What’s a great, differentiated

customer experience (CX) really worth to a company?

It’s a question that seems to vex lots of business executives, many of whom publicly tout their commitment to the customer but are actually unsure about the ROI of customer experience — leaving them reluctant to invest in customer experience improvements.

As a result, companies continue to subject their customers to complicated sales processes, cluttered websites, dizzying 800-line menus, long wait times, incompetent service, unintelligible correspondence and products that are just plain difficult to use.

To help business leaders understand the overarching influence of a great customer experience (as well as a poor one), my firm sought to elevate the dialogue.

That meant getting executives to focus, at least for a moment, not on the cost/benefit of specific customer experience initiatives but, rather, on the macro impact of an effective customer experience strategy.

We accomplished this by studying the cumulative total stock returns for two model portfolios – composed of the Top 10 (“Leaders”) and Bottom 10 (“Laggards”) publicly traded companies in customer experience.

As the graphic in the next section vividly illustrates, the results of our study were quite compelling.

The Results

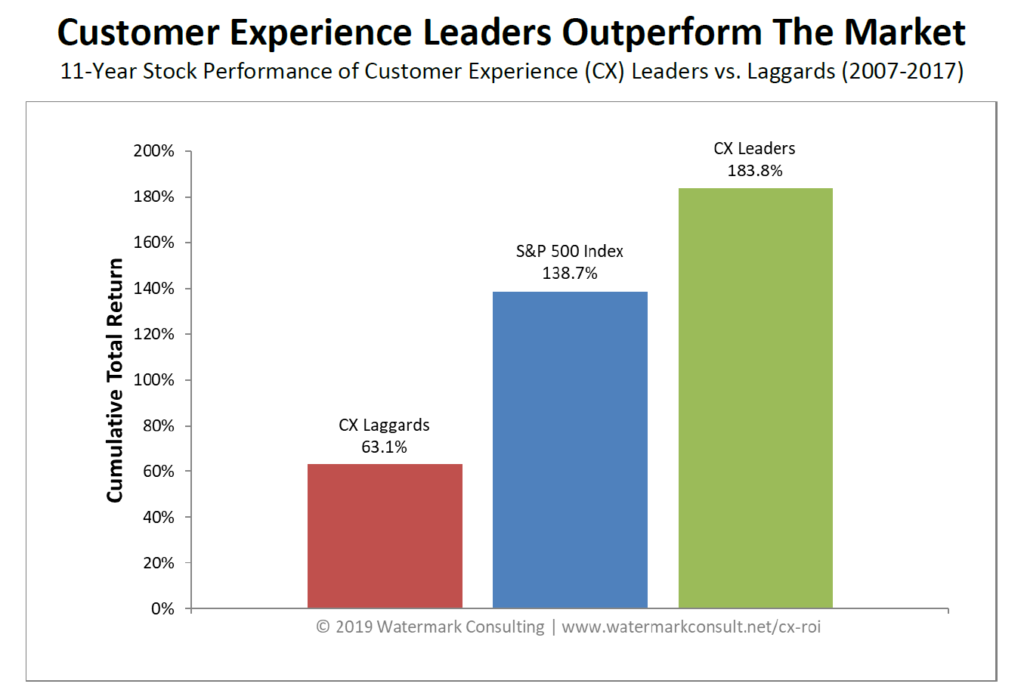

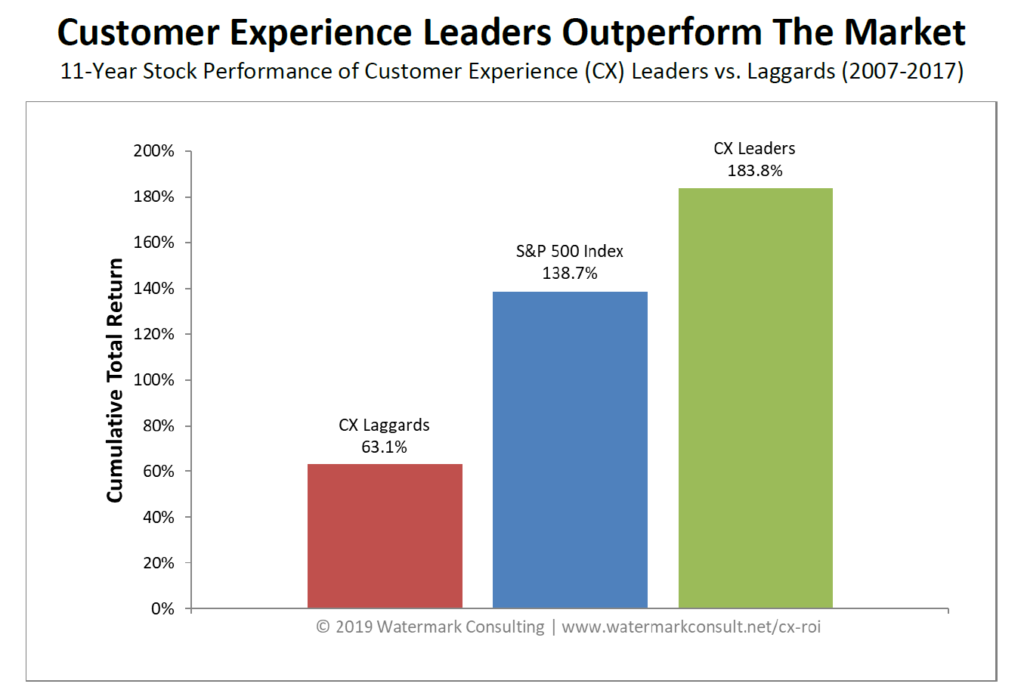

Eleven years of customer experience rankings were available for our analysis. The graph below shows the cumulative total return across that period for the Leaders and Laggards.

- Customer Experience Leaders outperformed the broader market, generating a total return that was 45 points higher than the S&P 500 Index.

- Customer Experience Laggards trailed far behind, posting a total return that was 76 points lower than that of the broader market.

- Customer Experience Leaders generated a total cumulative return that was nearly three times greater than that of the Customer Experience Laggards.

Commentary

This analysis reflects

over a decade of performance results, spanning an entire economic cycle, from the pre-recession market peak in 2007 to the post-recession recovery that continues today.

