Inflation is a complex phenomenon, its roots intertwined in various economic, political and global factors. This presents unique challenges and opportunities for the investment strategies of insurance companies.

Insurers are still navigating from a terrain marked by prolonged low investment rates and squeezed margins to an unpredictable inflationary environment and balance sheets holding large unrealized losses. This article explores how insurers can adapt their investment strategies to hedge against uncertainties caused by inflation and extended periods of higher interest rates, exploring avenues such as real estate, equities and specialty products, while also incorporating strategic asset allocation and risk management best practices. Conning believes applying more dynamic investment strategies may also benefit insurers over the long term for most economic conditions.

The Impact of Inflation and the Outlook for Interest Rates

Our March 2022 Viewpoint studied the impact of inflation on insurance companies’ financial statements, observing deviations between actual results and projections due to deteriorations in assets and liabilities. We highlighted the extended influence of inflation and some companies’ constraints in implementing protective measures. We also discussed the limited flexibility that many investment portfolios have in dealing with these challenges amid regulatory and rating agency scrutiny. Ultimately, we determined that a thorough portfolio assessment and strategic planning can significantly mitigate these concerns.

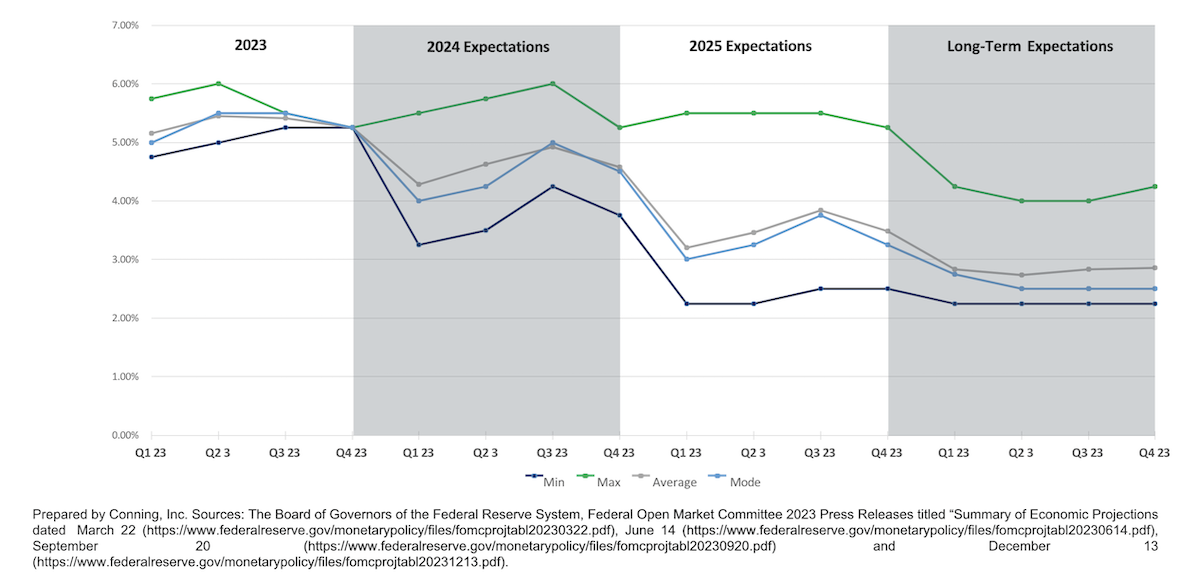

The federal funds rate ended 2023 at 5.33%. Despite the U.S. Federal Reserve’s declaration to halt the cycle of increases, the outlook for the next two years remains uncertain (see Figure 1), but there is a strong inclination toward keeping rates higher for an extended period.

Figure 1 - The Fed’s Outlook: Higher Interest Rates for Longer but an Unclear Path

Although the exact timing and sequence of policy adjustments remains uncertain, the implications of maintaining higher interest rates for an extended period are multifaceted.

These are positives for insurance companies: Sustained higher rates present a unique opportunity to recalibrate pricing strategies, innovate by launching products and move their investment portfolios toward higher-yielding investments.

However, higher rates could also lead to elevated borrowing costs for the economy overall, prompting a pullback in business investment and expansion, potentially ushering in a phase of economic deceleration. (The real estate sector’s responses remain uncertain.) Moreover, the capacity of financial companies to manage unrealized losses hinges on their ability to maintain sufficient liquidity, and any disruption in the capital market or broader economy could lead to premature rate cuts, which may initially invigorate growth but also carry the risk of renewing inflationary pressures.

