As full-stack insurtechs keep aiming at profitability, let’s take a look at the latest financials of the (not too) new kids on the block.

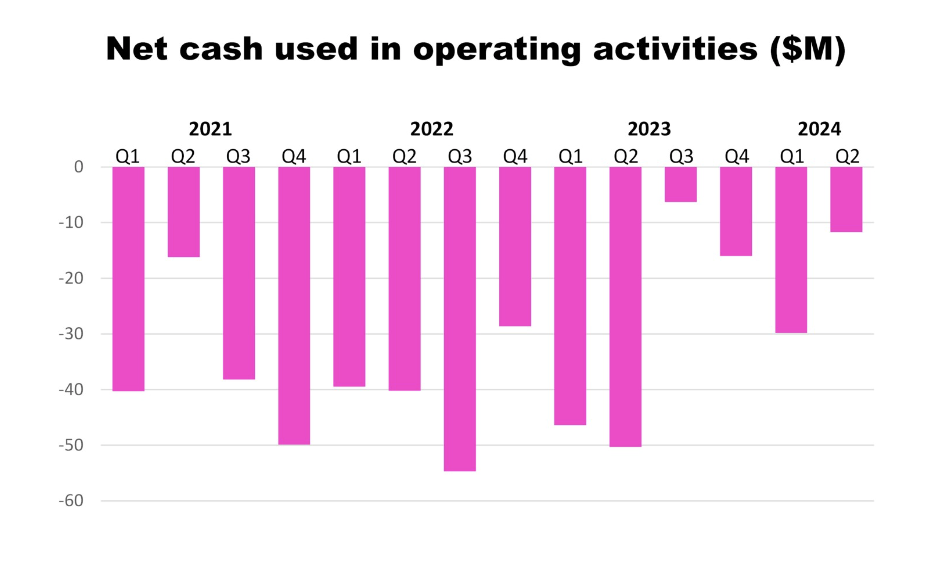

Lemonade – our undefeated master of storytelling – opened their shareholder letter with a triumphalist, “we were net cash flow (“NCF”) positive,” while their operations are still burning millions of dollars each quarter.

They have definitely improved - as noted in the December edition of this newsletter - but they are still burning a lot of cash.

See also: Auto Insurance: Perennially Predictably Profitable

We are talking about a grown company (nine years old) with almost 2.2 million customers and expected in-force premiums at almost $1 billion by the end of this year. In their shareholder letters, the reference to “improvement” is everywhere:

- 14 times related to Q2 ’23,

- 23 on Q4 ’23,

- 12 on Q1 ’24,

- 18 on Q2 ’24.

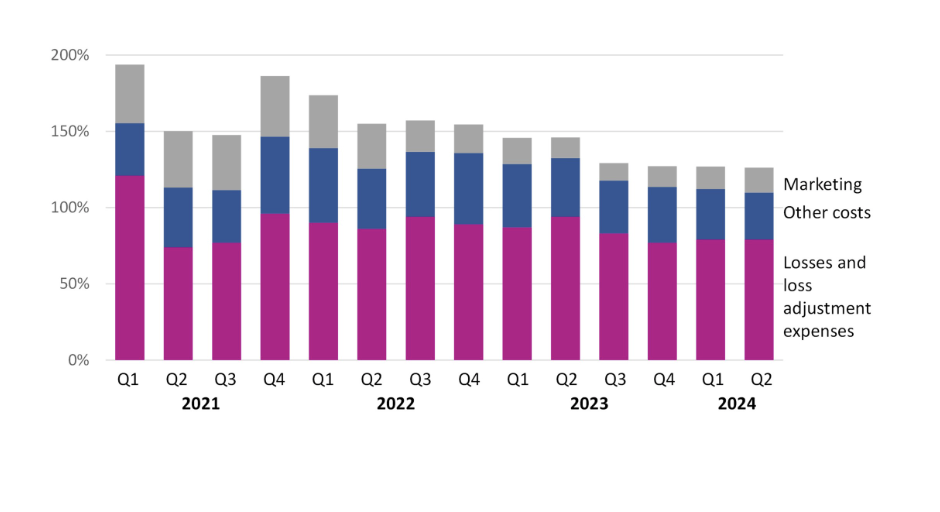

Yet their gross combined ratio has stayed just a few points below 130% for these past four quarters. They have lost $104.5 million in this first half of '24 (compared with the $133 million loss in H1 '23), bringing the cumulated losses to $1.2 billion.

