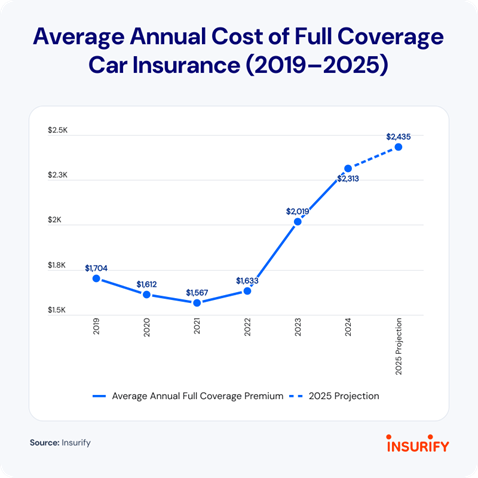

Car insurance rates have been rising dramatically, with a 15% increase in 2024 alone. American drivers now pay an average of $2,313 annually for full coverage, with some states exceeding $3,000. Insurify projects that rates will increase another 5% in 2025, bringing the national average to $2,435. While the pace of increases has slowed, financial pressures remain significant for many drivers.

Key Factors Driving Rate Increases

Rising vehicle repair costs, high-tech and electric vehicles (EVs), and climate risk are among the main causes of these increases. EV insurance costs surged 28% in 2024, twice as fast as for comparable gas-powered models, making them 23% more expensive to insure on average. Climate change has also played a role, as insurers factor in the growing financial impact of hurricanes, hailstorms and other severe weather. Additionally, state-specific regulations and market conditions have led to disproportionate increases in some states.

In regions prone to natural disasters, insurers are adjusting their pricing models to account for the heightened risk. States with high rates of uninsured motorists, frequent weather-related claims, or unique legal structures regarding liability often see steeper increases in insurance premiums.

See also: Are High Insurance Premiums Holding EVs Back?

Most Expensive States for Car Insurance

The states experiencing the highest car insurance costs include Maryland ($4,060, up 53% in 2024), New York ($3,804, up 14% in 2024 and projected to rise a further 10% in 2025), and Florida ($3,166, with an expected 10% increase in 2025 due to climate risks and insurance fraud). Other states, such as Nevada and Georgia, are also seeing significant boosts, with projected increases of 8% in 2025.

Maryland now has the highest average full-coverage premium in the country, surpassing states such as Florida and Michigan, which have historically been at the top. This dramatic increase is due in part to new state legislation requiring insurers to provide enhanced underinsured motorist coverage and cover diminished value claims.

New York continues to be one of the most expensive states for car insurance due to high population density, frequent accidents and stringent coverage requirements. The state's no-fault insurance system has long contributed to higher rates. Florida faces similar issues, with a no-fault system that has led to a significant rise in fraudulent claims.

Fastest-Growing Insurance Rates

Minnesota saw the fastest-growing rates in 2024, with a 58% increase, followed by Maryland (53%) and California (48%). These increases were driven by severe storms, legislative changes and rising climate risks. Minnesota's increase is largely attributed to a string of severe hailstorms that resulted in costly vehicle damage.

Meanwhile, EV insurance costs remain a major factor in rising premiums. The Tesla Model 3 is the most expensive EV to insure, at $4,362 annually, which is 25% higher than a comparable Mercedes-Benz A-Class. Similarly, the Hyundai Ioniq 5 and Kia EV6 cost 41% and 32% more to insure than their gas-powered counterparts.

Climate Change and Insurance Premiums

Climate-related damages are also driving up claims. Hurricanes Helene and Milton caused nearly $50 billion in insured losses in 2024, including 138,000 flooded vehicles. Hail damage claims have also risen sharply.

In states like California, insurers are grappling with the increasing risk of wildfires. South Carolina and Florida also face heightened risk due to hurricanes and flooding. In response, some insurers are limiting coverage options or withdrawing from high-risk markets altogether.

See also: 10 Most Expensive States for Car Insurance

How Drivers Can Mitigate Rising Costs

To mitigate rising costs, drivers should compare rates across multiple insurers, consider telematics programs that track driving behavior for discounts, and bundle policies with home or renters insurance. Telematics programs can offer discounts of up to 30% for safe drivers who enroll.

With insurers stabilizing financially, there may be some moderation in rate increases, but affordability will remain a challenge for many. Drivers who shop around and leverage available discounts will be in a better position to manage rising costs.

Looking Ahead

While auto insurance rates are projected to rise at a slower pace in 2025, affordability remains a growing concern. With the cost of car ownership rising across the board—from vehicle prices to maintenance and fuel—many Americans are feeling the pressure.