See also: The ABCs of Agency Planning for 2024

Mitigation Strategies for the Risks Ahead

During periods of uncertainties, correlations between asset classes typically shift, as we saw back in 2022 when both equities and bonds underperformed.

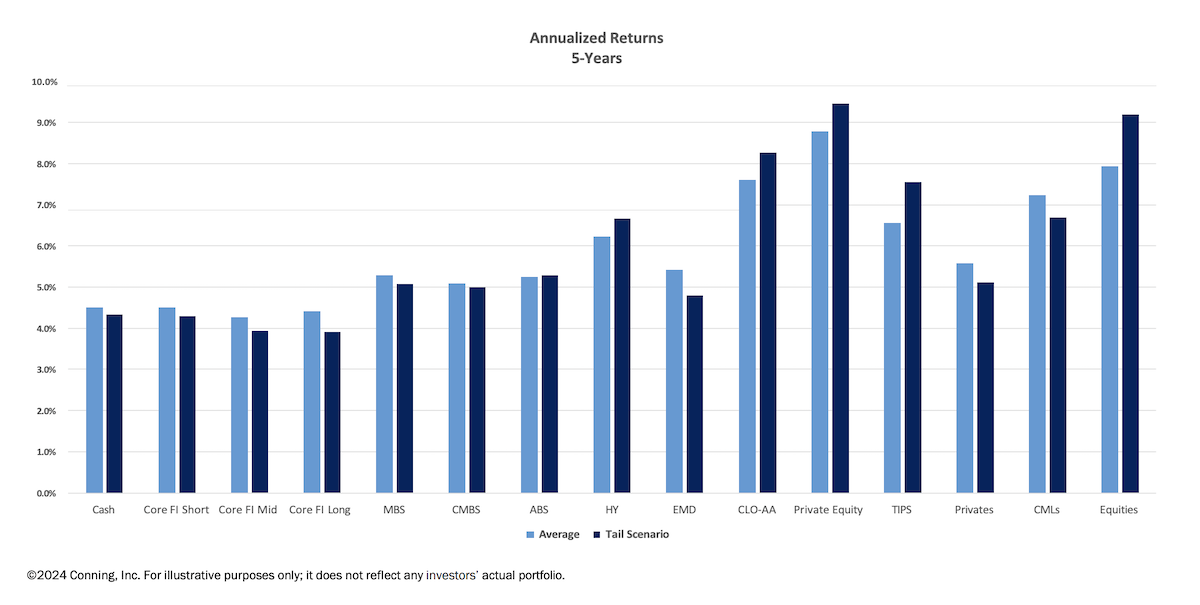

Figure 2 models how various sectors within the insurance industry investment universe might perform over a five-year period, both on average and in a tail scenario in which inflation ranges between 3.5% and 9.5%.

Figure 2 - Projected Five-Year Performance During Average and Tail Scenarios

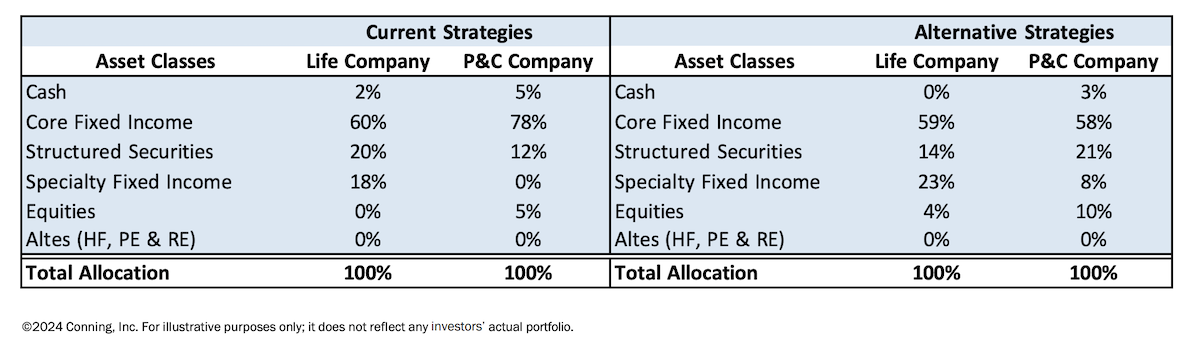

To demonstrate further, we sampled two insurance company portfolios: a life company with a business mix of 50% individual life, 20% group life and 30% individual annuities, and a workers’ compensation insurer. Their investment strategies, both before and after they were modified to adjust to a higher-interest-rate environment, are in Figure 3.

