pay the least, at an average of $1,000 annually.

- Vehicle maintenance and repair costs have increased by nearly 38% over the past five years, according to the Bureau of Labor Statistics Consumer Price Index.

- Increasingly severe and frequent weather events are driving up auto insurance premiums. Hail-related auto claims represented 12% of all comprehensive claims in 2023, up from 9% in 2020, according to CCC Intelligent Solutions.

See also: It's Time to Revitalize Auto Insurance

The 10 most expensive states for car insurance

Three of the 10 most expensive states for car insurance — Florida, Michigan and New York — have no-fault systems. In these states, drivers file claims with their own insurance companies to receive compensation for their injuries, no matter which party caused the accident. No-fault systems are supposed to speed claims but have also provided opportunities for insurance fraud.

Other states with sky-high insurance rates, like Florida, Louisiana and Nevada, face weather-related damages from hurricanes and wildfires. While climate risk has historically affected homeowners insurance more than auto insurance, insurers factor in the risk of car damage from hail, wind and falling objects.

Vehicle theft rates, traffic congestion from high population density and an increase in car accidents contribute to higher rates, too. Recent analysis of the 10 most expensive states for car insurance identified the hidden factors affecting policyholders.

Maryland

- Average annual cost of full coverage: $3,400

- Percentage higher than the U.S. average: 46%

- Projected average rate increase in 2024: 41%

Maryland saw an 8.2% rise in motor vehicle crash deaths in 2023, while on average the U.S. saw a 3.6% decline, according to the National Highway Traffic Safety Administration.

New Maryland legislation, effective July 1, requires auto insurers to provide enhanced uninsured motorist coverage.

South Carolina

- Average annual cost of full coverage: $3,336

- Percent higher than U.S. average: 43%

- Projected average rate increase in 2024: 38%

South Carolina ranks 13th in the U.S. for questionable vehicle-related insurance claims, according to the National Insurance Crime Bureau (NICB).

A 2023 South Carolina Supreme Court decision increased financial responsibility for insurance companies, ruling that auto insurers cannot limit property damage claims to just covered vehicles under UM/UIM coverage. Under the new law, insurers must effectively cover all properties registered to the policyholder and their family.

New York

- Average annual cost of full coverage: $3,325

- Percent higher than U.S. average: 43%

- Projected average rate increase in 2024: 4%

New York drivers had the most expensive full coverage in the country at the end of 2023 but saw a 1% decrease in the first half of 2024 while rates in other states increased significantly. New York is the ninth most densely populated state in the U.S., which increases the risk of claims. New York also has the highest number of stolen cars, with 32,715 thefts in 2023, NICB data shows.

Nevada

- Average annual cost of full coverage: $3,271

- Percent higher than U.S. average: 40%

- Projected average rate increase in 2024: 20%

The state had the third-highest vehicle theft rate in 2023, with 572.7 car thefts per 100,000 residents, according to the NICB.

Nevada's rising climate risk could play a large role in future rate setting. Wildfires burn an average of 450,000 acres in Nevada annually, and the state also sees some damage from major storms. .

Florida

- Average annual cost of full coverage: $3,201

- Percentage higher than U.S. average: 37%

- Projected average rate increase in 2024: 18%

The state's continuing insurance crisis, influenced by severe weather events, has pushed some insurers out of the state entirely, while others have declared insolvency. In 2023, Farmers Insurance stopped offering coverage in Florida, and AAA didn't renew certain home and auto insurance policies.

Over the past two years, Florida has seen a flurry of legislative activity aimed at reducing frivolous lawsuits against insurers, lowering consumers' insurance rates and mitigating auto insurance fraud. But the no-fault state accounts for 74% of questionable auto glass claims in the U.S., according to the National Insurance Crime Bureau.

Louisiana

- Average annual cost of full coverage: $3,182

- Percentage higher than U.S. average: 37%

- Projected average rate increase in 2024: 23%

The state's growing insurance crisis, tied to Louisiana's high hurricane and tornado risks, has mostly affected home insurance. However, the state's climate risk is also beginning to affect car insurance rates, as comprehensive coverage — one part of a full-coverage policy — protects against damages sustained in a weather event.

Louisiana also saw a 10% surge in vehicle thefts in 2023, according to NICB data.

