How many companies do you hear say, "We are customer-centric"? Pretty much all of them, right? To be fair, I can't imagine many would ever come out and say they are NOT customer-centric. But I rarely believe the claim of being customer-centric. What I think most companies mean is that they are

product-centric first, then and only then customer-centric.

That is: What’s in our kit bag that we can sell to you? We as the consumer end up with multiple product (centric) offerings and do the orchestration and administration ourselves. This is the way it’s always been. The average consumer has between 12 and 17 individual insurance products. Think about it: home, motor, pet, life, gadget, protection, health... the list goes on. Then add up the number of people per household. What happens when you have four adults (two parents, two kids): Is that 40 policies? For grudge purchases like insurance, that's a whole load of grudge! Another way to validate this product-centricity -- when you call your insurer and the rep asks you for your policy number before your name!

If we innovate and design products in silos, we create great individual products -- but do we miss the big picture?

We create a fragmented and poor end-to-end experience for customers, leaving them to do all the hard work.

We may as well buy products from multiple providers (which in most cases we do). There are very few composite carriers that have got this right (or are moving toward an integrated approach).

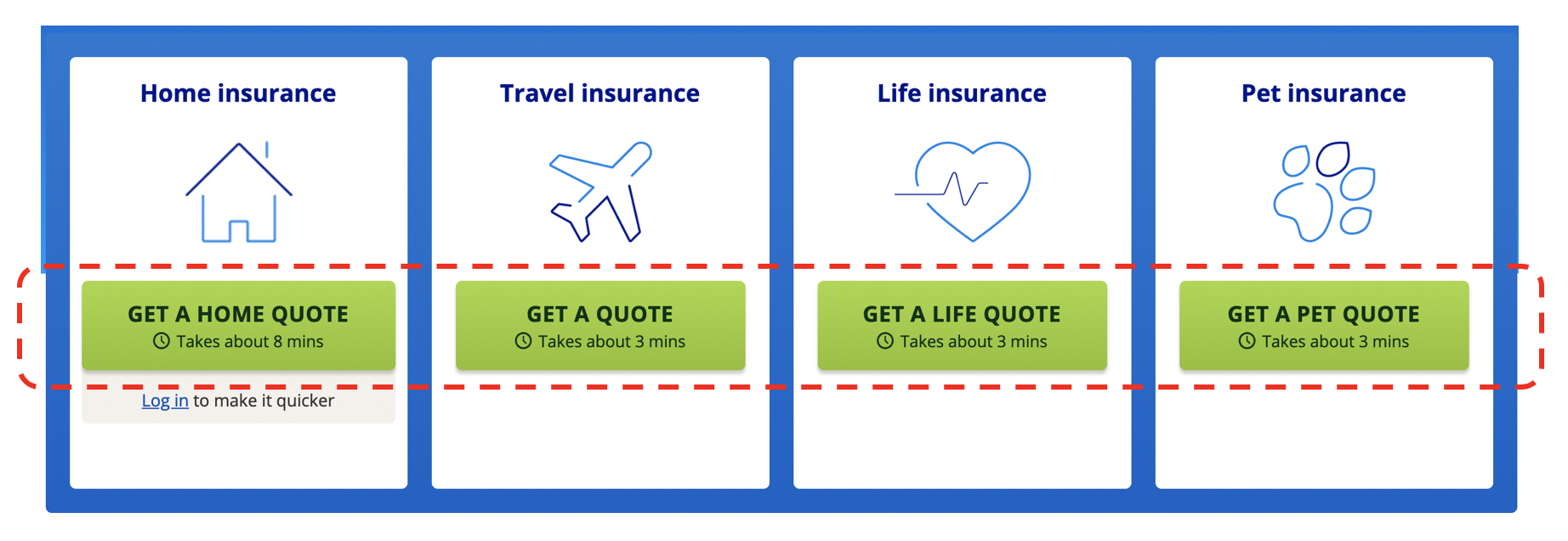

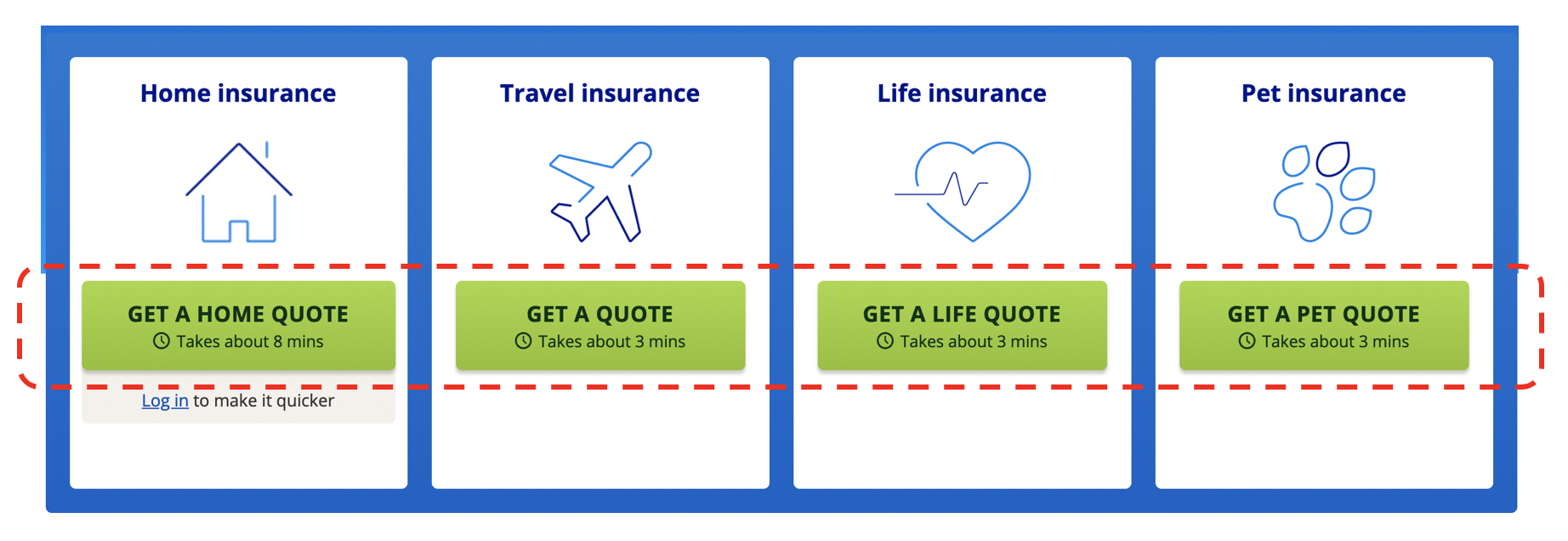

We make the problem worse by advertising in the same silos (in the U.K., at least) on our price comparison sites and focus on how long it takes to get cover: home insurance in eight minutes, travel in three and life insurance in three.

LV did a

study saying we spend more time choosing our annual holiday than we do buying life insurance. That just seems mad to me!

How are we meant to engage with customers or get them to fall in love with what we are offering? We need new methods!

See also: So, You Want to Work With Insurtechs?

When Is Insurance NOT Insurance?

I am a firm believer of falling in love with the things we want. I don’t want:

- Auto insurance - I want the ability to drive from place to place.

- Buildings insurance. I want the cover I need so that my mortgage company gives me the money to buy a house.

- Health insurance - I want the help to stay healthy and out of hospital and so on. You get the idea here.

Partly, this is the move from reactive to preventive capabilities - or at least that's what we say in the insurance circles. See

here for the Great Insurtech Debate that covered some of this.

I LOVE YOU

To help move away from these multiple product silos, the key for me is the addition of some sort of service. Customers actually want more than the insurance product. So give them the same products, this time shielded by a services layer they actually need and engage with.

This service layer would have a number of fundamental impacts, both positive and negative:

