Carriers are admitting that this has been the hardest market some have ever worked through, and there’s been a lot of volatility over the last three to four years. Between drivers’ behaviors shifting in a post-COVID world, to higher spikes in frequency, elevated loss cost severity and a sustained increase of inflation, there’s extreme pressure on the sector’s technical sustainability even with a net combined ratio improvement to 105% in the third quarter of 2023 from 112.1% a year earlier.

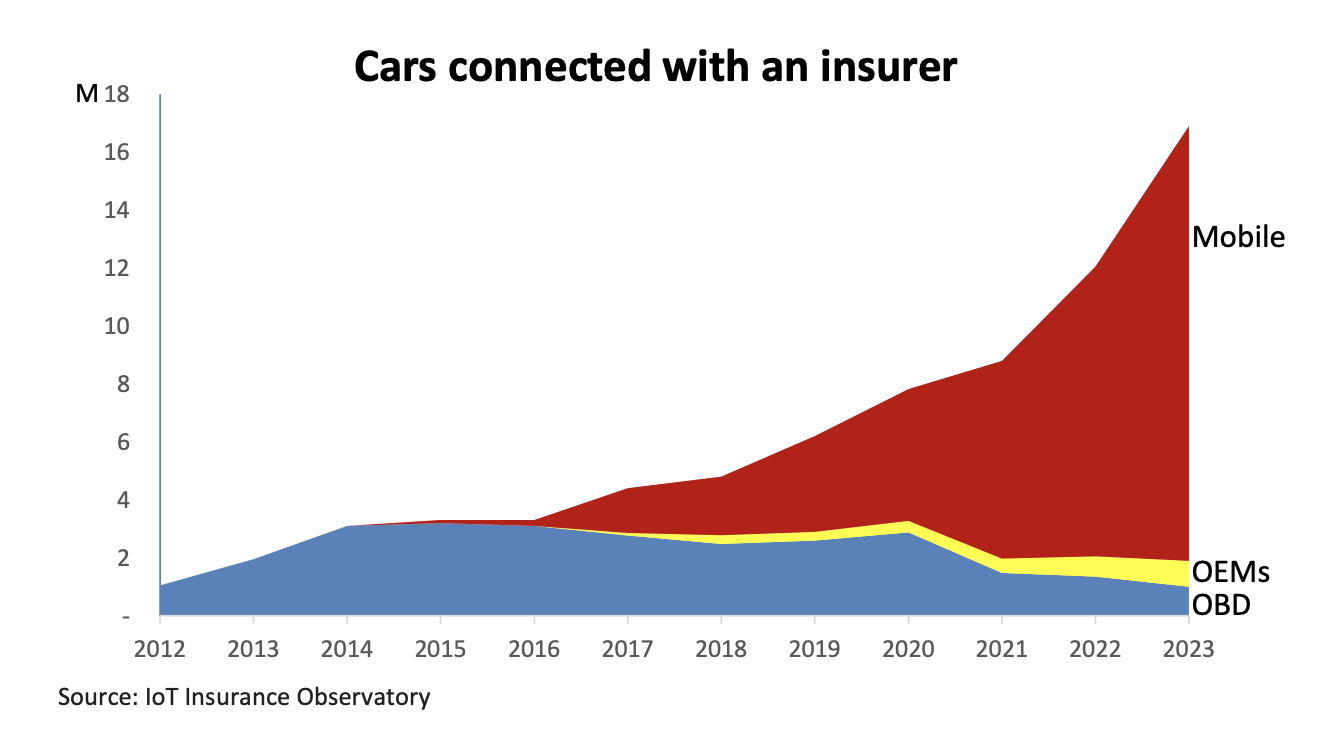

Telematics has grown significantly over the past three years, and there is broad consensus among U.S. insurance carriers that the use of telematics is a necessary capability for auto insurers to succeed. However, telematics hasn't made a dent in mitigating these sector issues because it has not yet been used in the right ways.

See also: Have We Turned the Corner on Distracted Driving?