Louisiana lawmakers passed a series of auto insurance reforms in 2024. The laws target excessive medical billing in personal injury lawsuits and limit policyholders' time to file an immovable property claim to two years after the policyholder knows (or should know) about the damage. These reforms, aimed at lowering rates, reduce some insurer responsibility.

Delaware

- Average annual cost of full coverage: $2,982

- Percentage higher than U.S. average: 28%

- Projected average rate increase in 2024: 13%

The state has the seventh-highest population density in the country, according to U.S. Census Bureau data.

In one bright spot for policyholders, the Delaware Department of Insurance adopted a regulation in January 2024 requiring insurers to promptly refund any unearned auto insurance premiums (meaning payment for the unused days of coverage after a driver cancels their policy).

Washington, D.C.

- Average annual cost of full coverage: $2,977

- Percentage higher than U.S. average: 28%

- Projected average rate increase in 2024: 17%

Washington, D.C., has the highest population density in the nation. The district also saw traffic fatalities increase by more than 40% between 2022 and 2023, according to National Highway Traffic Safety Administration data.

Premium increases may soon slow in D.C. The D.C. legislature passed a law requiring home and auto insurers to file for prior approval to raise rates. Excessive increases require notice and an opportunity for a hearing. Previously, D.C. had a file-and-use system, meaning insurers could raise rates immediately after filing with the Department of Insurance.

Michigan

- Average annual cost of full coverage: $2,719

- Percent higher than U.S. average: 17%

- Projected average rate increase in 2024: 8%

Michigan adopted a no-fault insurance system in 2019 in an attempt to lessen rate increases. The state saw a 4% increase in full-coverage premiums between June 2023 and June 2024, compared with a 28% rise nationwide, but Michigan still has some of the highest rates in the country.

The Michigan Department of Insurance and Financial Services Fraud Investigation Unit received 3,789 fraud reports between July 1, 2023, and June 30, 2024. 99% were insurance-related, and 50% involved auto and no-fault claims.

Georgia

- Average annual cost of full coverage: $2,688

- Percent higher than U.S. average: 15%

- Projected average rate increase in 2024: 24%

On July 1, 2023, House Bill 221 went into effect, ending the state's file-and-use provision and giving Georgia's insurance commissioner 60 days to review rate filings before insurers can implement increases. Despite the new legislation, Georgia drivers saw a 21% increase in full-coverage costs between June 2023 and June 2024.

See also: Unprofitable Insurance: Tail Effect Hits Auto Lines

States where car insurance is rising fastest

The cost of full coverage across the U.S. increased by 28% between June 2023 and June 2024 — but drivers in some states are seeing year-over-year rate increases of more than 50%.

Minnesota, which saw a 55% increase in rates, experienced $1.8 billion in damage following a series of storms that dropped hail up to baseball size across the Twin Cities in August 2023.

Severe storms also hit Missouri and northwest Illinois in 2023. A supercell produced large hail and heavy rains, forming a tornado as it moved across the states.

North Carolina faces a different weather risk — hurricanes. In 2023, Hurricane Idalia hit the state. While the hurricane weakened to a tropical storm, it still brought damaging high winds, heavy rainfall and local flash flooding. Storms like this cause water damage to cars.

Missouri and California are among the 10 states with the highest auto theft rates per capita.

California is playing catch-up

The state froze rate increases during COVID, but drivers saw a 45% full-coverage rate surge in the last year.

California is increasing its minimum car insurance requirements. Gov. Gavin Newsom signed Senate Bill 1107 into law in late 2022, doubling and, in some cases, tripling the liability limits for auto insurance policies. The change takes effect Jan. 1, 2025. This means California residents will see higher premiums next year, albeit with higher protection limits.

California's consumer protection laws keep insurance costs down for policyholders, but it's difficult for insurers to operate profitably. The state's Department of Insurance is slow to approve rate boosts, and insurers have pulled back on writing policies. GEICO has closed all its California offices, State Farm has stopped quoting via phone, and Progressive has halted advertising in the state.

As more insurers leave the state, the department may approve additional rate increases to keep companies in the market.

See also: Modernizing Commercial Auto Insurance

What consumers can do

Consumers can take several steps to manage insurance costs, including comparing rates among multiple insurance companies and asking about available discounts for safe driving, military service, vehicle safety features and multi-vehicle policies. Adjusting deductibles and participating in usage-based insurance programs may also help reduce costs.