Positives:

- greater customer-centricity, as the services layer does the orchestration/administration

- less burden on the customer at the product level - makes our lives more convenient and gives us time back

- higher number of products per customer for the carrier (usually an important or at least measured metric across the industry -- and ranges from 1.1 per customer to six)

Negatives

- may reduce insurance premium written despite being more profitable because of the service revenue

- may reduce transparency? Will the regulators like this?

That leaves the new model looking more like this: the service layer getting bigger, the insurance slices shrinking and all the lines blurred between the once product-centric and siloed innovation world. It also means we innovate at the customer level, not the product level. Feels like a WIN WIN WIN.

So What Do These Services Look Like?

There are tons of examples here that can be called up and not just in personal lines. In the same way I pay for uptime on aircraft engines, I can do the same from Hartford Steam Boiler given their IoT acquisitions, with preventive maintenance and servicing vs. buying the policy outright in the first place.

Some initial examples could include:

For insurers, the next question is: Do I need to own those services, or could I just partner with multiple other providers to focus on the right outcome? Think about emergency home repair in your home policy or legal cover on your motor cover. These are still at a product level but not owned by the insurer themselves.

The key question is - What did the customer come out to buy in the first place?

Step out a level and start to aggregate the thinking at the customer (need), level not the (individual) product level.

One of my favorite examples is Peugeot's

Just Add Fuel. It plays to many things for me -- from mobility as a service to brilliant orchestration of the end-to-end things you need to drive: servicing, tax, roadside assistance, tires and, of course, insurance. Super-convenient and hassle-free!

I call the Peugeot approach embedded and invisible insurance. Many folks don't like this term or general principle, asking what happens to all the spending on identity, brand and direct marketing. Will regulators like the approach -- is it transparent enough?

The winner will be the most efficient manufacturer. A great example of this is

CoverGenius, which is integrating to the commerce level, not making the customer do the swivel chair integration! Hear from

Mitch Doust, too, on the InsurTech Insider podcast

here on what they are up to and how they enable embedded insurance experiences for their customers.

See also: Predicting the Future of Insurtech

A great example from another industry on removing barriers for customers comes from Match.com. Any single parents wanting to go on a date get up to

three hours babysitting free of charge. Now, I’m not single, but finding a babysitter is nearly impossible where we live.