Figure 3 - Sample Portfolios, Current and Altered Strategies

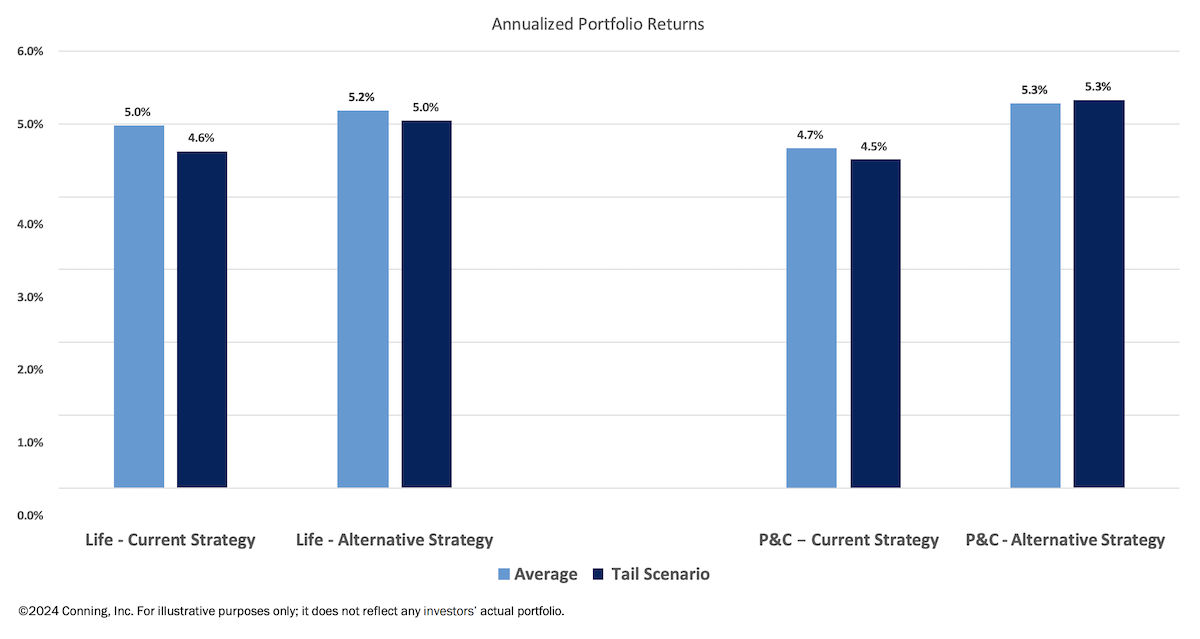

Figure 4 illustrates how total returns for both companies declined 0.4% and .2%, respectively, as a result of tail scenarios (in this case, an environment where inflation remains above target for an extended period) and how modifying the investment strategy can reduce the impact (the decline in returns improved from 0.4% to 0.2% for the life company and from 0.2% to 0.04% for the P&C company).

For both of our sample insurer portfolios, the key to navigating such environments lies in the flexibility and adaptability of their investment strategies. Such strategies might include investments in asset classes with a growth component or a natural inflation hedge or changing duration to better manage interest rate risk and mitigate some of the inflationary pressure.

Figure 4 - Sample Portfolio Projected Performance, Average and Tail Scenarios

We also point out how the modeling illustrates how the alternative strategies may improve portfolio performance in both the average and tail scenarios. While we are seeking to address the immediate concerns of a higher-for-long rate environment, we believe the dynamic nature of the alternative strategies offers significant benefits in other market conditions.

In scenarios in which the financial landscape undergoes meaningful changes, Conning also believes it is necessary to conduct a thorough assessment of a company’s investment portfolio to identify risks, level of diversification and areas for improvement.

