KEY TAKEAWAYS:

--Insurers must price risks more accurately, or they will lose their low-risk customers -- those with the highest lifetime value. That means moving beyond proxies such as age, credit history and gender and using actual driving behaviors.

--Many insurers have avoided using telematics data because they don’t want a monitoring period that requires them to wait until they’ve collected sufficient driving data to price accurately, but monitoring periods are no longer required.

--While the insurance industry has made strides in using telematics for upfront discounts, insurers can also communicate with customers about their driving during the term of the policy and can improve renewal pricing to increase loyalty.

----------

Holiday shopping is in full swing, and customers aren’t just tracking down gifts for family and friends. They’re also hunting for better rates on their car insurance. In fact, auto insurance shopping has hit record highs over the past three years as more drivers consider switching carriers in search of cheaper premium prices.

For drivers, the holidays and winter months mean snowy, icy roads, dangerous conditions and heightened risk while driving. For insurers, winter adds another slippery layer to their profitability challenges. As insurers increase premium prices to offset heightened losses, customers are reaching a point where they can’t afford their auto insurance.

It’s a perfect winter storm, and insurers that can’t find better ways to attract and retain customers will be left out in the cold.

Improving retention starts with a better understanding of drivers' behavior and a better way to estimate the lifetime value of customers. There’s more available data than ever about how people drive, walk, bike and use other forms of transportation — and if insurers know how to use it, they can reverse customer defections and turn data into the gift that keeps on giving.

See also: Auto Insurance in an Existential Crisis

Insurers need a better way to retain customers

In today’s highly competitive market, insurance companies can’t respond to inflation and other market pressures by simply raising premium rates across the board. That’s a surefire way for insurers to continue to lose even more customers in the new year – especially those high-lifetime-value customers (i.e., lower-risk customers) insurers need to keep on their books.

Instead, insurers need to price customers more accurately and fairly to create predictable insurance outcomes, improved loss ratios and more profitable decisions for their bottom line.

What’s stopping companies from achieving these goals?

The answer comes down to the traditional approach to assessing and pricing customers. Many insurers have relied on proxies — such as age, credit history and gender — to evaluate customers and predict the likelihood and cost of accidents.

Although these metrics provide upfront information to predict risk, proxies often fall short in delivering the pricing accuracy insurers hope to achieve. That’s because they fail to provide visibility and accurate predictions of actual driving behavior on the road.