Beyond Insurance

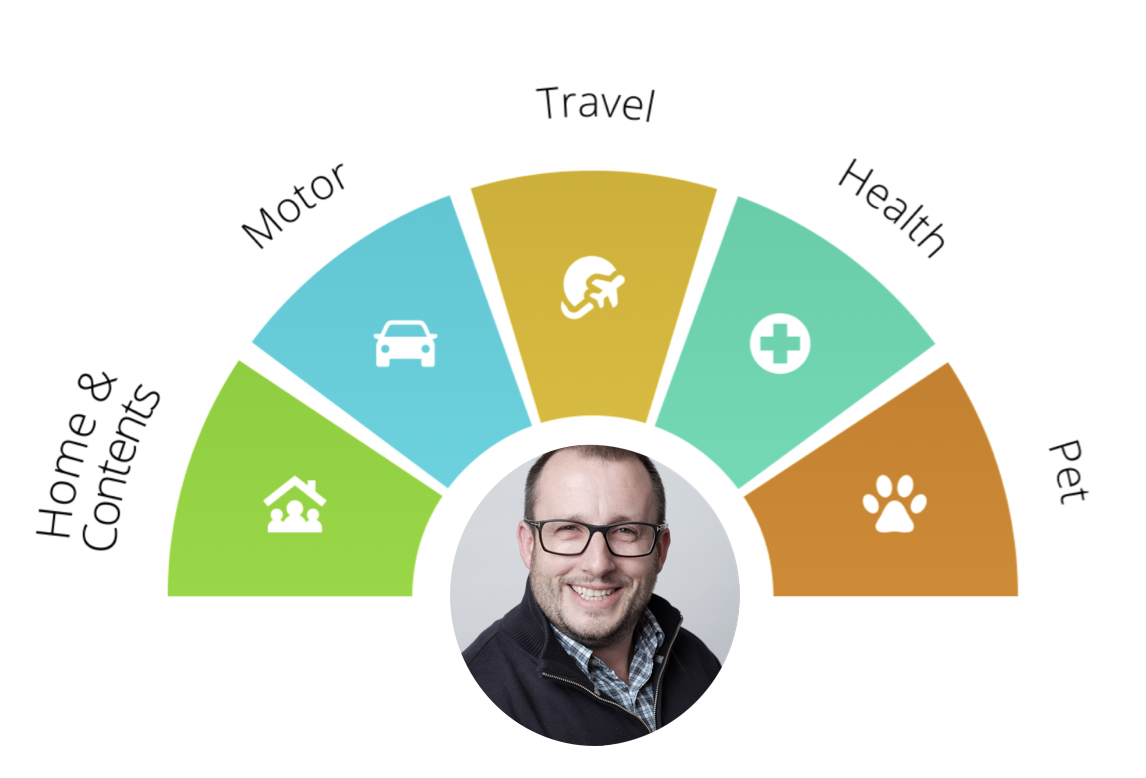

So let's assume for one minute that the top half of my customer circle is filled with tens of insurance products that we all have. Now expand to look at the services we engage with on a regular basis and are likely to love as little as insurance. I quickly arrive at utilities and banking, with many lessons and observations that I think can be worked through for insurers, too.

Utilities

It’s fair to say we love these (read: care as little) as much as we do insurance. It’s pretty much a commodity product with some big legacy incumbents and some startups. Sound familiar? The startups have some unique and interesting propositions, be it great user experience (

Bulb is my favorite), 100% renewable energy or something else. There are price comparison sites helping you find the best/cheapest option based on your usage and preferences. But just like insurance, there is a level of inertia that limits people from switching

energy providers.

That said, there are a number of things going on here that may, just may, have material impacts for how we engage insurers.

Specifically, automatic provider switching!

There’s been a whole host of firms pop up and offer this service. In the U.K., we have

Labrador,

Flipper,

WeFlip and now

AutoSergi from the price comparison website giants themselves, plus many others.

With Flipper, you pay a monthly subscription of just £2.50 to automatically flip to lower-cost providers, but it's free until you have made savings. In the U.S.. you have BillShark, and this is just the tip of the iceberg. The Guardian ran a piece late last year on how we can help people change providers for the best deal, in some cases saving £1,500 per year. There are easily 10-plus players in this space now, although not without challenge. I recall Flipper has been to the brink and back, and, just this month, it's reported that Labrador has gone bust (

here).

Challenges aside, take the idea of auto switching to insurance?

Would most of us actually care if our journey out was insured to a different provider to the journey back, or house insured with provider X one month and a different one the next?

The Final Ingredient in the Cake: Banking

As much as I love all of the new Neo Banks and challenger capabilities such as

Starling,

Monzo,

Yolt,

Emma and hundreds of others, my life seems to take place on my credit card.

While I have moved to a Neo Bank (and properly moved, shutting down my old account), it does pretty much what I had before. Yes, maybe with a shinier interface. Yes, in a more engaging way. But I have my money in, and then bills out. It's not that complicated. What sets my bank apart is the

Market Place, which enables access to insurance through a number of providers, as well as many other services and utilities to make use of the open banking and transactional data.