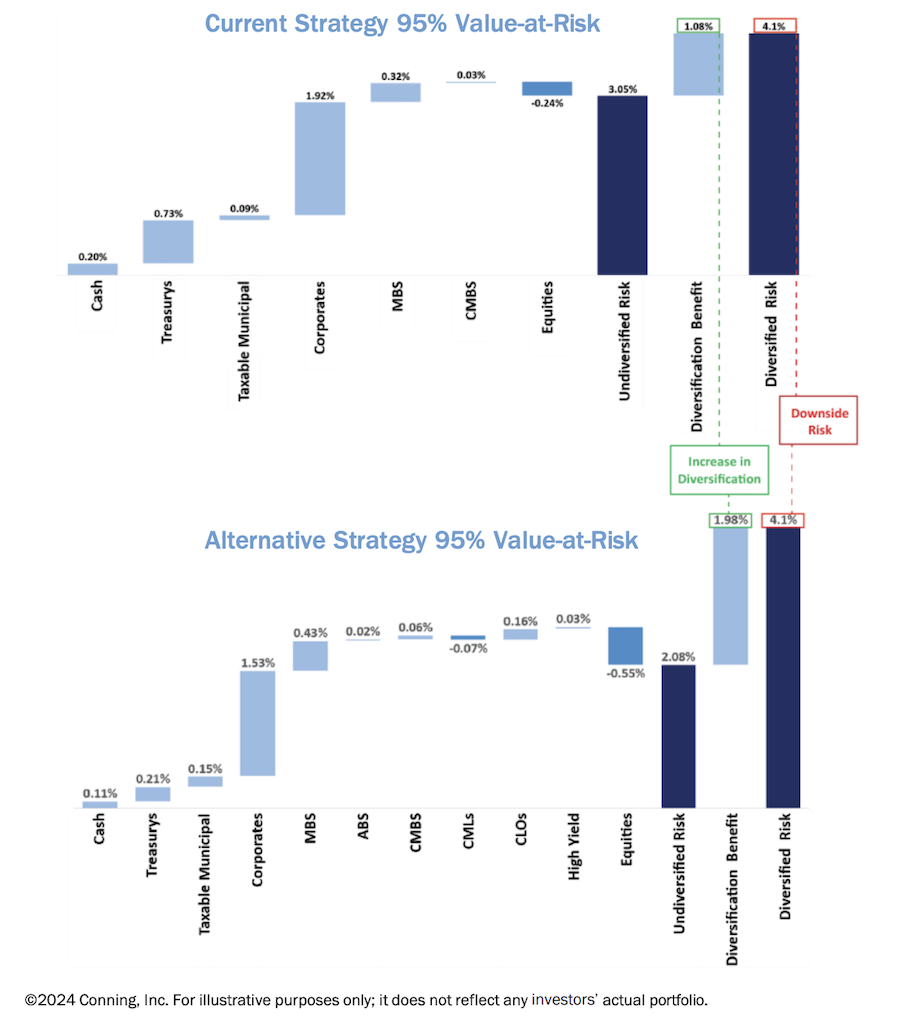

The two charts in Figure 5 illustrate how we can adjust the investment portfolio of the workers’ compensation insurer with an optimal asset allocation, resulting in no change to downside risk (as measured by the 95% Value-at-Risk) but improving diversification benefits by 90 basis points.

Figure 5 - Projected Strategy Impact on P&C Portfolio’s Risk, Diversification

See also: 5 Key Mistakes in Long-Term Planning

Measuring Value at the Enterprise Level

When we examine the possible risks to both assets and liabilities, we can help insurers understand the adverse consequences to enterprise metrics such as net income, operating cashflow or surplus. It becomes essential to evaluate how a modified investment strategy can benefit the enterprise value of the company, not only investment yield or total return.

Using Conning’s proprietary modeling software, we’re able to measure the economic impact in each case and for each strategy. With a suitable strategic asset allocation (SAA) analysis, we’re able to assess such risks and adeptly adjust duration and introduce asset classes (such as specialty fixed income, collateralized loan obligations (CLOs), commercial mortgage loans (CMLs), equities, etc.) to help manage periods of uncertainty and market volatility. This helps position the company’s profile (assets and liabilities) to minimize risk exposure, enhance return and diversification and meet financial goals.