There are at least four major issues to solve to unlock the full potential of telematics:

- Agents aren’t UBI promoters. Their income is a commission on premium: Would you be excited as an agent to sell a product where the only communicated benefit is the potential to reduce insurance premium - and also agent income - by 30% or even more? At the same time, there are many friction points around “selling” a telematics program to new policyholders.

- Accurate match between risks and rates only happens at policy renewal after a monitoring period.

- Data is mostly used to evaluate risks instead of also helping to reduce them.

- Telematics has been used only for new policyholders, versus also offered to a carrier’s existing book of business (limiting by design the number of risks that can be addressed with this innovation).

In relation to the first point, mastering the usage of telematics data allows the opportunity to unlock a significant amount of value. Carriers should optimize the sharing of this value with both customers and their agents.

Moreover, carriers need to do a better job at articulating the benefits of telematics to their agents. Insurers should design and execute a structured approach for sharing their vision with their agents about the adoption of telematics and benefits to the agent’s business. Those include the ability to satisfy and retain more policyholders, the ability to offer competitive rates and close more deals for the agency portfolio and the possibility of up-selling many policyholders receiving a discount.

Insurers should also design processes where agents have visibility into the evolution of the usage of telematics and its related services by their clients. This will allow agents to enhance their relationship with their clients and more effectively do their job.

Friction points associated with enrolling clients in a telematics program can be addressed through agent training, sales support and straightforward processes for program activation.

Regarding the second point, the industry has progressively understood the predictive value of telematics. It can have a positive impact on loss ratios, retention and customer lifetime value.