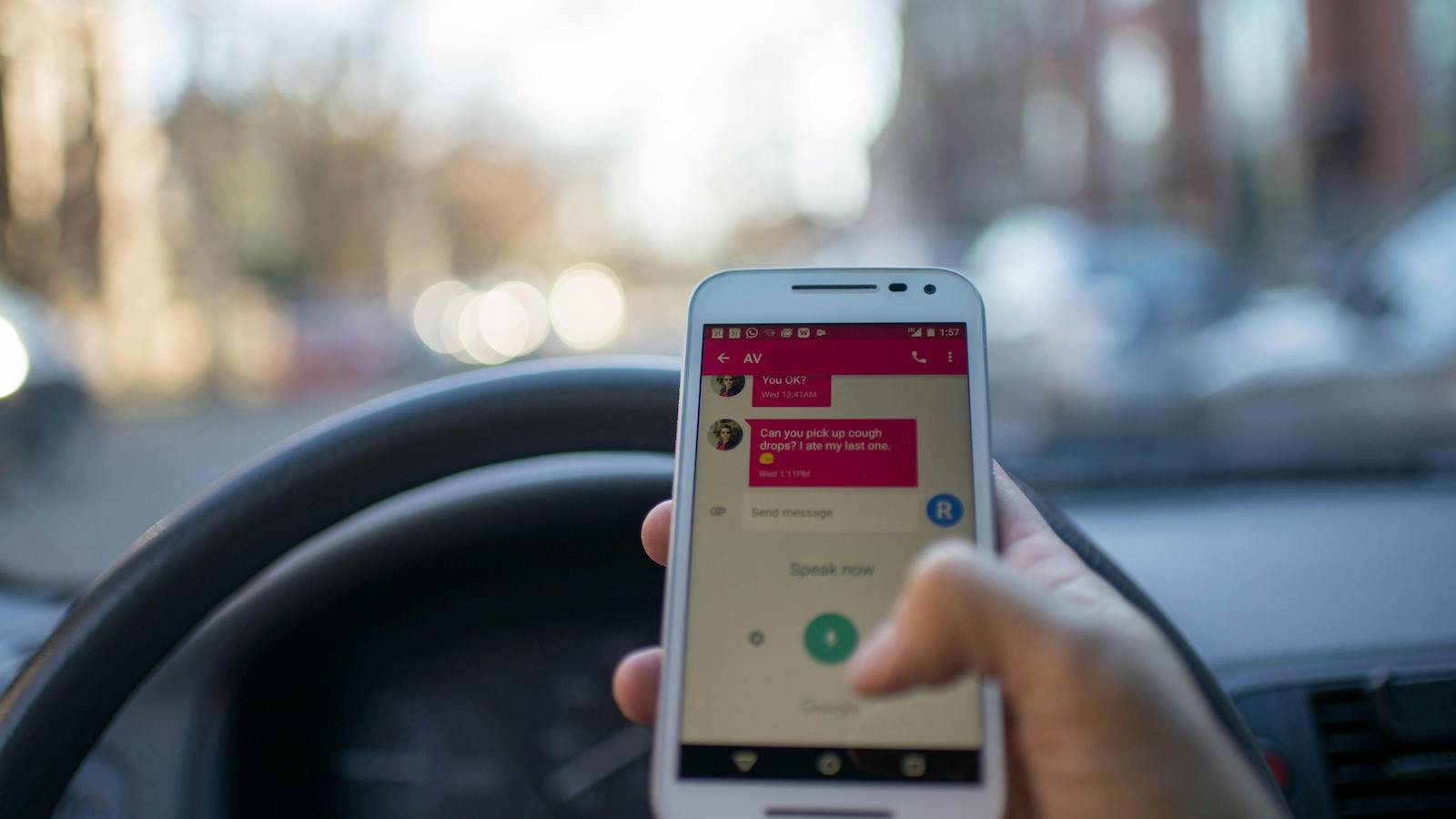

Insurers that rely too heavily on proxies often make incomplete assessments about drivers that can lead to underpricing of unsafe drivers and overpricing of safer ones. It doesn’t make sense to charge a safe 20-year-old driver more than a middle-aged driver who speeds and texts while driving.

These decisions aren’t just unfair for drivers, they’re bad for business. It’s time for insurers to move beyond proxies and take a smarter, more strategic approach to customer pricing, renewals and retention.

How insurers can gain more from telematics data

The best way to price customers and determine risks on the road is by evaluating a customer’s real driving habits. By focusing on actual driving behaviors, insurers can achieve better pricing accuracy and sophistication, driving improved customer retention and greater customer lifetime value.

But until now, there’s been a significant gap when it comes to understanding and analyzing driving behavior. Today’s telematics data — sourced from smartphones, in-car devices and connected cars themselves, with user permission— helps fill this gap by offering enhanced visibility and precise insights into driving habits. This information is more reliable, relevant and comprehensive than ever before.

As insurers work to gain and retain customers, they also need to extract more value from data; here are three ways they can do it:

- Derive deeper, more meaningful insights

There’s more data collected on driving behavior than ever. The challenge is translating this information into meaningful, contextualized insights. Today’s telematics data doesn’t just capture how people get from point A to point B. It offers a depth and breadth of insights, such as when someone speeds or constantly slams on the brakes, when they switch routes and drive on unfamiliar roads and contextual information like the speed limit of roads traveled and weather conditions they’re driving in.

Imagine how these insights can be applied to holiday travel. While we know the holidays bring higher levels of traffic and a higher number of crashes, data from Arity shows that drivers are more likely to speed home following Thanksgiving and Christmas days. Armed with this information, drivers could be encouraged to avoid traveling during these times or be extra attentive on the road.

Likewise, auto insurers could encourage drivers to make safer holiday travel plans by providing feedback and coaching and rewarding them with reduced policy deductibles for safe driving behavior, especially around the holidays and during winter months.

- Access and analyze real-time information

Many insurers have avoided using telematics data because they don’t want a monitoring period that requires them to wait until they’ve collected sufficient driving data to price accurately. That’s no longer the case. Insurers today can access data at a faster pace to gain insights that are reliable, relevant and responsive to conditions on the road.

This approach empowers insurers to price confidently and instantaneously. Insurers that take into account data about driving behaviors at the quote stage can eliminate the need for monitoring periods and pricing adjustments down the road.

By leveraging real-time information and insights, insurers can accurately price customers based on their actual driving and respond to shifts in frequency and severity to offer fair, competitive rates. Safe drivers can be offered a discounted rate, while risky drivers can be encouraged to drive safely using a tangible reward like a future discount or a penalty such as a higher premium that reflects their higher risk.

The same data can be used to price existing policyholders at renewal. Instead of using the proverbial peanut butter approach of spreading higher premiums across the board, why not use actual driving behavior insights to determine which policyholders deserve higher rates and which don’t? With this sophisticated renewal approach, insurers are more likely to retain their best drivers.

- Strengthen telematics’ scale and sophistication

There’s been a lack of telematics data available at the scale necessary to deliver tangible value to insurance companies. That’s starting to change. Advancements in data analytics are making telematics more accessible, more feasible and more useful in understanding and predicting driving behavior at an unprecedented scale.

While the insurance industry has made strides in using telematics for upfront discounts, insurers need to scale usage across the entire value chain. With greater scale and sophistication of telematics data, insurers can forgo offering a generic participation discount and, instead, target customers with competitive rates, as well as improve renewal pricing for existing customers to increase loyalty.

A large-scale telematics database can also help insurers market to and convert high-potential lifetime value customers. In addition, it can improve crash and claims processing — providing value and savings for longtime customers, new policyholders and prospective customers alike.

See also: Setting Record Straight on Auto Claims Severity

Pricing people based on how they drive, not who they are

Winter won’t last forever. Neither should the exodus of customers leaving their carriers. With better telematics data — and better ways to leverage it — insurers can move beyond traditional proxies and price people based on how they drive, rather than who they are, where they live or what their credit score is.

This is now possible with telematics data available at scale, with no monitoring periods.

Insurers can’t control ice on the roads or snowy conditions. But they can navigate the challenges of winter driving by embracing telematics to improve customer pricing and retention and avoid leaving customers in the cold.