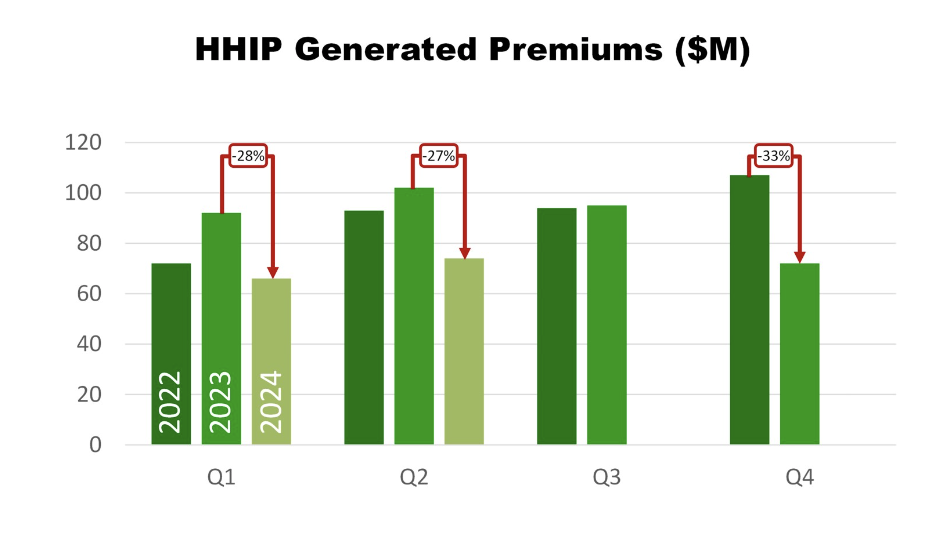

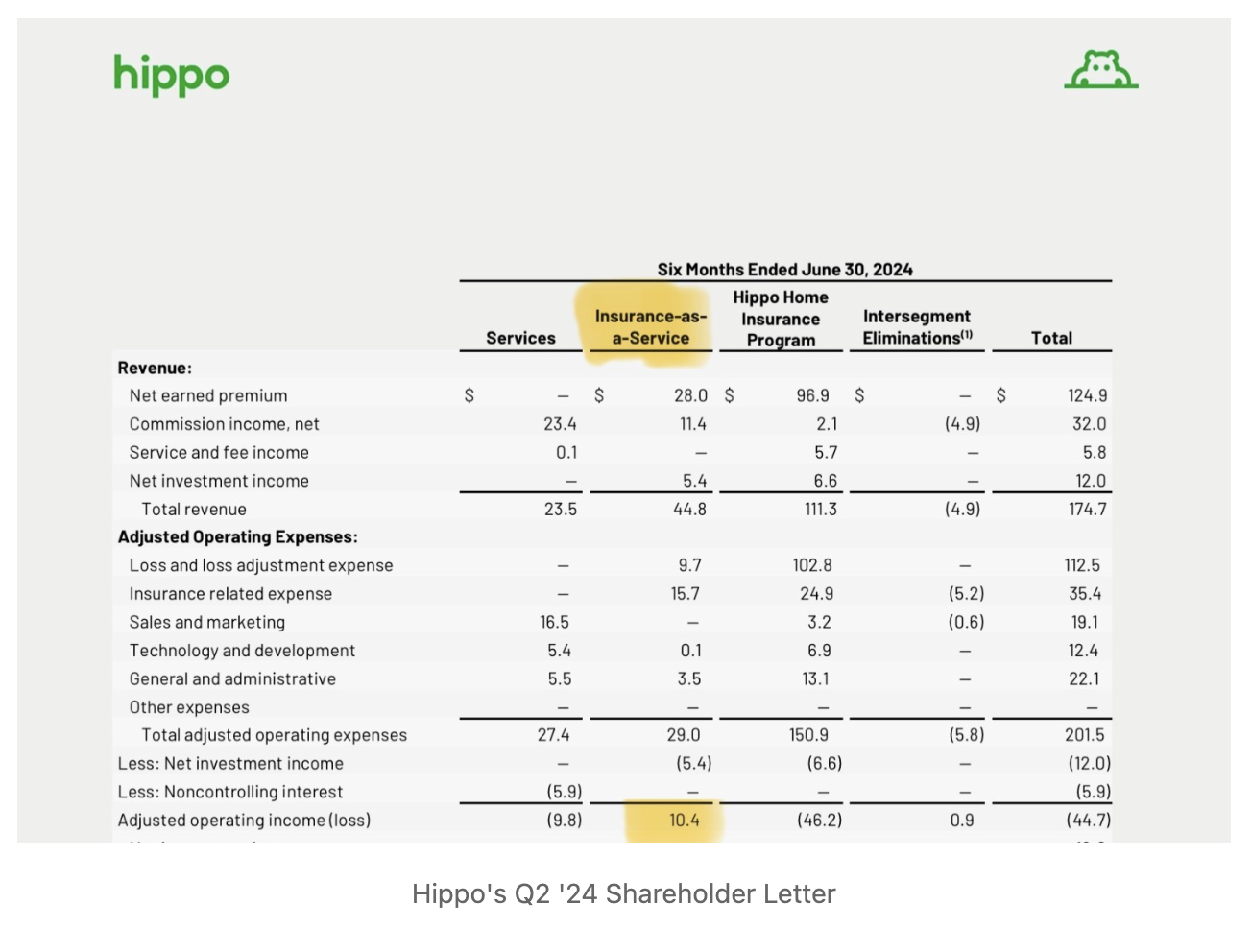

Hippo lost $70 million in the first half of ‘24 (compared with $173 million in H1 ‘23), and the operating activities generated $7 million (compared with -$45 million in H1 ’23). Hippo has continued its turnaround by pruning its original homeowner business in this first half of the year. This segment of the business ("Hippo Home Insurance Program - HHIP" in their letters) has shrunk its top line by almost 30% compared with the same quarter of the previous year, while starting to reduce its loss ratio. The original Hippo homeowner portfolio is still a loss-making business.