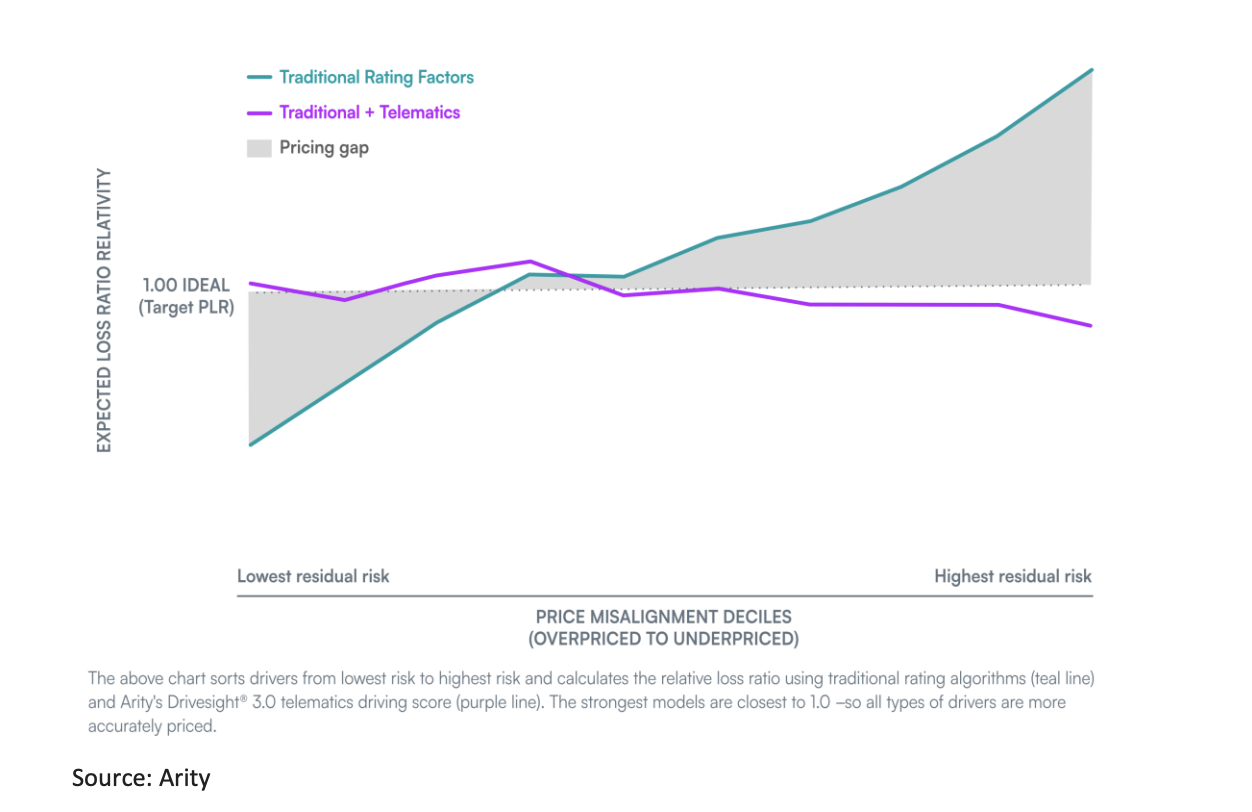

Monitoring the behavior of drivers with a promise of potentially greater savings at renewal, based on how the person drives, is an approach that goes all the way back to the early telematic days that leveraged OBDII dongles in cars. All these years have taught us that telematics represents a significant advancement in the evolution of pricing sophistication.

Telematics enables auto insurance policyholders to receive the best rates based on their driving patterns and vehicle operations (pricing equity). Implementing more precise pricing at each renewal stage across each risk pool defined by traditional variables is enabled by telematics. This strategy entails charging lower premiums for the safest risks and higher premiums for the riskiest ones in each pool.

The outcome is enhanced customer retention among the best risks and reduction in premium leakage from the riskier pool (if they stay with a carrier). This economic value is necessary to finance both the premium reduction for safe drivers and the telematics program costs.

However, this approach requires monitoring the driver for a coverage period before achieving any benefit from this pricing sophistication. Instead, if the driving score is already available at the point of sale, the insurer is able to better match risks and rates at the time of quote and can attract better risks in each risk pool.

The evolution of technology facilitates the ability to meet customers where they already are. Consumers already have many apps on their mobile phones that share, with consent, their location data and driving behaviors in exchange for valuable app features and experiences, like crash detection or fuel efficiency. Insurers now have the ability to tap into these consumers and their existing driving behavior history before they even show interest in participating in a telematics program.

For instance, Arity IQSM network allows insurers to call on existing telematics driving history on tens of millions of drivers to more accurately price customers at time of quote. Much like the way insurers currently request credit information, insurers can obtain near-real-time insights into a customer’s driving behavior at new business. Participation in data sharing for insurance purposes is contingent on consumer consent.

By integrating actual driving data history into the quoting process, insurers can significantly enhance pricing accuracy. This translates into competitive pricing for many drivers and more precise evaluation of higher-risk drivers in each segment; increases customer retention, especially for top-tier drivers; and ultimately improves overall profitability by ensuring that policyholders pay the right premium based on their actual driving risk.

Roads aren’t getting safer - data insights from Arity

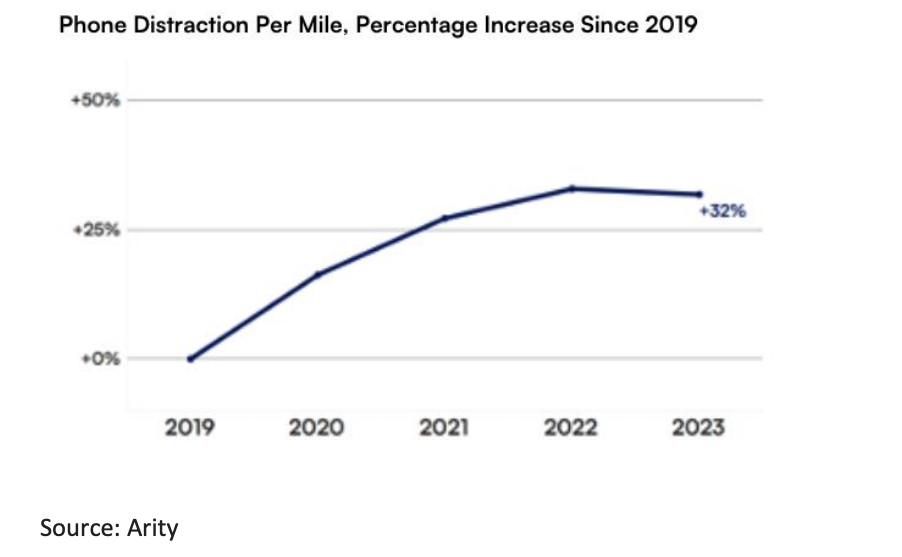

Related to the third issue, U.S. roads aren’t getting any safer. Drivers are more distracted, more reckless and more aggressive. More than 40,000 people die on U.S. roads each year, and a lot of the deaths can be attributed to an increase in risky driving behaviors.