While there are obviously many factors that influence a company’s stock price, the results of this study indicate that, over the long term, a great customer experience helps build business value, while a poor customer experience erodes it. That’s an important takeaway, for public and private entities alike.

What creates that enhanced value?

Revenue growth. When most people think about the economic benefit from a great customer experience, this is where their heads go. That’s entirely appropriate, because revenue growth is indeed one clear advantage of customer experience excellence. Why? Happy, loyal customers have better retention, they’re less price-sensitive and they’re more willing to entertain offers for other products and services – all helping to raise revenue. Plus, because they love you so much, they spread positive word-of-mouth and refer new customers to you – lifting revenue even higher.

Expense control. This is the part of customer experience economic equation that most businesses fail to appreciate. (It’s also why using revenue growth, alone, to demonstrate customer experience ROI is

misguided.) When you have happy, loyal customers, it helps to better control – if not reduce – your expenses. For example, due to all the customer referrals you’re getting, you can spend less on business acquisition – which reduces expenses. In addition, happy customers tend to complain less, putting reduced stress on your operating infrastructure (e.g., lower call volumes), thereby also helping to keep expenses in check.

Of course, these economic dynamics cut both ways. Customer Experience Laggards struggle to raise revenue (e.g., poor retention, high price-sensitivity, limited cross-purchasing, negative word-of-mouth), and they’re burdened with higher expenses (e.g., to acquire new customers, and to deal with the existing unhappy ones). This weighs on their long-term profitability and makes them less valuable in the eyes of the market.

To learn more about the study’s methodology, and what Customer Experience Leading firms do to achieve their outperformance, view Watermark’s complete

Cross-Industry Customer Experience ROI Study.

The Insurance Industry Perspective

The insurance industry often views itself as being

different than other sectors, given, for example, its highly regulated nature and the fact that its products are something of a “grudge purchase” for consumers.