The only segment consistently generating profits is the business of giving underwriting capacity to MGAs (presented as “insurance-as-a-service” in their shareholder letter). This further confirms that the acquisition of Spinnaker in 2020 has been the best management decision in the history of this venture.

Root lost $14 million in the first six months of 2024 (compared with $78 million lost in H1 ‘23), bringing their accumulated losses to $1.73 billion over the life of this venture. Their operations generated $77 million of cash (compared with -94 million in H1 ’23).

See also: How AI Can Keep P&C Insurers Profitable

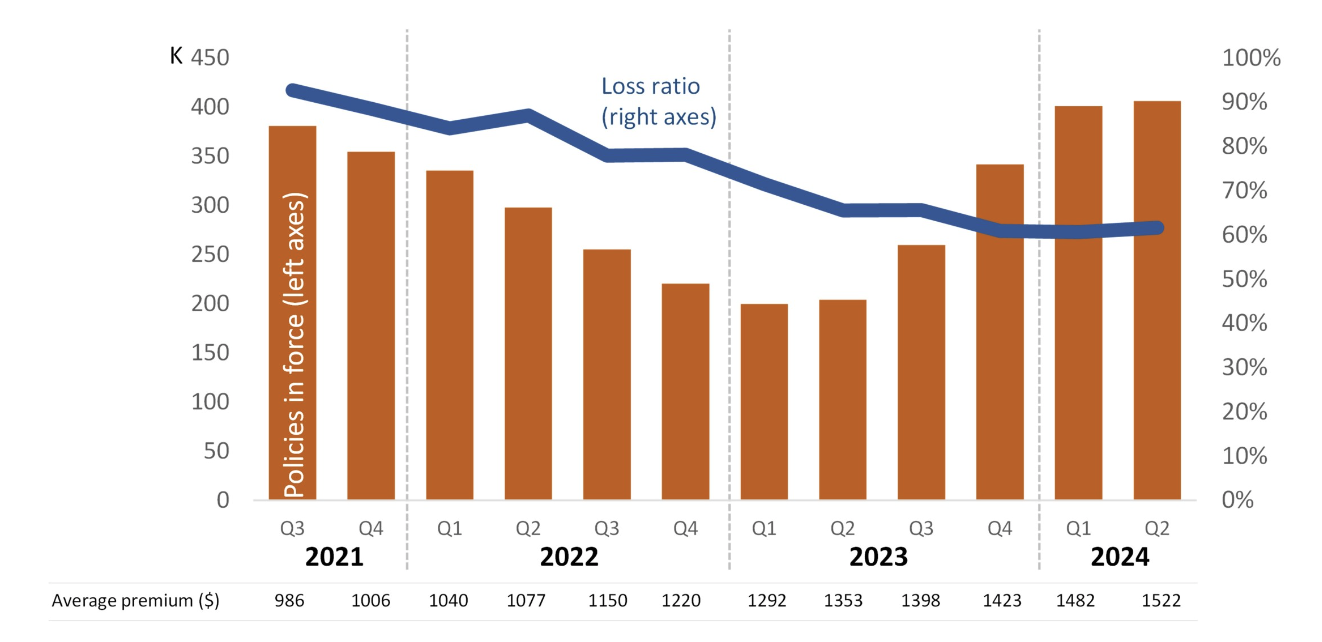

Root had a strong focus and excellent results in U-turning their auto portfolio since the end of 2021:

- From Q3 ’21 to Q1 ’23, the average auto premium increased by 30%, reducing the loss ratio from 93% to 72% while the client base shrunk by almost 50%. This was very predictable! Adrian Jones and I wrote in our first article about the Insurtech full-stack carriers back in March 2018: “It is tempting to acquire insurance customers by underpricing and later transforming them into profitable customers. A loss ratio over 100% implies a pricing problem, not a problem with the underwriting model. Insurers with a customer base that came for cheap insurance and expects it to continue will find their market vanishes when they begin repricing to bring loss ratios to acceptable levels, destroying any value from customer loyalty”.

- In the following 12 months (Q1 ‘23 to Q1 ’24), average premiums further increased by 15%, and the loss ratio landed at 60%. Surprisingly, the customer base doubled. However, this exceptional performance happened in a context where “large carriers in many states have struggled to obtain regulatory approval for rate changes and, consequently, have tightened their underwriting guidelines”.

In the last quarter, Root showed only a 1% growth of the customer base and an increase of 3% of the average premiums, with a slight increase of 100 basis points in the loss ratio. The next six to 12 months will tell us more about the “superiority in matching price to risk” claimed in their last shareholder letter.

Maybe next year.