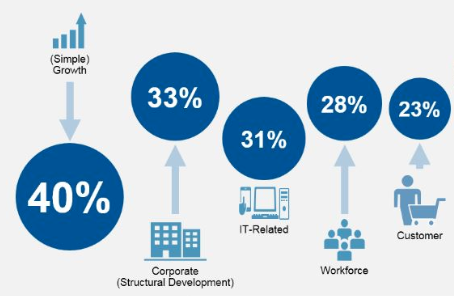

Responders are taking some measure of credit for moving their organizations ahead of competitors in the race for growth and relevance. The Gartner survey findings further reveal that the priorities ranked two through five – including new partnerships and M&A (part of corporate development), new technologies, workforce capabilities and the customer – all presumably enable the No. 1 priority on the C-suite list, which is, no surprise, growth.

Add to the priority to-dos an additional leverage point that may be too buried to get well-deserved attention: to develop innovation metrics that monitor and accelerate the conversion of insights and ideas to sources of value for all stakeholders.

Neither attempts at defining surgically precise metrics nor peering into one’s crystal ball will lead to helpful innovation metrics.

Using legacy performance measures to assess concepts that may have little resemblance to established products and services, or treating innovation as an immeasurable, both turn out to undermine potential opportunities. Only the C-suite is empowered to assign new metrics that can nurture these investments and judge them appropriately, and that may not conform to the standards the entire organization has been taught are right. Choices should have rigor, be reasonable for the evaluation of potentially unprecedented products and services, and be able to hold their own even in zero-sum resource allocation processes.

See also: Innovation — or Just Innovative Thinking?

Early in my career, an executive gave me valuable advice, more recently reinforced in conversations with corporate leaders, startup founders and investors as I undertook the research for my book, The Change Maker’s Playbook. Back then, my team and I were seeking seed funding for a new concept. In a presentation to this particular executive, we shared copious financial analyses, including five years’ worth of P&Ls carried out to the penny. He waved aside our spreadsheets and told us, “Don’t seek a level of precision that cannot be possible when you are looking at something so new.”

Growth opportunities are put at risk when overly precise and backward-looking metrics, from old business models, are applied to gauge potential impact and measure their worthiness to be moved forward.

Instead, executive teams can adopt common-sense approaches to ensure discipline – the right kind of discipline — for evaluating emerging business models.

For an early-stage, new-to-market concept, what is most important is to ask the right questions, rely on judgment where facts simply do not exist, seek metaphors from other sectors or markets and accept good enough data that can be refined along the way. Smart questions answered in fast test-and-learn cycles can lead to relevant metrics and keep innovation projects moving closer to success or the set-aside file.

Here are five suggested questions to find the right metrics for your innovation initiatives:

Responders are taking some measure of credit for moving their organizations ahead of competitors in the race for growth and relevance. The Gartner survey findings further reveal that the priorities ranked two through five – including new partnerships and M&A (part of corporate development), new technologies, workforce capabilities and the customer – all presumably enable the No. 1 priority on the C-suite list, which is, no surprise, growth.

Add to the priority to-dos an additional leverage point that may be too buried to get well-deserved attention: to develop innovation metrics that monitor and accelerate the conversion of insights and ideas to sources of value for all stakeholders.

Neither attempts at defining surgically precise metrics nor peering into one’s crystal ball will lead to helpful innovation metrics.

Using legacy performance measures to assess concepts that may have little resemblance to established products and services, or treating innovation as an immeasurable, both turn out to undermine potential opportunities. Only the C-suite is empowered to assign new metrics that can nurture these investments and judge them appropriately, and that may not conform to the standards the entire organization has been taught are right. Choices should have rigor, be reasonable for the evaluation of potentially unprecedented products and services, and be able to hold their own even in zero-sum resource allocation processes.

See also: Innovation — or Just Innovative Thinking?

Early in my career, an executive gave me valuable advice, more recently reinforced in conversations with corporate leaders, startup founders and investors as I undertook the research for my book, The Change Maker’s Playbook. Back then, my team and I were seeking seed funding for a new concept. In a presentation to this particular executive, we shared copious financial analyses, including five years’ worth of P&Ls carried out to the penny. He waved aside our spreadsheets and told us, “Don’t seek a level of precision that cannot be possible when you are looking at something so new.”

Growth opportunities are put at risk when overly precise and backward-looking metrics, from old business models, are applied to gauge potential impact and measure their worthiness to be moved forward.

Instead, executive teams can adopt common-sense approaches to ensure discipline – the right kind of discipline — for evaluating emerging business models.

For an early-stage, new-to-market concept, what is most important is to ask the right questions, rely on judgment where facts simply do not exist, seek metaphors from other sectors or markets and accept good enough data that can be refined along the way. Smart questions answered in fast test-and-learn cycles can lead to relevant metrics and keep innovation projects moving closer to success or the set-aside file.

Here are five suggested questions to find the right metrics for your innovation initiatives:

- How big is the addressable market? As soon as the team can characterize the potential audience for an innovation, it becomes possible to estimate how many users and buyers exist. How big is the audience, in your geography, of people who represent the demographics, have purchasing ability and are reachable by your brand? Once you have this estimate, take the 1% test, i.e., would a good result be to earn 1% of the market?

- What would you have to believe? In the absence of a rearview mirror’s worth of history, better to look forward and envision market, customer, operational and other basics that would need to exist for a concept to appear reasonable. A useful answer to this question assumes the team’s ability to avoid clouding the future view of what is possible with too much knowledge of past precedents that may now be irrelevant. What does the intensity of user reaction to prototypes reveal: Are you solving a functional problem, or are you also hitting an emotional chord with your audience, suggesting a willingness to buy? What breakthroughs can you discern by examining what is happening in other markets or sectors?

- What are the key drivers of revenue and expenses? In early iterations, set aside the spreadsheets and calculators. Think conceptually about your preliminary assumptions regarding the business model. What appears to be the primary revenue driver? And what do your assumptions suggest about potential expense drivers? Perhaps early on each of these will only be assigned “high” “medium” or “low” designations to indicate importance, but not be any more quantifiable.

- Can you figure out the unit profit model? Factor in early tests, as you refine your prototype and begin to engage potential users, gathering insight to determine the unit profit model and how comfortable the team is that it can be delivered.

- What is the potential to scale? With the confidence that you understand unit-level profitability dynamics, test for the path to scale. What will it take to attract each new customer or dollar of sales, for example, and how steep will the growth curve be?