Another New Bank,

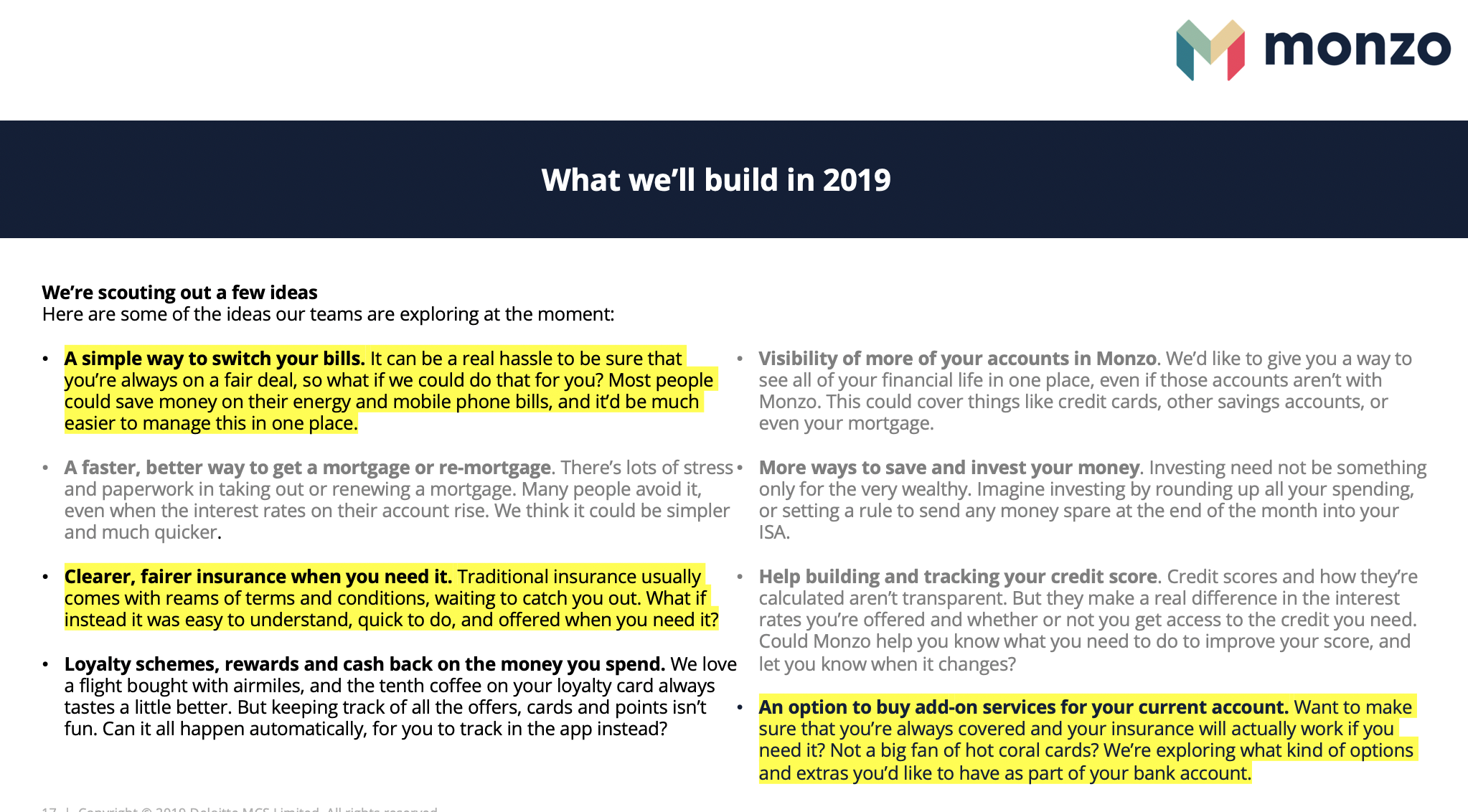

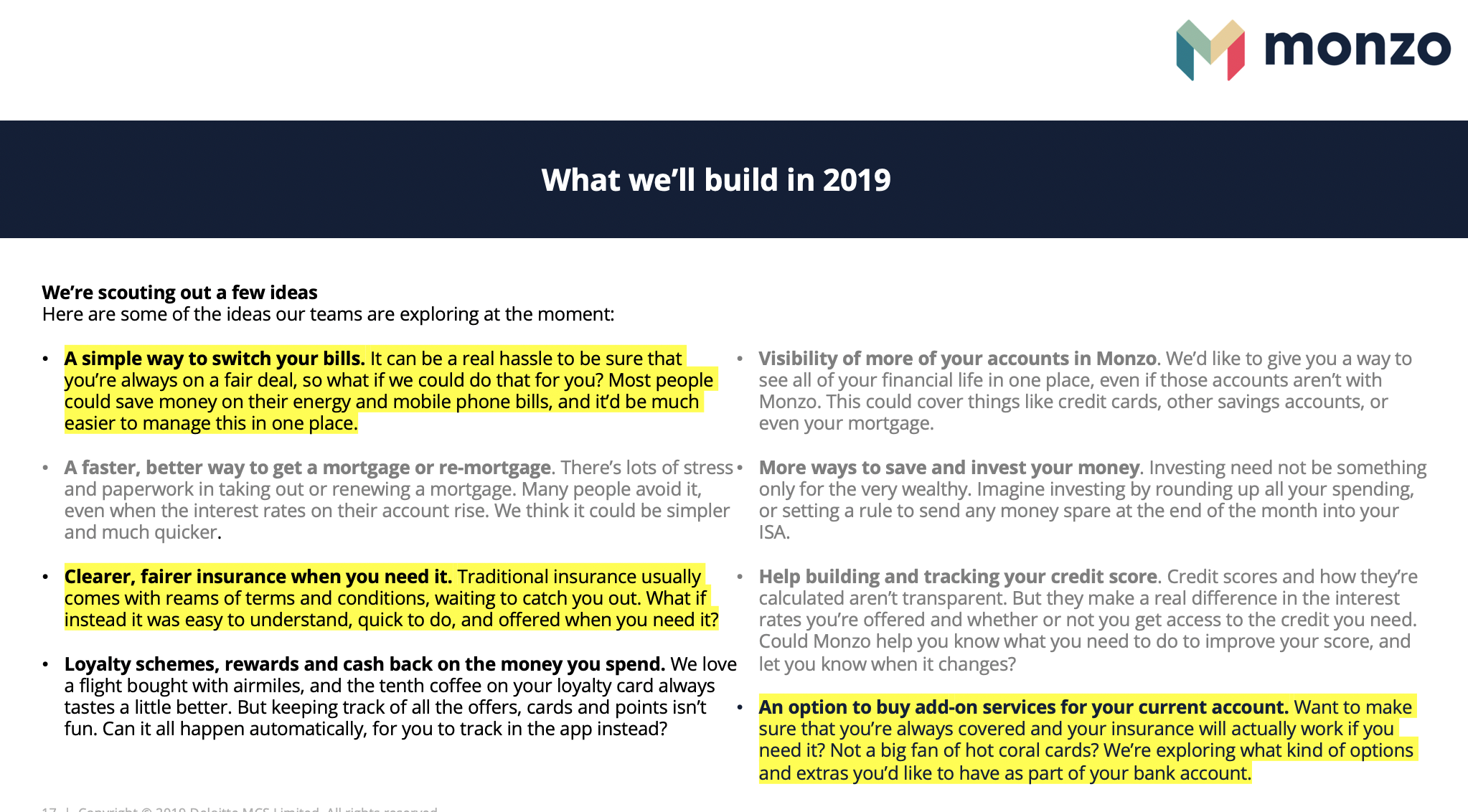

Monzo, which could be valued at $2 billion if the

latest rumored raise is correct, has an iconic following for its

Hot Coral card. The more than 1.5 million customers give Monzo an opportunity to service this customer base with more than just banking. In a recent

blog, Monzo talked about services that could be added: bill switching, clearer fair insurance and much more.

With All These Ingredients, How Do We Make Cake?

With All These Ingredients, How Do We Make Cake?

