This article is an excerpt from a white paper, "Capturing Hearts, Minds and Market Share: How Connected Insurers Are Improving Customer Retention." To download it, click here.

Part 1 of this series explained why retention is so much harder these days. This article explains how insurers can solve the problem.

Know Your Customers

Understand values and behaviors of your customers. Start with available data sources. Augment structured data from traditional back-end systems with unstructured data like those collected through call centers and written correspondence. With these data, you can deduce meaningful patterns and behavior-based customer segments.

Enter into active dialogues to establish meaningful relationships. Use social media analytics and conversations via social networks to increase customer touch points. Use the knowledge gained about their wants and needs to sustain intermittent conversation about things that are helpful to the customer.

Build an environment where sharing data creates mutual benefits for customer and insurer. Transparency is key. Create and publicize a "customer data policy" that specifies how and when you will use data shared directly or generated through means such as "big data gathering," and how customers will benefit. Use shared data to create extra customer value, as detailed in the next section.

Offer customer value

It is no surprise that customer value - that is, the value that a customer derives from the relationship with his or her insurer - drives customer loyalty. In a previous study, we defined customer value as the adequate response to customers' changing needs. How can insurers translate this to understand which value drivers influence retention?

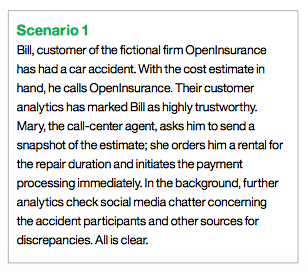

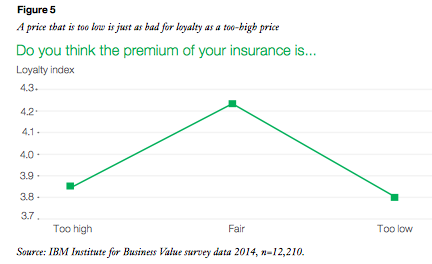

The fairness zone: The first component of customer value we will discuss is - again - price. For most of our respondents, the absolute level of premiums mattered less than individual perception of price fairness - a too-low price has the same negative effect on loyalty as one that is too high (see Figure 5). This means that a customer to whom the price seems right is two to three times less likely to switch in a given year. The fairness of premiums is also an emotional component that insurers need to get right (and tools like social media analytics can support this).

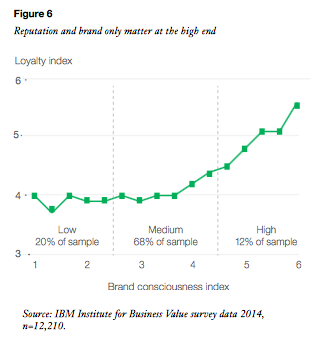

What is the power of brand? The second value factor we examine is brand. What is the retention value of a good brand? According to our data, it's less than expected. Only 21% of our respondents name "reputation" as one of the factors that cause them to stay with their chosen insurers. Could brand still be an implicit value driver?

Our recent consumer products industry study, "Brand enthusiasm: More than loyalty," showed that brand consciousness and brand loyalty are changing, and our data echoes those findings. Only 12% of respondents have a high brand consciousness, and that is the only bracket where it has a strong effect on loyalty in the insurance world (see Figure 6).

This suggests that an extra investment in brand creates limited loyalty returns; a great brand only matters if your customers belong to the few who are brand conscious to begin with. Moving customers to the "high" consciousness bracket might prove difficult to achieve.

So how can insurers, many of whom already have a strong brand, make this work to their advantage? We propose adopting the concept of "brand enthusiasm." Brand enthusiasm is influenced by the level of customer engagement, which we will explore in the next section, and again leads to the increased emotional involvement with the insurer that we call "heart share."

Transparency, not complexity

Last but not least, we examined other product-related value drivers. We suspected that the often high complexity of insurance products has a negative effect on loyalty, but our data proved this hypothesis wrong. Although product complexity might be a deterrent to purchase (which was outside the scope of the survey), even those who perceived the product they bought to be highly complex did not show a higher propensity to switch.