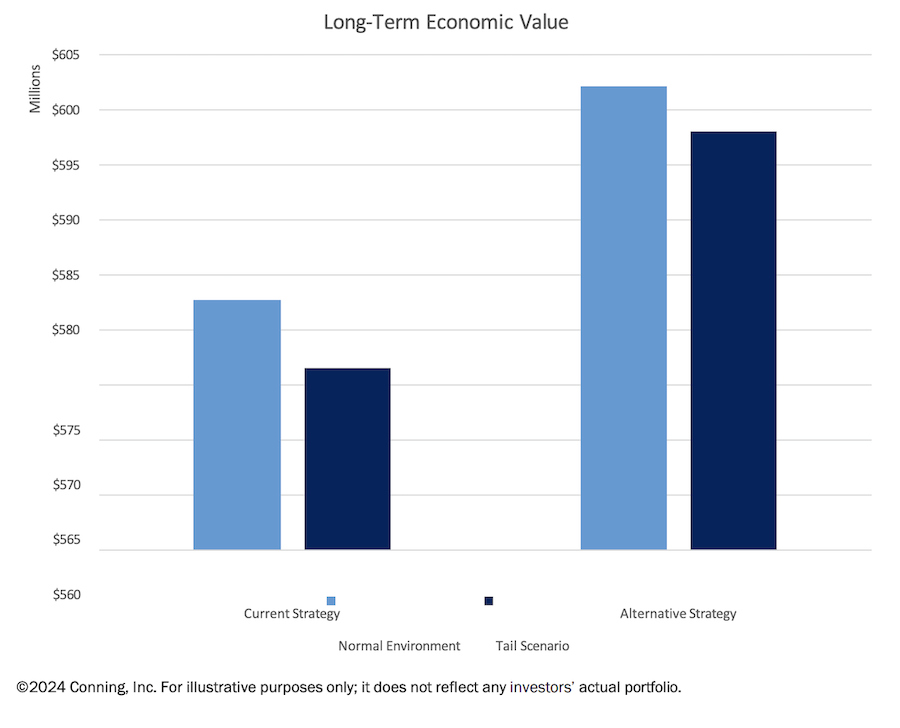

Figure 6 demonstrates how the alternative strategy for the workers’ compensation insurer outperforms the existing strategy in a normal steady state and the tail scenario (a period of above- target inflation).

Figure 6 - Projected Strategy Impact on P&C’s Enterprise Value

The negative impact on the company’s economic value was improved by more than $2 million in our example as a result of a timely optimal asset allocation. (Conning uses economic value as a measure of valuation, which reflects the market value of assets minus the discounted value of liabilities plus the value of future operations.)

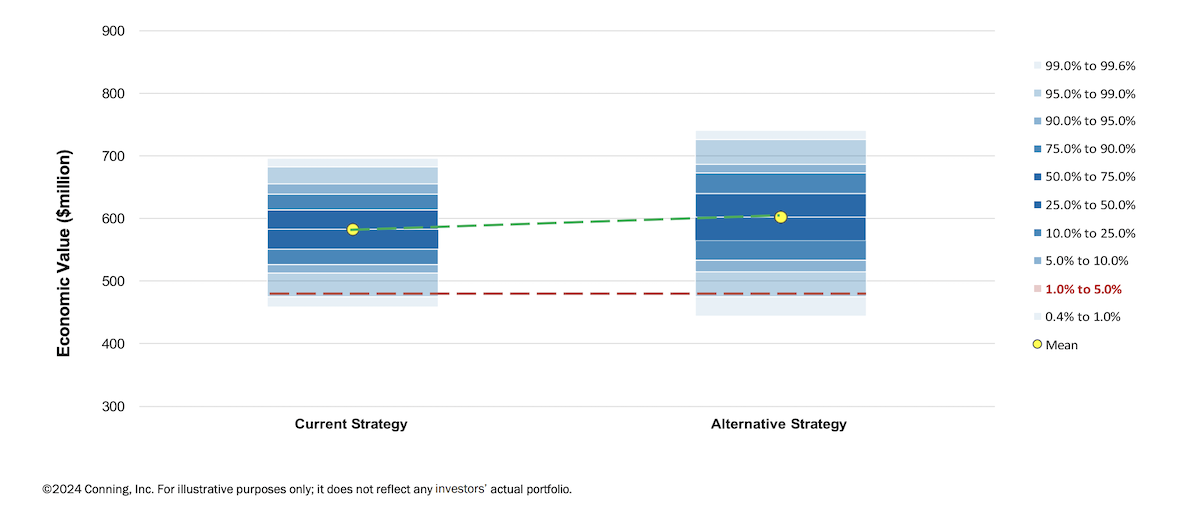

Expanding to the full distribution of outcomes, Figure 7 illustrates the long-term economic value of the workers’ compensation company projections for both steady state and an environment in which inflation remains above target for some time. Although the alternative strategy introduces additional variations in results (comparing the two floating bar charts), the 99% Value-at-Risk (a measure of downside risk) remains stable (comparing the two strategies across the dotted red line), and economic value under the alternative strategy is higher.

Figure 7 - Projected Distribution of P&C Insurer’s Economic Value by Portfolio Strategy

Swift and Steady Can Win the Race

The ability to respond swiftly to the constantly changing economic environment can be a huge benefit to insurers. While our study focused on addressing higher-for-longer rate concerns, we think a dynamic approach to investment strategy offers rewards in most economic environments.

Whether addressing the intricacies of inflation risk, duration risk or the complexities of elevated correlation risk, strategic reallocation of investments must consider the intricate interplay among assets and liabilities (a nuanced and comprehensive approach) in the prevailing economic environment. Such meticulous assessments and strategic investment realignments are pivotal in mitigating the impacts, thereby optimizing the overall portfolio performance in the face of dynamic market conditions.