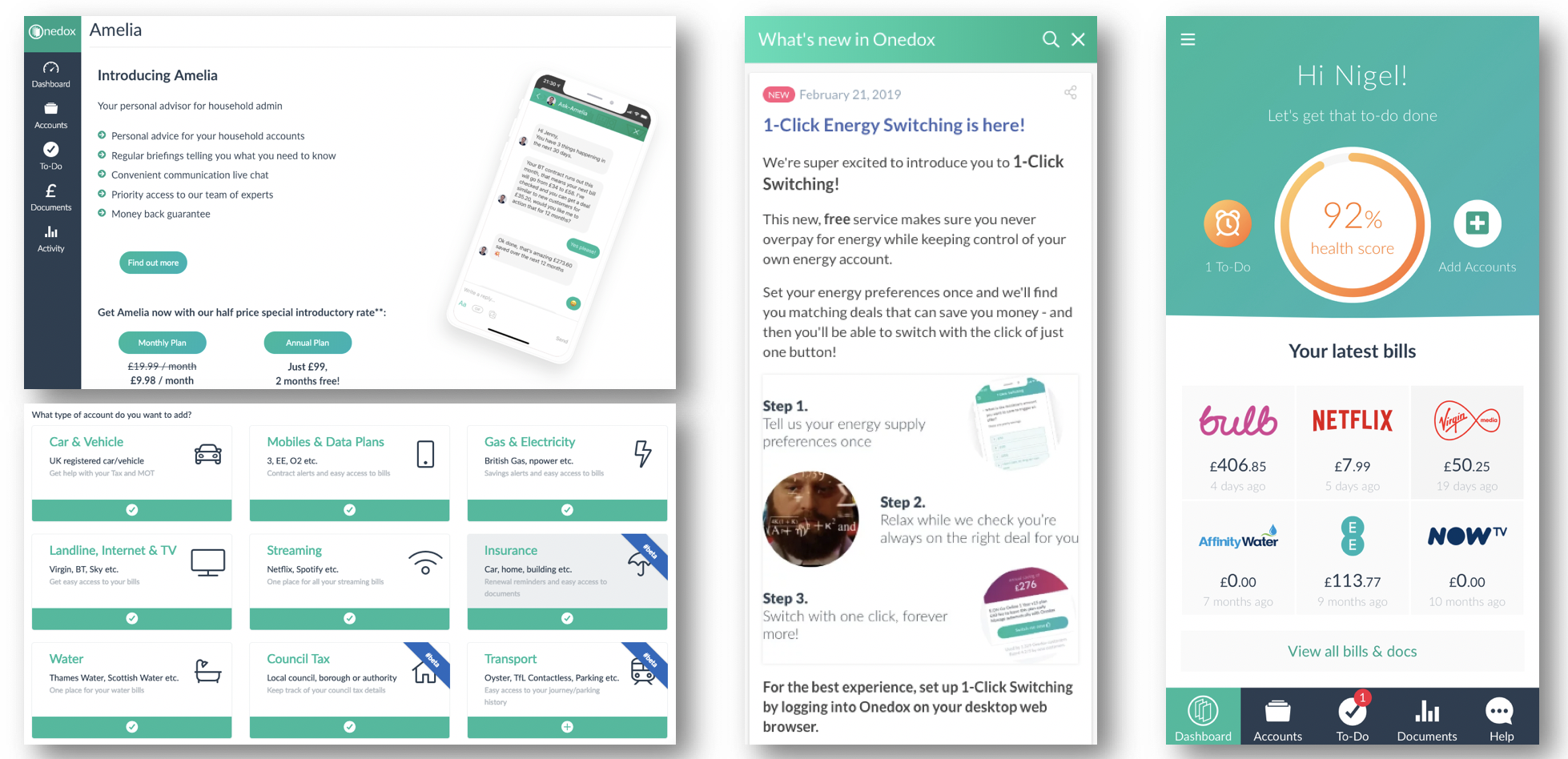

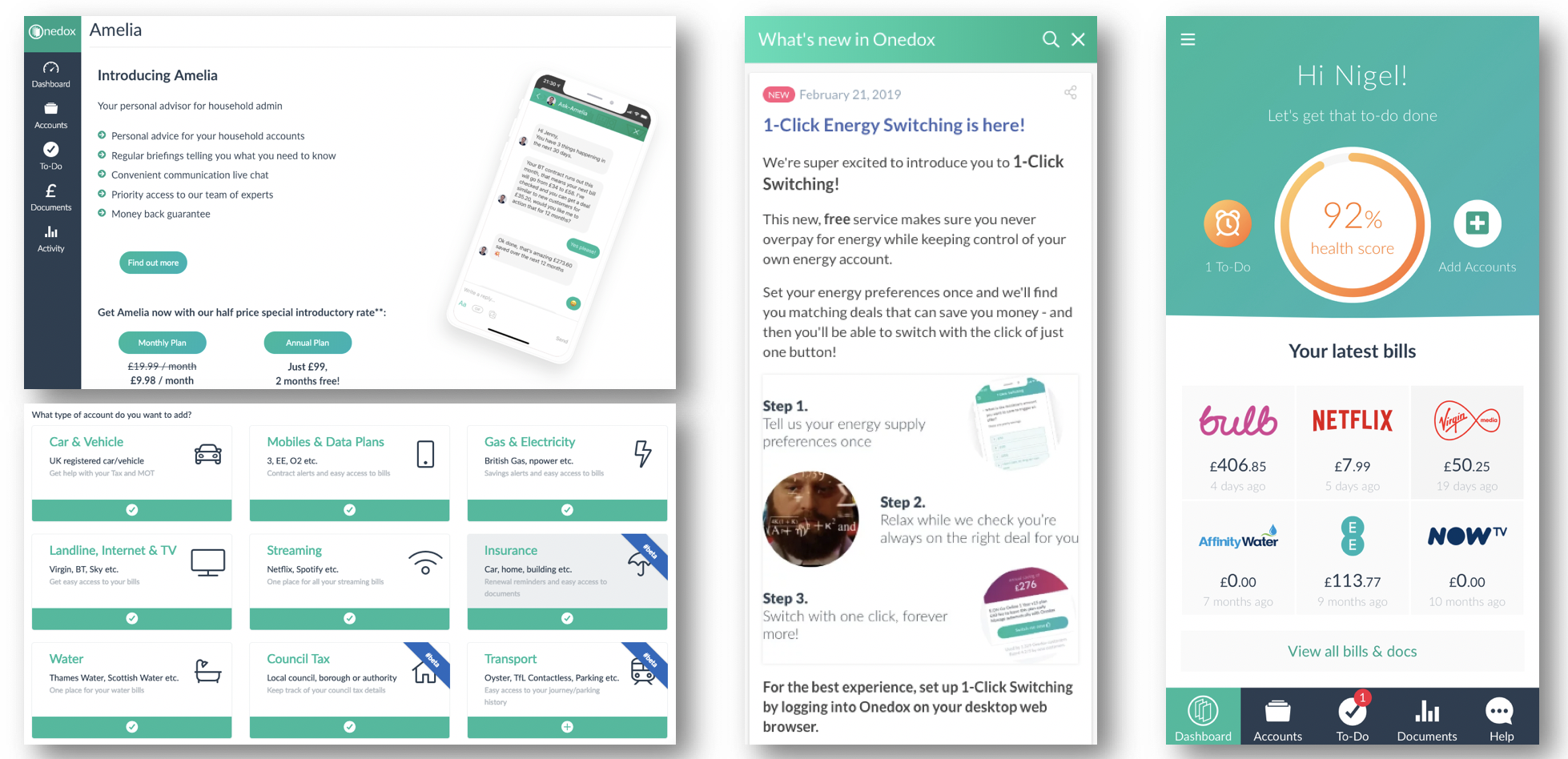

Many all-in-one services already exist. One of my favorites is

Onedox, which wraps all of the above into a single service and has a website and app that allow you to add:

- household bills, including broadband, media, phone, streaming services

- other stuff, like when my mortgage is due, my TV license, my local council tax and much more

- having all the bills (pdfs) downloaded to one place without me having to log in anywhere else

I can add multiple providers, I get one-click energy switching and a neat app to store all this stuff in one place, rather than log into my separate providers and accounts.

See also: 3 Insurtech Trends Accelerating in 2019