In contrast, transparency about the product strongly influences loyalty in a positive way. Transparency leads the customer to understand and be more comfortable with the product (and the insurer) even when it is complex. Seventy percent of respondents who reported that their product understanding was high expressed high loyalty - almost three times as many as those with low product understanding. High transparency leads to rational involvement: the "mind share" in our study title.

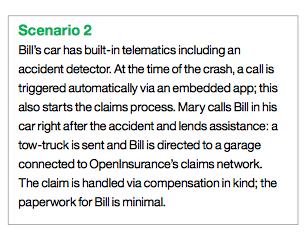

What current technology can help insurers promote customer value? To give customers an emotional connection and involvement with a fair price and a transparent product, telematics is ideal. Regarding fairness, customers can see that the rate is based on their personal risk and influenced by their personal actions. Examples include a "pay-how-you drive" auto product or the use of exercise tracking devices in health insurance. Transparency of this sort of auto product is high, and for many telematics offerings, there is an additional fun factor by seeing how well you drove, thus competing against yourself for better driving scores.

Recommendations: Offer value

Support your customers in areas they personally value, even if they are not directly related to your core business. Offer information to your customers in useful areas that are widely related to their coverage: for example, traffic or weather information for auto insurers. Create communities of interest - in social networks or directly hosted by you - to share news, tips and enhance exchange among like-minded individuals and your organization.

Add risk mitigation or prevention into your products and services. Commercial insurers have been doing this for years. Start offering these at the outset of the contract relationship. Later, add tracking via telematics, plus assistance services.

Personalize offerings and provide pick-and-choose product options. Product flexibility starts in the back end. Your application architecture must enable a modular approach to products and services. Build a roadmap for flexibility using industry standards such as IAA. From the front end, add in-depth analytics to flexibly balance the offered options with market needs.

Fully engage your customers across access points

Incumbents at risk

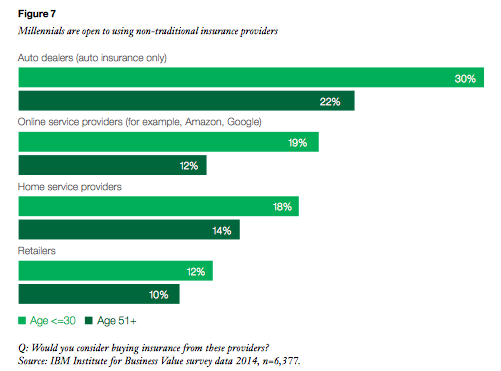

One characteristic of the Millennial customer is the desire for omni-channel shopping for their goods and services. For insurance shoppers, this extends well beyond using traditional insurers - many Millennials are open to using adjacent providers and new entrants into the market (see Figure 7).

In the short run, offerings like Google Compare mainly replace existing aggregators; insurers still cover the actual risk. In the long run, online service providers - given their good customer knowledge across many products and services - could start to accept risk themselves. In this case, customers' already-stated willingness to switch would become a real threat to incumbents.

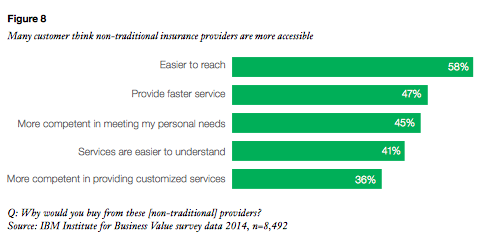

In addition, the reason respondents gave for considering those providers should be troubling to insurers: They describe non-traditional providers as faster, more transparent and easier to reach (see Figure 8). To counter this, carriers need to engage with their customers across a broader range of access points than ever before.

The age of mobility

One option is to be more accessible on the go. Ninety-six percent of our respondents own some form of mobile device, most often smartphones (owned by 82 percent of respondents) and tablets (owned by 49 percent); they have become commonplace modern accessories throughout the world. Still, only 13 percent of respondents who bought their insurance online, either directly or via an aggregator, used their mobile devices to buy. On the other hand, 29 percent of all respondents stated they would like their insurers to offer an option to buy through a mobile device, and that this would increase their loyalty.

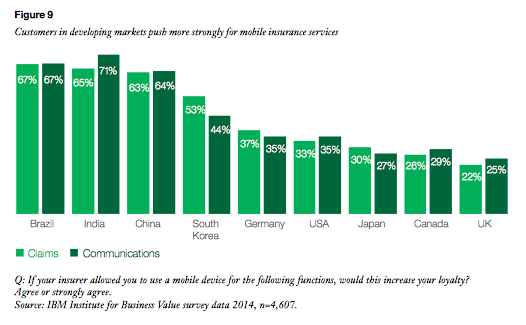

Expanding mobile offerings outside of searching and buying is an instant accessibility increase with potential loyalty gains. The biggest effects would be in submitting claims (42 percent) and in simple communication (43 percent). Many insurers have already invested in apps for claim submission, but again, they seem to be either unknown or too hard to use.

The effect of expanded mobile offerings differs widely by country, with the more empowered customers in developing markets increasing their loyalty more (see Figure 9). Still, given the larger market sizes in mature markets, investment in mobile services are still expected to generate returns.

Connecting everything, everywhere

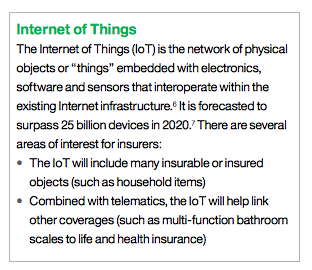

Looking toward the longer term, insurers will also need to consider investing in the Internet of Things (IoT) to enhance customer engagement. A growing number of consumers either own or can imagine owning an Internet-connected device like a refrigerator or a washing machine (56 percent of millennials, 36 percent of boomers).

Currently, only a small percentage of customers told us they would be comfortable with insurers using the data from these devices (21 percent of millennials, 15 percent of boomers.) Still, for those respondents, the greater accessibility and convenience of the IoT would lead to an increase in loyalty. Insurers can make use of the IoT if they sell it right: with high transparency regarding how the data is used (and not used).

Recommendations: Fully engage

Embrace mobile to enable constant access for your customers. For your main set of lines of business, envision "customer journey maps." These maps document the typical steps a customer must take during the provider relationship, from needs discovery through information gathering and purchase, all the way through after-sales services and claims processes. For each step, identify interaction options to generate a complete picture of potential mobile touch points.

Support decision making throughout each step of the sales process at the convenience of your customers. Create one unified front end for the customer, whether they come in through an agent, call center, the Internet or mobile devices. Make customer data and product information equally available at all touch points.

Have information available anytime, anywhere to support instantaneous fulfillment of client requests. Equip tied agents, underwriters, claims adjusters and other fulfillment roles with mobile technology like tablets and other handheld devices. This allows you to abandon a fixed workplace in favor of greater fulfillment flexibility - for example, claims can be adjusted directly on-site.

Ready or not - are you capturing the hearts and minds of your customers?

How are you using your in-house sources of customer knowledge? In what ways are you gathering and adding external information, such as that from social networks? How are you combining internal and external information? How is it used to generate greater customer value and loyalty?

Where and how are you using needs-based or persona-based segmentation approaches? How will you deepen your level of understanding individual customers?

To what degree can your customers pick and choose options from your product portfolio? What is your plan to remove the barriers to further customization?

How do you communicate with your customers? What is your approach to staying abreast of the ways they prefer to communicate, now and in the future?

In what ways are you engaging millennials? And how will you stay updated to address the customers of the future, such as Generation Z and beyond?

This article is an excerpt from a white paper, "Capturing Hearts, Minds and Market Share: How Connected Insurers Are Improving Customer Retention." To download it, click here.