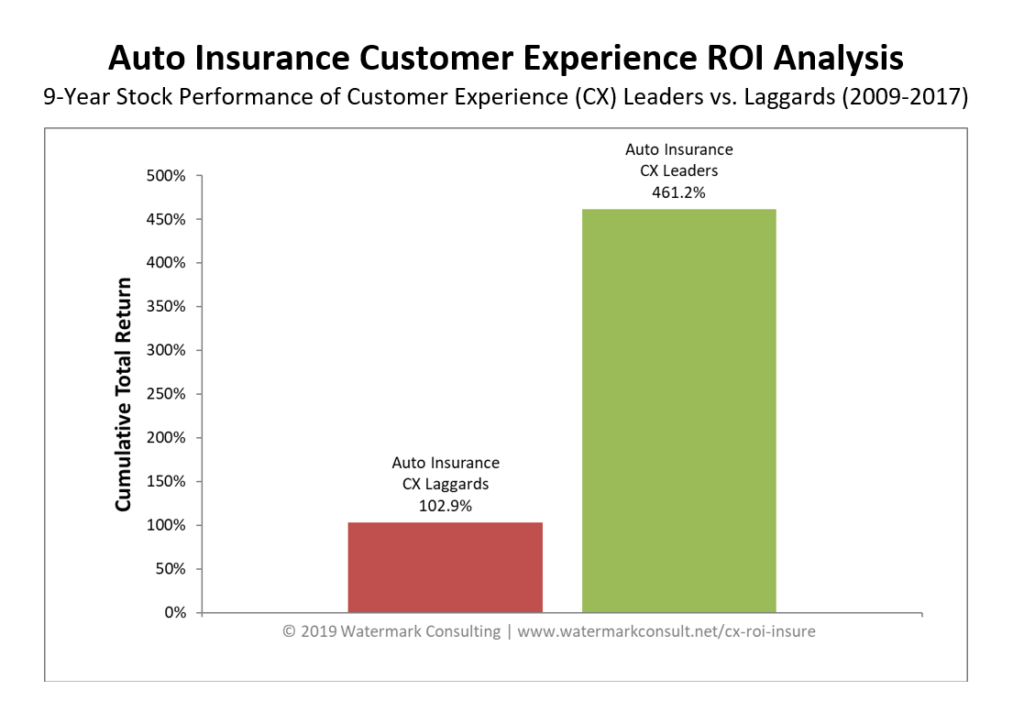

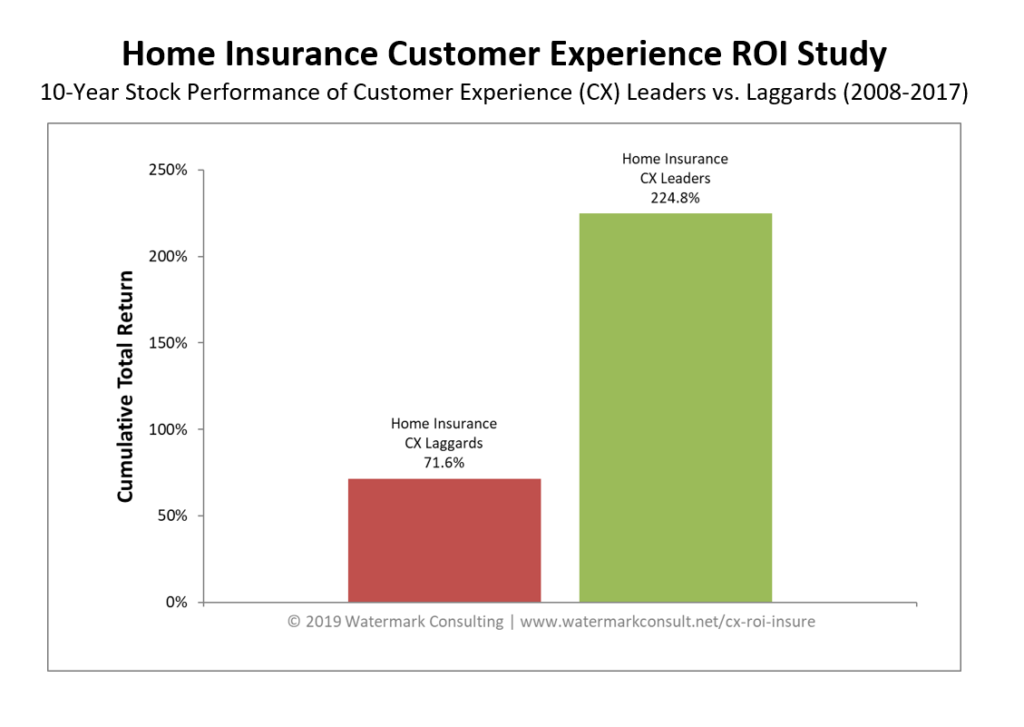

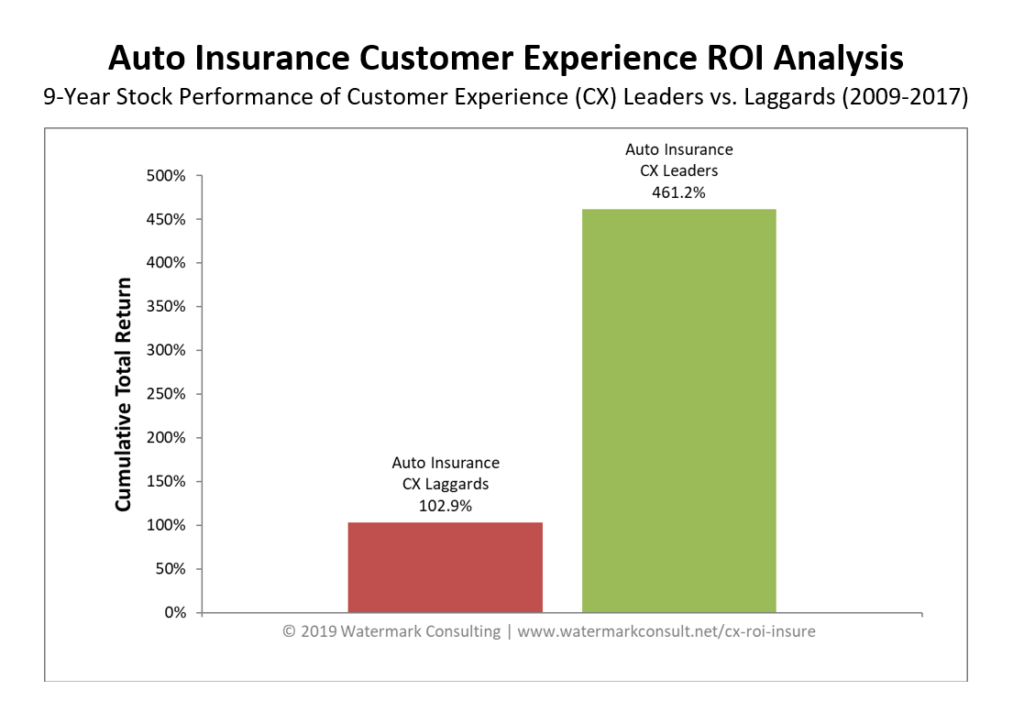

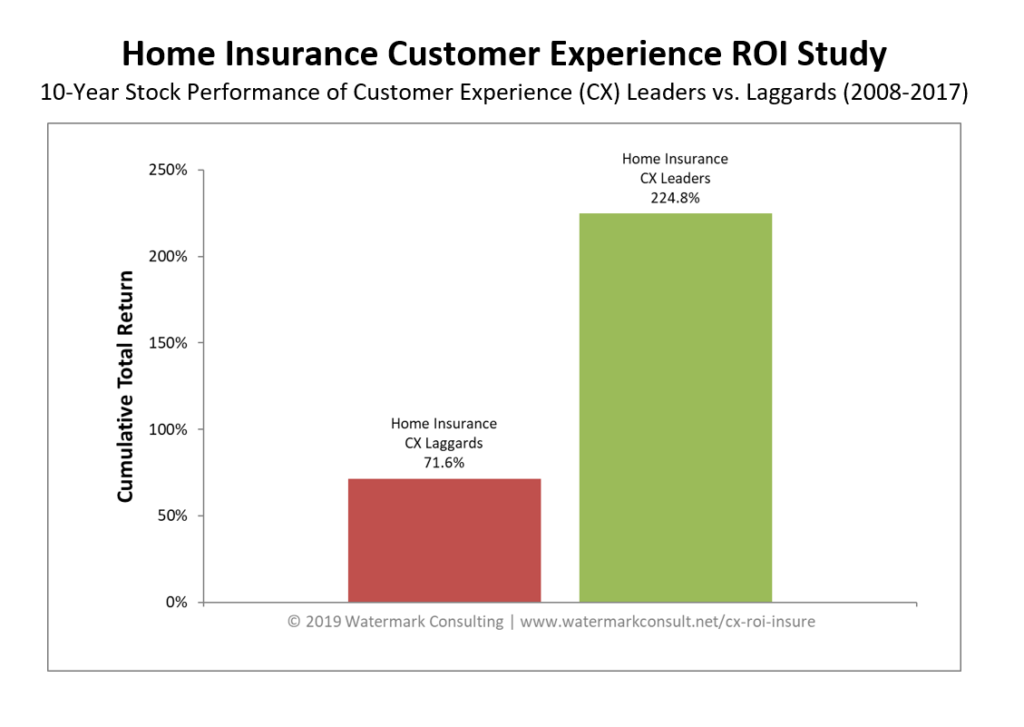

Well, we’ve crunched the Customer Experience ROI numbers for the Auto and Home insurance industries – and it turns out the customer experience story is even more compelling in those sectors:

Insurance Customer Experience Leaders outperformed the Laggards by over a three-to-one ratio. It’s a striking result that suggests, at least in this regard, the insurance industry

isn’t different from most other sectors, and the compelling economics of a customer experience excellence still apply.

To learn more about Watermark’s insurance industry analysis, including the implications for insurance providers seeking to improve their own customer experience, view the complete

Insurance Customer Experience ROI Study.

Insurance Customer Experience Leaders outperformed the Laggards by over a three-to-one ratio. It’s a striking result that suggests, at least in this regard, the insurance industry isn’t different from most other sectors, and the compelling economics of a customer experience excellence still apply.

To learn more about Watermark’s insurance industry analysis, including the implications for insurance providers seeking to improve their own customer experience, view the complete Insurance Customer Experience ROI Study.

Insurance Customer Experience Leaders outperformed the Laggards by over a three-to-one ratio. It’s a striking result that suggests, at least in this regard, the insurance industry isn’t different from most other sectors, and the compelling economics of a customer experience excellence still apply.

To learn more about Watermark’s insurance industry analysis, including the implications for insurance providers seeking to improve their own customer experience, view the complete Insurance Customer Experience ROI Study.