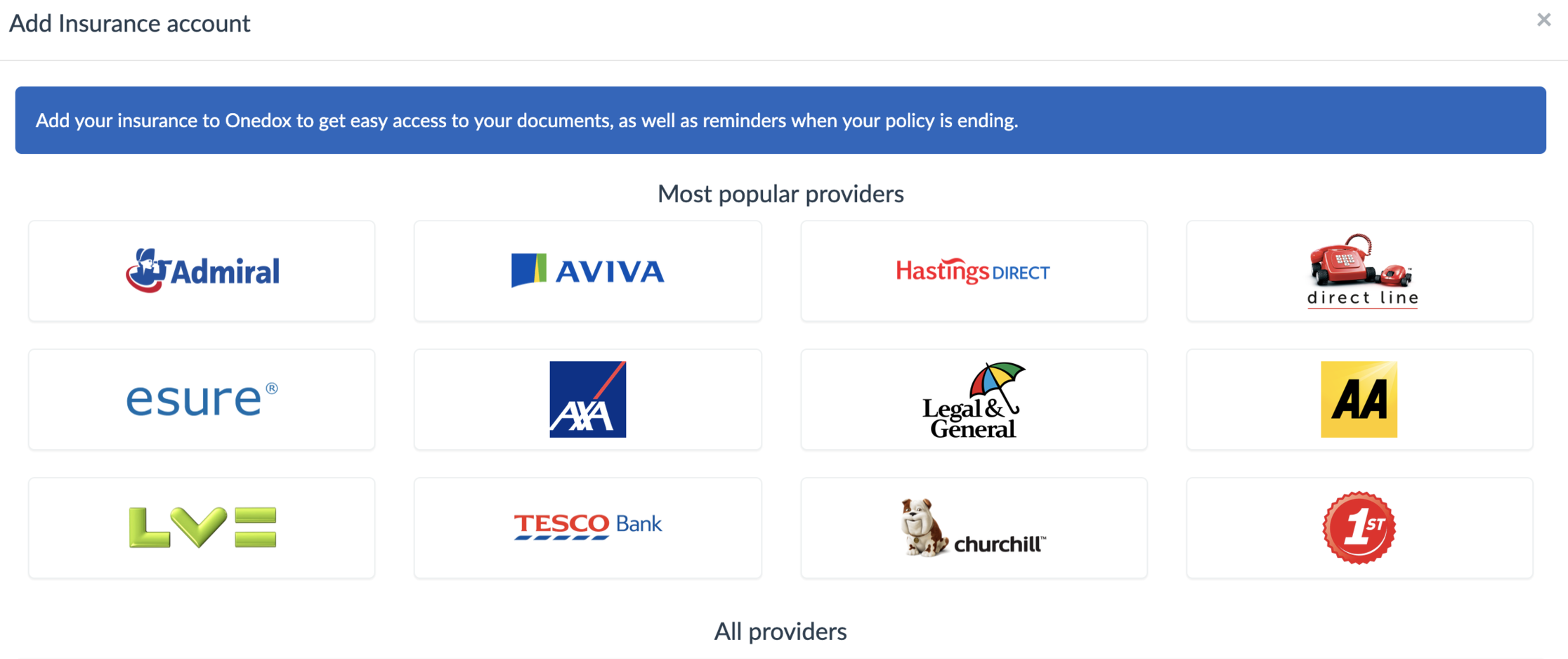

Keep going. Add insurance providers (below) and soon insight through open banking. See

here for the vision on that particular one.

I find Onedox super helpful and already notice behavior changes, in that I don't need to go to any of the other providers.

Youtility is another that was recently featured in the national press.

So, who will own the customer of the future?

We want our time back. Period. For insurers, this means that we can no longer offer something people can't fall in love with, or want last in the chain of thoughts. We have to find ways to blur the lines. Why can't insurers take the front foot on this one, creating and orchestrating partnerships that add value?