We all know that smartphones are contributing to a rise in traffic deaths – it’s the biggest shift in drivers’ behavior over the last few decades. In fact, distracted driving continues to increase year over year. From 2019 through the end of 2023, Arity observed a more than 32% increase in the amount of distracted driving per mile, and recent data shows that it is only continuing to increase.

Insurance programs that constantly monitor drivers have all the necessary information for improving risks. Instead of using data only to evaluate the risk level of policyholders, insurers can use the driving insights to also promote less risky driving behaviors.

Insurers need to add structured behavioral change mechanisms to their telematics programs to significantly influence behaviors and make roads safer. A 2022 FHWA study empirically demonstrated how frequent and tangible rewards are the most effective elements to nudge drivers in reducing their distraction behind the wheel.

Finally, in relation to the fourth point, carriers need to move beyond the limits imposed back in the days by OBDII dongles in cars, only making telematics benefits available to new business customers and at renewal. This approach persists today with smartphone-based programs. The societal need to mitigate distraction by introducing structured behavioral change programs would realize its full potential if the usage of a telematics SDK were extended to all policyholders in the portfolio, instead of only making it available to new customers. As Matteo articulated in a recent article, this approach is likely to bring as much as a five-percentage-point reduction of the combined ratio on any auto insurance portfolio.

More broadly, telematics can be strategically leveraged across all insurance core processes – from marketing, to underwriting and point-of-sale pricing, to promoting engagement and loyalty with newly onboarded policyholders and even to supporting customers through crash and claims.

Arity's multi-year experience has shown that to truly take advantage of the value can have across the entire organization, three things have to be true about telematics data:

- It has to be available on everyone

- If a carrier doesn’t have telematics data at scale, they’re leaving valuable opportunities on the table. With the largest telematics dataset tied to actual insurance claims, Arity is working toward connecting to every driver in the U.S. and currently has 3X more driving data than the combined total number of users who are opted-in to a U.S. based telematics insurance program today.

- It has to be integrated across the enterprise

- This can be measured in two ways. One, penetration – how many drivers an insurer has telematics data on. And two, usage – whether an insurer is using telematics at each stage of the customer journey. Both of these are important key performance indicators (KPIs_ that all insurers should focus on to improve profitability with telematics.

- It needs continuous innovation

Telematics isn’t a one-and-done initiative. Arity has been in the business of collecting and understanding driving behaviors and risks (1.5 trillion miles of driving data and counting) since 2016 – we’ve seen it change. What used to be data collected through plug-in devices has transformed into a lot more data collected through mobile apps and connected cars. And innovation isn’t going to stop there.

Telematics is also about putting the data in context to understand risks more deeply, such as having insight into the types of roadways traveled, the posted speed limit of road segments and the interaction between driving events such as distracted driving and hard braking. Arity’s data shows that if a driver is talking on their phone while driving and immediately follows that with a hard braking event, the potential insurance cost of such an incident is typically 60% higher. That’s powerful insight. And the ability to deliver such insights at scale is critical. Solutions like Arity IQ are enabling insurers to continue to trailblaze telematics.

Better pricing sophistication to match rate with risks and behavioral change approaches to reduce risk level (especially distraction) are extraordinary opportunities for the future of auto insurance. The insurer of the future, by mastering the usage of telematics data across the insurance value chain, will be able to write profitable business while offering the lowest possible premiums to each policyholder. This will allow many policyholders to pay a lower premium, which will directly improve the availability and affordability of insurance coverage.