To captivate customers, it isn't enough to just change the technology that they touch. You have to take a broad look at all systems.

[embed]https://soundcloud.com/insurance-thought-leader/capgemini-salesforce-insurance-thought-leadership-3[/embed]

ITL Editor-in-Chief Paul Carroll recently hosted a webinar on "Captivating Customers With All-Channel Experiences,” featuring experts from Capgemini and Salesforce.com and the former chief customer experience officer at AIG. To view or listen to the webinar, click here. For the slides, click here.

In almost all cases, to provide experiences that captivate customers, insurers must modify their legacy technology infrastructure.

Some insurers are building an overlay, taking an innovative approach to the technology that customers touch, but that isn’t enough. Insurers need to take a broader look and make sure that new customer technology integrates effectively with back-end systems such as claims, policy administration, billing and enterprise resources planning (ERP). That way, all parts of the enterprise are driving toward providing the desired customer experience.

These changes will make agents more satisfied and efficient. The changes will also help captivate customers, who want to deal with all parts of the insurance process as one seamless operation. That means both upgrading the technology for agents and incorporating them tightly into the insurer’s systems.

Cloud solutions have proven to deliver capabilities insurers need faster and with less business disruption than traditional, on-premises alternatives. The result is lower total cost of ownership and significantly reduced project risk. Such an approach lets insurers remain firmly focused on the customer. Insurers can focus on designing the customer journey and experience rather than be burdened by the design, build, test and deployment of the technology.

To get there from here, insurers need to integrate the interactions among employees, customers and agents and among social networks, internal systems and business processes. The result needs to support any device, use unified business logic and provide access to data. There needs to be a consistent customer experience across all channels (self-service, agents and call centers).

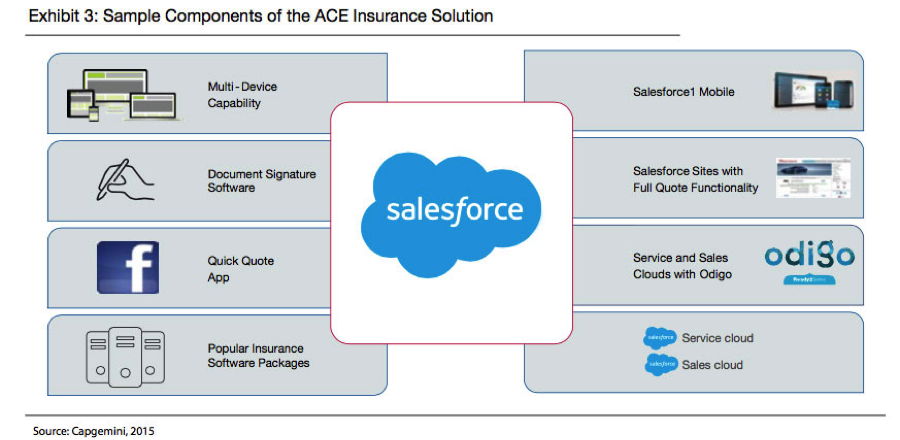

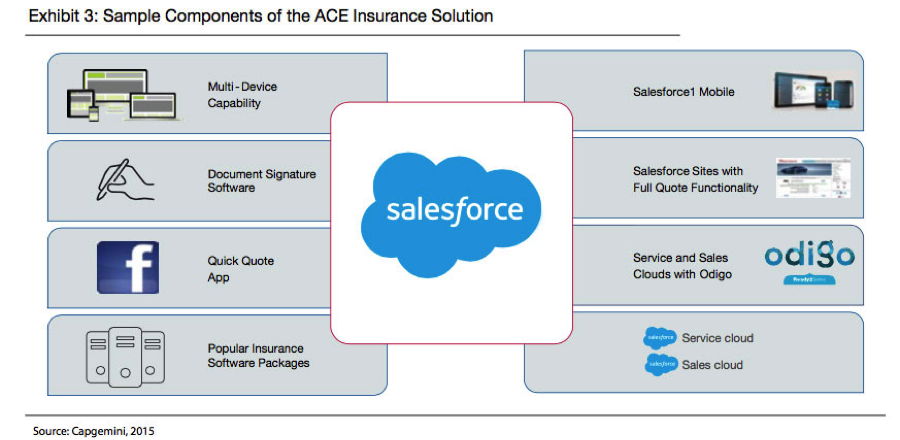

Exhibit 3 provides a sample of the necessary components (in this case, on a Salesforce platform):

- Customer Interaction Hub, which provides ease of use and information accessibility

- Platform, which provides multi-device capabilities

- Service Cloud, which helps agents track the history of customers and policies and engage regularly with customers

- A cloud-based contact center telephony system. The system (in this case, Odigo) must provide services such as intelligent call routing, natural language recognition, mobile channel integration, biometrics or voice-based authentication, multi-site routing and management dashboards. The platform must allow customers to originate a transaction in one channel and take it forward in another, such as self-service.

- Document signature software, to allow customers to sign quotes and policies online

- Integration with popular insurance software packages for policy quotes, binding, claims

When developing for a multi-channel experience, it’s crucial to do lots of A/B testing – changing one variable at a time for a sample of customers, seeing how they react and incorporating those changes that produce better results. It’s also important to actually watch customers to see how they navigate a process – where they stop, where they start up again, where they get sidetracked, where they get confused. We’ve watched customers many times, and the results can be surprising enough to at least require considerable tinkering.

For example, with three releases each year, Salesforce has delivered 47 major releases since its inception. Each release is informed by learning from how users behave, adopt and use Salesforce’s features. As a result, more than 1,700 features have been sourced directly from Salesforce’s customer community. In insurance, Salesforce learns from more than 2,500 insurance customers. These continuing improvements happen in an agile fashion, and follow an iterative cycle of release, learn and improve.

The race to become a leading insurer that is able to attract, satisfy and retain customers is in full motion. Those insurers that can blend traditional channels and digital channels in a seamless way will lead the race, creating clear competitive advantage with the capabilities in place to capitalize on market disruption over the coming years.

The first two articles in this series are here and here. For the white paper from which these articles are adapted, click here.

When developing for a multi-channel experience, it’s crucial to do lots of A/B testing – changing one variable at a time for a sample of customers, seeing how they react and incorporating those changes that produce better results. It’s also important to actually watch customers to see how they navigate a process – where they stop, where they start up again, where they get sidetracked, where they get confused. We’ve watched customers many times, and the results can be surprising enough to at least require considerable tinkering.

For example, with three releases each year, Salesforce has delivered 47 major releases since its inception. Each release is informed by learning from how users behave, adopt and use Salesforce’s features. As a result, more than 1,700 features have been sourced directly from Salesforce’s customer community. In insurance, Salesforce learns from more than 2,500 insurance customers. These continuing improvements happen in an agile fashion, and follow an iterative cycle of release, learn and improve.

The race to become a leading insurer that is able to attract, satisfy and retain customers is in full motion. Those insurers that can blend traditional channels and digital channels in a seamless way will lead the race, creating clear competitive advantage with the capabilities in place to capitalize on market disruption over the coming years.

The first two articles in this series are here and here. For the white paper from which these articles are adapted, click here.

When developing for a multi-channel experience, it’s crucial to do lots of A/B testing – changing one variable at a time for a sample of customers, seeing how they react and incorporating those changes that produce better results. It’s also important to actually watch customers to see how they navigate a process – where they stop, where they start up again, where they get sidetracked, where they get confused. We’ve watched customers many times, and the results can be surprising enough to at least require considerable tinkering.

For example, with three releases each year, Salesforce has delivered 47 major releases since its inception. Each release is informed by learning from how users behave, adopt and use Salesforce’s features. As a result, more than 1,700 features have been sourced directly from Salesforce’s customer community. In insurance, Salesforce learns from more than 2,500 insurance customers. These continuing improvements happen in an agile fashion, and follow an iterative cycle of release, learn and improve.

The race to become a leading insurer that is able to attract, satisfy and retain customers is in full motion. Those insurers that can blend traditional channels and digital channels in a seamless way will lead the race, creating clear competitive advantage with the capabilities in place to capitalize on market disruption over the coming years.

The first two articles in this series are here and here. For the white paper from which these articles are adapted, click here.