Summary

I have a few key questions that keep coming up again and again:

- When is insurance not insurance? Will we focus on the service, not the underlying cover?

- Who will own the customer of the future? Is it the utility, bank or insurance company?

- What other industries have done a great job at orchestrating their own and other services into a single, convenient marketplace or offering?

- How does the U.K. market differ from Central Europe, the U.S. or Asia?

- Is there a combined service you would subscribe to if offered?

I can summarize this story in five points:

- Value-added services blur the lines between product silos, changing the premium and profit mix for carriers.

- Insurance can become embedded and invisible in the underlying service.

- As services move beyond insurance only, there are plenty of ingredients, but we eat cake!

- Watch out for open banking and utility switching -- if they win the race, where does that leave us?

- The change is happening already.

Ultimately, there is no point serving customers all the individual ingredients and saying, go make it yourself. They really just want cake!

As always, would love your thoughts, builds, challenges on this.

We create a fragmented and poor end-to-end experience for customers, leaving them to do all the hard work.

We may as well buy products from multiple providers (which in most cases we do). There are very few composite carriers that have got this right (or are moving toward an integrated approach).

We make the problem worse by advertising in the same silos (in the U.K., at least) on our price comparison sites and focus on how long it takes to get cover: home insurance in eight minutes, travel in three and life insurance in three. LV did a study saying we spend more time choosing our annual holiday than we do buying life insurance. That just seems mad to me!

We create a fragmented and poor end-to-end experience for customers, leaving them to do all the hard work.

We may as well buy products from multiple providers (which in most cases we do). There are very few composite carriers that have got this right (or are moving toward an integrated approach).

We make the problem worse by advertising in the same silos (in the U.K., at least) on our price comparison sites and focus on how long it takes to get cover: home insurance in eight minutes, travel in three and life insurance in three. LV did a study saying we spend more time choosing our annual holiday than we do buying life insurance. That just seems mad to me!

How are we meant to engage with customers or get them to fall in love with what we are offering? We need new methods!

See also: So, You Want to Work With Insurtechs?

When Is Insurance NOT Insurance?

I am a firm believer of falling in love with the things we want. I don’t want:

How are we meant to engage with customers or get them to fall in love with what we are offering? We need new methods!

See also: So, You Want to Work With Insurtechs?

When Is Insurance NOT Insurance?

I am a firm believer of falling in love with the things we want. I don’t want:

For insurers, the next question is: Do I need to own those services, or could I just partner with multiple other providers to focus on the right outcome? Think about emergency home repair in your home policy or legal cover on your motor cover. These are still at a product level but not owned by the insurer themselves.

The key question is - What did the customer come out to buy in the first place?

Step out a level and start to aggregate the thinking at the customer (need), level not the (individual) product level.

One of my favorite examples is Peugeot's Just Add Fuel. It plays to many things for me -- from mobility as a service to brilliant orchestration of the end-to-end things you need to drive: servicing, tax, roadside assistance, tires and, of course, insurance. Super-convenient and hassle-free!

I call the Peugeot approach embedded and invisible insurance. Many folks don't like this term or general principle, asking what happens to all the spending on identity, brand and direct marketing. Will regulators like the approach -- is it transparent enough?

The winner will be the most efficient manufacturer. A great example of this is CoverGenius, which is integrating to the commerce level, not making the customer do the swivel chair integration! Hear from Mitch Doust, too, on the InsurTech Insider podcast here on what they are up to and how they enable embedded insurance experiences for their customers.

See also: Predicting the Future of Insurtech

A great example from another industry on removing barriers for customers comes from Match.com. Any single parents wanting to go on a date get up to three hours babysitting free of charge. Now, I’m not single, but finding a babysitter is nearly impossible where we live.

Beyond Insurance

So let's assume for one minute that the top half of my customer circle is filled with tens of insurance products that we all have. Now expand to look at the services we engage with on a regular basis and are likely to love as little as insurance. I quickly arrive at utilities and banking, with many lessons and observations that I think can be worked through for insurers, too.

Utilities

It’s fair to say we love these (read: care as little) as much as we do insurance. It’s pretty much a commodity product with some big legacy incumbents and some startups. Sound familiar? The startups have some unique and interesting propositions, be it great user experience (Bulb is my favorite), 100% renewable energy or something else. There are price comparison sites helping you find the best/cheapest option based on your usage and preferences. But just like insurance, there is a level of inertia that limits people from switching energy providers.

That said, there are a number of things going on here that may, just may, have material impacts for how we engage insurers. Specifically, automatic provider switching!

There’s been a whole host of firms pop up and offer this service. In the U.K., we have Labrador, Flipper, WeFlip and now AutoSergi from the price comparison website giants themselves, plus many others.

With Flipper, you pay a monthly subscription of just £2.50 to automatically flip to lower-cost providers, but it's free until you have made savings. In the U.S.. you have BillShark, and this is just the tip of the iceberg. The Guardian ran a piece late last year on how we can help people change providers for the best deal, in some cases saving £1,500 per year. There are easily 10-plus players in this space now, although not without challenge. I recall Flipper has been to the brink and back, and, just this month, it's reported that Labrador has gone bust (here).

Challenges aside, take the idea of auto switching to insurance?

Would most of us actually care if our journey out was insured to a different provider to the journey back, or house insured with provider X one month and a different one the next?

The Final Ingredient in the Cake: Banking

As much as I love all of the new Neo Banks and challenger capabilities such as Starling, Monzo, Yolt, Emma and hundreds of others, my life seems to take place on my credit card.

While I have moved to a Neo Bank (and properly moved, shutting down my old account), it does pretty much what I had before. Yes, maybe with a shinier interface. Yes, in a more engaging way. But I have my money in, and then bills out. It's not that complicated. What sets my bank apart is the Market Place, which enables access to insurance through a number of providers, as well as many other services and utilities to make use of the open banking and transactional data.

Another New Bank, Monzo, which could be valued at $2 billion if the latest rumored raise is correct, has an iconic following for its Hot Coral card. The more than 1.5 million customers give Monzo an opportunity to service this customer base with more than just banking. In a recent blog, Monzo talked about services that could be added: bill switching, clearer fair insurance and much more.

For insurers, the next question is: Do I need to own those services, or could I just partner with multiple other providers to focus on the right outcome? Think about emergency home repair in your home policy or legal cover on your motor cover. These are still at a product level but not owned by the insurer themselves.

The key question is - What did the customer come out to buy in the first place?

Step out a level and start to aggregate the thinking at the customer (need), level not the (individual) product level.

One of my favorite examples is Peugeot's Just Add Fuel. It plays to many things for me -- from mobility as a service to brilliant orchestration of the end-to-end things you need to drive: servicing, tax, roadside assistance, tires and, of course, insurance. Super-convenient and hassle-free!

I call the Peugeot approach embedded and invisible insurance. Many folks don't like this term or general principle, asking what happens to all the spending on identity, brand and direct marketing. Will regulators like the approach -- is it transparent enough?

The winner will be the most efficient manufacturer. A great example of this is CoverGenius, which is integrating to the commerce level, not making the customer do the swivel chair integration! Hear from Mitch Doust, too, on the InsurTech Insider podcast here on what they are up to and how they enable embedded insurance experiences for their customers.

See also: Predicting the Future of Insurtech

A great example from another industry on removing barriers for customers comes from Match.com. Any single parents wanting to go on a date get up to three hours babysitting free of charge. Now, I’m not single, but finding a babysitter is nearly impossible where we live.

Beyond Insurance

So let's assume for one minute that the top half of my customer circle is filled with tens of insurance products that we all have. Now expand to look at the services we engage with on a regular basis and are likely to love as little as insurance. I quickly arrive at utilities and banking, with many lessons and observations that I think can be worked through for insurers, too.

Utilities

It’s fair to say we love these (read: care as little) as much as we do insurance. It’s pretty much a commodity product with some big legacy incumbents and some startups. Sound familiar? The startups have some unique and interesting propositions, be it great user experience (Bulb is my favorite), 100% renewable energy or something else. There are price comparison sites helping you find the best/cheapest option based on your usage and preferences. But just like insurance, there is a level of inertia that limits people from switching energy providers.

That said, there are a number of things going on here that may, just may, have material impacts for how we engage insurers. Specifically, automatic provider switching!

There’s been a whole host of firms pop up and offer this service. In the U.K., we have Labrador, Flipper, WeFlip and now AutoSergi from the price comparison website giants themselves, plus many others.

With Flipper, you pay a monthly subscription of just £2.50 to automatically flip to lower-cost providers, but it's free until you have made savings. In the U.S.. you have BillShark, and this is just the tip of the iceberg. The Guardian ran a piece late last year on how we can help people change providers for the best deal, in some cases saving £1,500 per year. There are easily 10-plus players in this space now, although not without challenge. I recall Flipper has been to the brink and back, and, just this month, it's reported that Labrador has gone bust (here).

Challenges aside, take the idea of auto switching to insurance?

Would most of us actually care if our journey out was insured to a different provider to the journey back, or house insured with provider X one month and a different one the next?

The Final Ingredient in the Cake: Banking

As much as I love all of the new Neo Banks and challenger capabilities such as Starling, Monzo, Yolt, Emma and hundreds of others, my life seems to take place on my credit card.

While I have moved to a Neo Bank (and properly moved, shutting down my old account), it does pretty much what I had before. Yes, maybe with a shinier interface. Yes, in a more engaging way. But I have my money in, and then bills out. It's not that complicated. What sets my bank apart is the Market Place, which enables access to insurance through a number of providers, as well as many other services and utilities to make use of the open banking and transactional data.

Another New Bank, Monzo, which could be valued at $2 billion if the latest rumored raise is correct, has an iconic following for its Hot Coral card. The more than 1.5 million customers give Monzo an opportunity to service this customer base with more than just banking. In a recent blog, Monzo talked about services that could be added: bill switching, clearer fair insurance and much more.

With All These Ingredients, How Do We Make Cake?

Many all-in-one services already exist. One of my favorites is Onedox, which wraps all of the above into a single service and has a website and app that allow you to add:

With All These Ingredients, How Do We Make Cake?

Many all-in-one services already exist. One of my favorites is Onedox, which wraps all of the above into a single service and has a website and app that allow you to add:

I can add multiple providers, I get one-click energy switching and a neat app to store all this stuff in one place, rather than log into my separate providers and accounts.

See also: 3 Insurtech Trends Accelerating in 2019

Keep going. Add insurance providers (below) and soon insight through open banking. See here for the vision on that particular one.

I can add multiple providers, I get one-click energy switching and a neat app to store all this stuff in one place, rather than log into my separate providers and accounts.

See also: 3 Insurtech Trends Accelerating in 2019

Keep going. Add insurance providers (below) and soon insight through open banking. See here for the vision on that particular one.

I find Onedox super helpful and already notice behavior changes, in that I don't need to go to any of the other providers. Youtility is another that was recently featured in the national press.

So, who will own the customer of the future?

We want our time back. Period. For insurers, this means that we can no longer offer something people can't fall in love with, or want last in the chain of thoughts. We have to find ways to blur the lines. Why can't insurers take the front foot on this one, creating and orchestrating partnerships that add value?

Summary

I have a few key questions that keep coming up again and again:

I find Onedox super helpful and already notice behavior changes, in that I don't need to go to any of the other providers. Youtility is another that was recently featured in the national press.

So, who will own the customer of the future?

We want our time back. Period. For insurers, this means that we can no longer offer something people can't fall in love with, or want last in the chain of thoughts. We have to find ways to blur the lines. Why can't insurers take the front foot on this one, creating and orchestrating partnerships that add value?

Summary

I have a few key questions that keep coming up again and again: