This one has been a long time coming. I have discussed the topic time and time again, both on the

podcast and with many folks -- both in incumbent insurers and at startups breaking new ground. In fact, it's the countless conversations with startups that have led me to this conclusion.

Quite simply, the more insurtech founders I meet across the globe, the more partnerships we create, the more convinced I am that the lowest common denominator for the insurtech (r)evolution is the core system itself, most notably the policy admin system and quote-and-buy process. Claims is present in some of the new platforms but seems to be a slower follower here for new/low code/business-focused platforms.

The Holy Grail

Having been involved in many large-scale core system transformations over the years, I feel the pain here. Ultimately, though, I believe they are the holy grail of holy grails.

I have worked with many clients on "core system transformation" projects and thoroughly enjoyed the challenge. These systems typically replaced decades of legacy claims, policy and billing platforms. These old systems were not built for the current (or future) market environment with its very specific and demanding requirements around data and engagement, to support today's very different customer expectations.

The multitude of platforms is a result of a whole host of factors, including increased M&A activity, out-of-support platforms, security issues and efforts to modernize or simplify. Those are all valid reasons to act, if the business case stacks up. Sadly, more often than not, it doesn't.

What's the alternative?

On fire but not hot enough

Unless there is a burning platform, I am seeing more organizations lean toward leveraging an insurtech solution to address the key challenge of speed-to-market for products,.

See also: Is Insurance Industry Too Complex?

Insurers are typically adopting a two-pronged approach, these being:

- Left to Right —solving the core system challenge from the foundations upward, addressing the burning platform issues through slow-moving projects that take months to years. These are the more traditional transformation programs, bigger and using some of the industry's leading core systems technology, such as Guidewire or DuckCreek. I don't think these are going away anytime soon. In certain markets, these programs will have more success than others.

- Right to left — starting with the customer and working backward into the organization, addressing the very specific "speed-to-market" challenge that almost every carrier I talk to is looking to solve. The internal change stack is either full or the existing platforms can't get there at the right speed or price point to test the market or to meet a specific demand that has been identified. These projects are typically fast-moving and short, lasting weeks to months.

These approaches are not mutually exclusive. Many of the folks I speak to are doing both and aiming to meet in the middle somewhere. I genuinely see the case for both in some of the insurers I work with. You simply can't run 30-year-old platforms and expect to meet modern-day agility requirements.

The second approach above, of course, is where the insurtech (r)evolution is playing out right now in full force.

Finding our feet

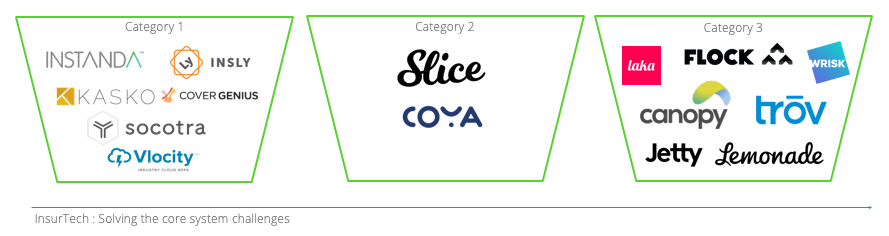

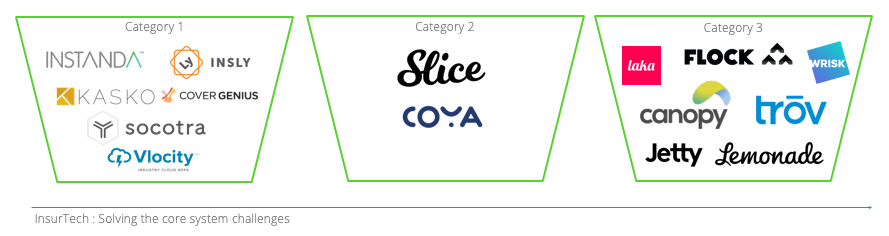

I categorized these challengers into three broad categories:

- Category 1 — Modern-day equivalents of the traditional (large) core system providers, albeit cloud-native and built for speed to market. These are all-encompassing, with a huge amount of flexibility, either to operate standalone or integrate into carriers' existing standard tools for rating, documentation, etc.

- Category 2 — As above, but with the added benefit of being able to write business in specific states or geographies, authorized by local regulators.

- Category 3 — Players that have been built from the ground up to solve a single, specific problem -- but that could easily be repurposed to solve another challenge or address a new line of business.

I mapped some of the existing players into each of these groups below. This is not exhaustive; we know there are north of 2,000 insurtech startups and over 100 providers in the platform space.

A little more detail

Category 1 — Instanda

A little more detail

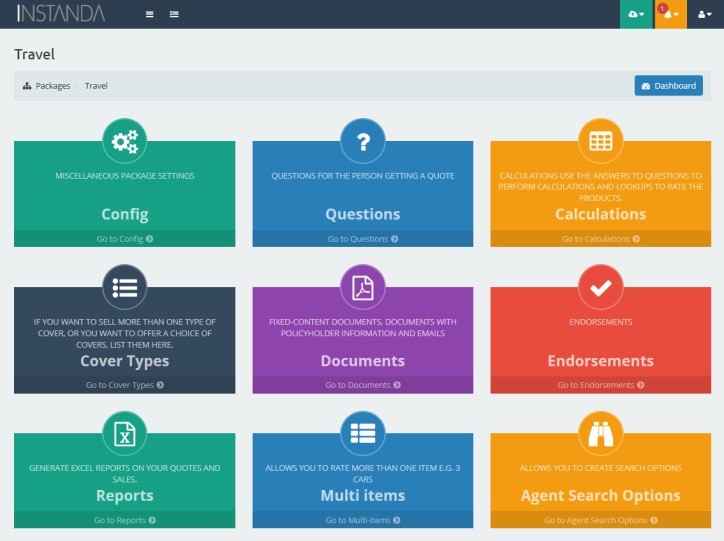

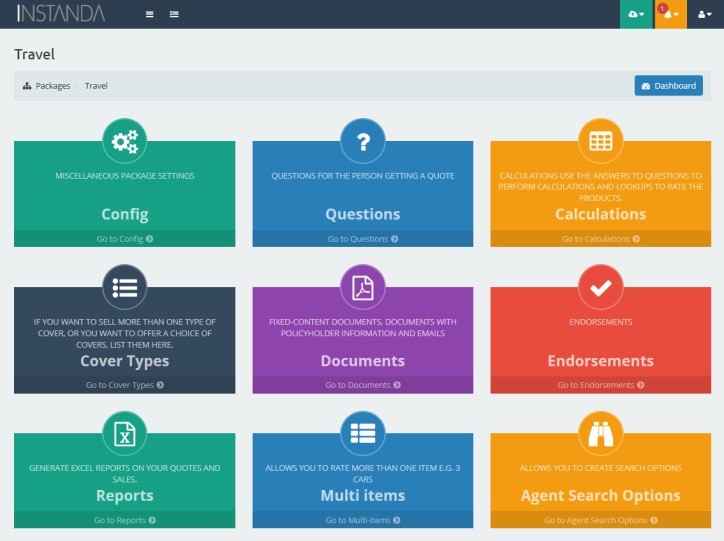

Category 1 — Instanda, for example, has 45-plus clients, from MGAs to insurers, that it has helped launch propositions and products to market in 8 to 12 weeks each, often less. Like everyone in this space, Instanda is cloud-native, sitting on Microsoft Azure, with the ability to spin up and down in a heartbeat. The screenshot below shows the simple, logical flow a business user can follow to create full insurance products, from rating questions and calculations to documents and endorsements. Adding to this, Instanda will quite happily deal with the first notice of loss (FNOL) phase for claims, passing then on to the client's in-house claims or TPA platform.

Category 2 — Slice

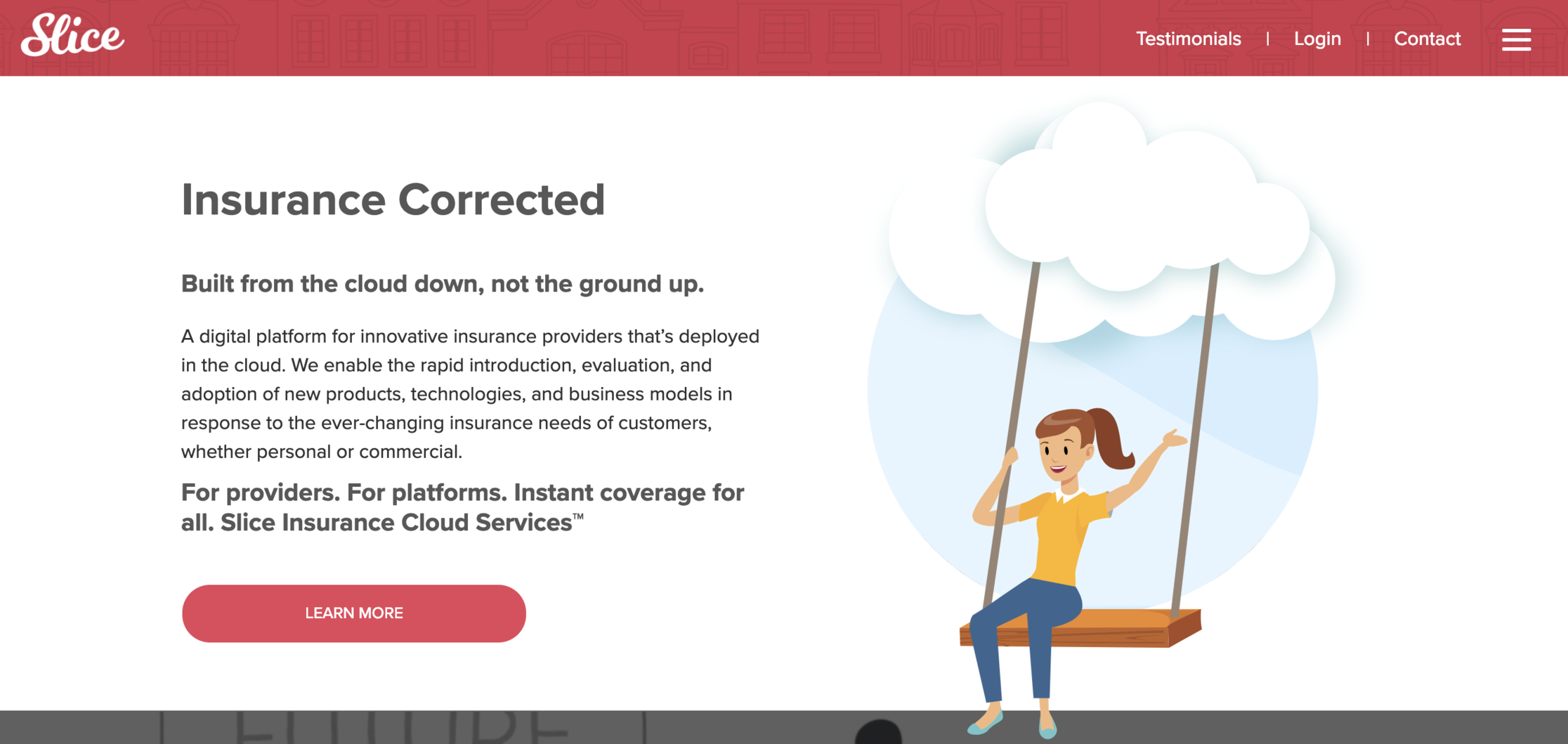

Category 2 — Slice not only has a cloud-based platform with ICS for policy and claims, it has the ability to write business in specific states. Built from the cloud down, Slice is outsourcing the speed-to-market challenge and has some great examples.

Category 3 —

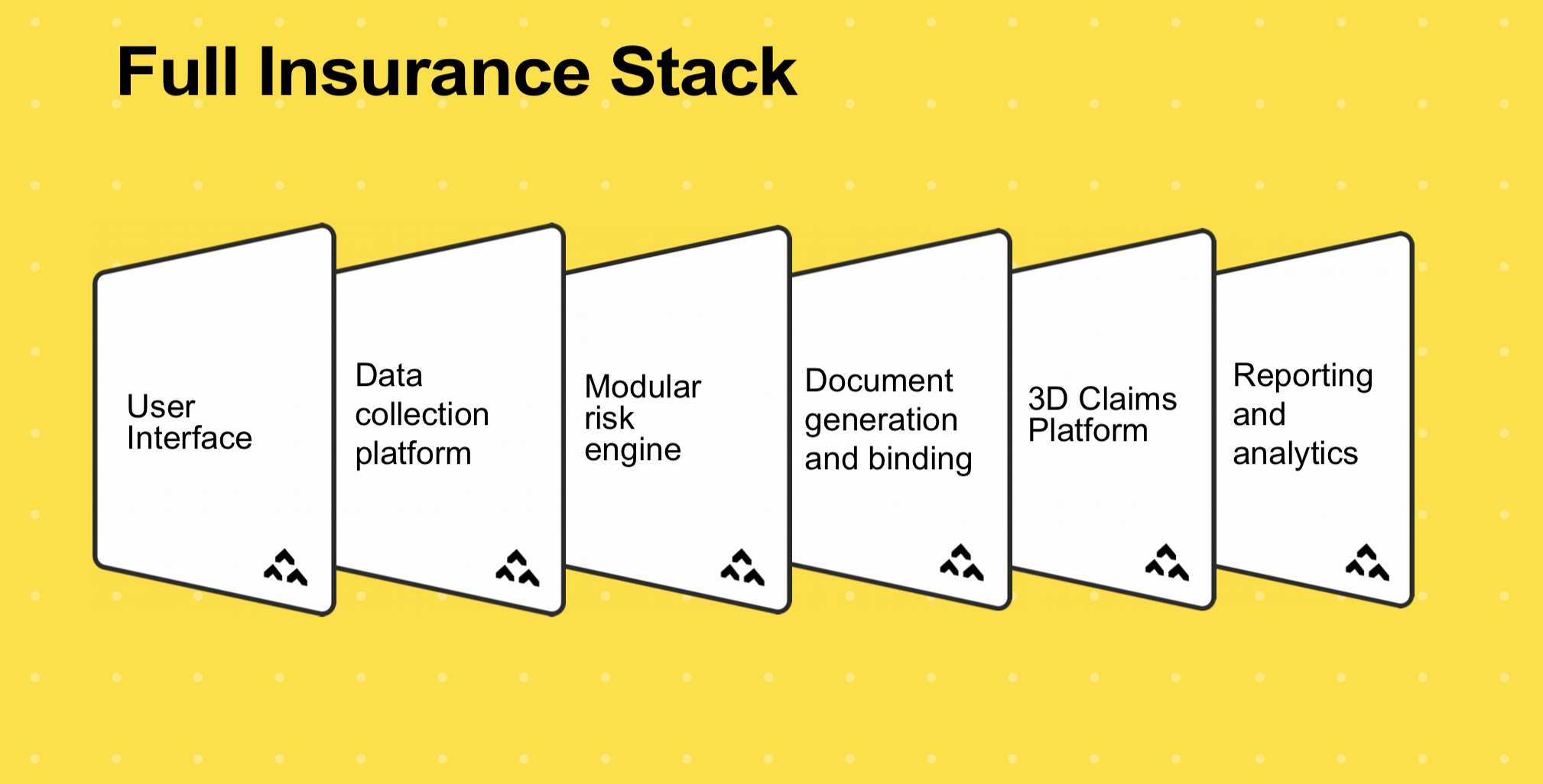

Category 3 — Finally, these folks have been on their merry way solving very specific challenges, whether it's

Laka reinventing the business model while solving cycle insurance, or

Flock with its head in the clouds with drone insurance or

Canopy for Renters or

MyUrbanJungle or

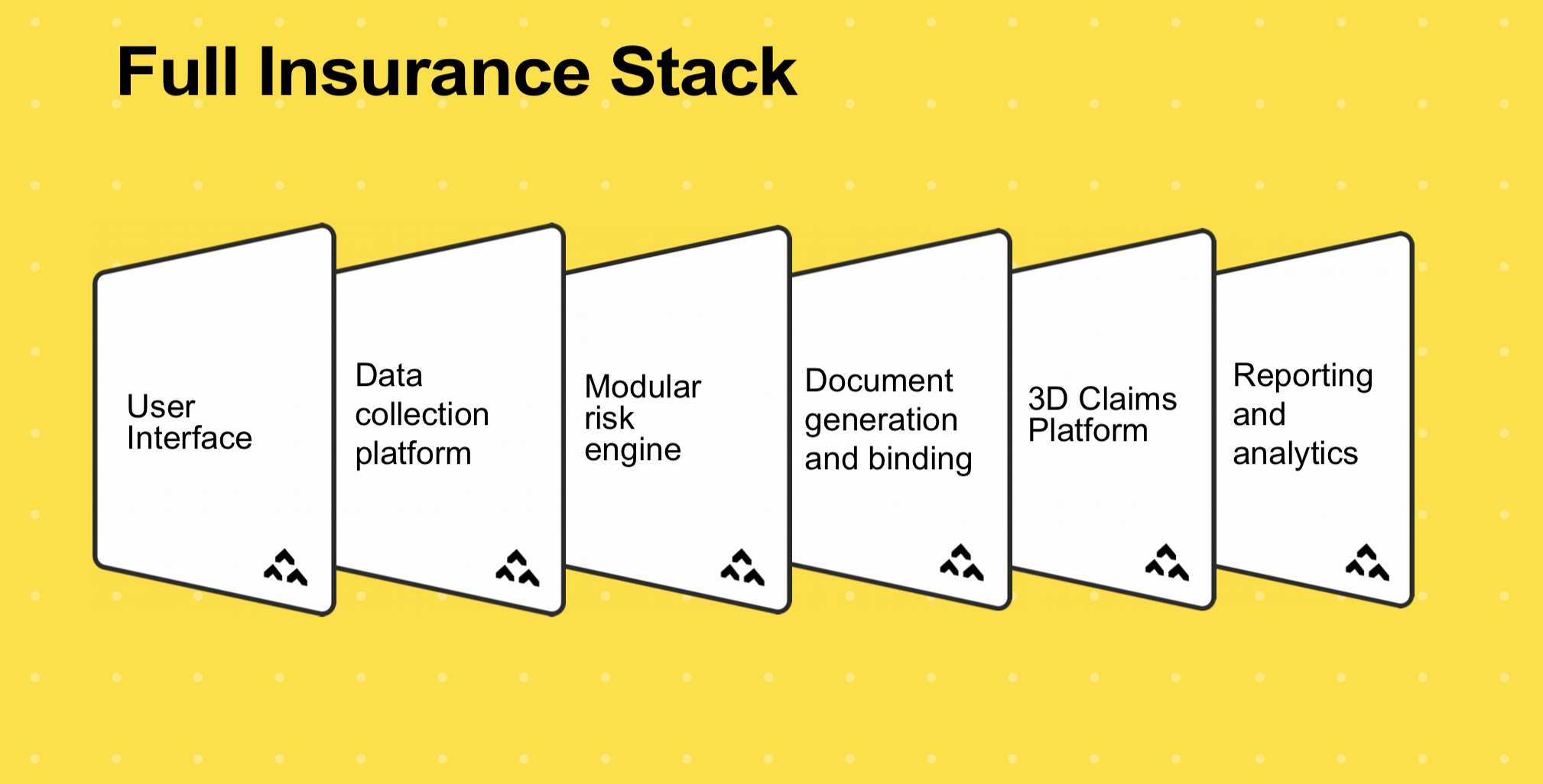

Buzz or so many others. They have built in most cases an end-to-end platform focused on one line of business or one specific product. There is nothing stopping them leveraging this technology for another line. For example, what else could Flock insure that needed: location, real-time pricing, third-party data and much more? You guessed it: anything in the mobility space. And I probably wouldn't limit it there, either. Have a look at the Flock full insurance stack:

My view is that those in Category 3 are more likely to (will need to?) pivot into Category 1 or 2 in the search of scale, unless, of course, the business segment they have gone after is large enough. I would ask: How can I turn my platform and capability to broader and greater use?

Solving business challenges

I see insurers leveraging any number of these platforms depending on what their specific business challenge is to address new market pressures very quickly, whether they want:

- new capability, flexibility and speed (category 1)

- above, plus the ability to test easily in new states/markets (category 2)

- a new specific product/line of business (category 3)

Interestingly, many of these platforms are country-specific or country-focused (not to say they can't work across geographies), a lot of these operating in the individual countries where they started. They are not only cloud-native but are geared up for the API economy. A great example is

CoverGenius, which integrates at the commerce layer, not as an additional task for the customer. (Here is an interview with

Sarah and the team

here.)

There will not be one single platform here. It's great to see insurers leveraging the right one to address the business problem.

New platforms, new challenges

Jump forward five to 10 years, and we may well be back to insurers having more platforms to manage than they currently do, but being less reliant on any single slow old beast. I'd hate to share some of the numbers that I see when it comes to the numbers of PAS platforms in play at most insurers; needless to say, it's never one!

Maybe we'll go full circle and head back to mainframes, but I very much doubt it. My hope and expectation are we get the data right and end up with a beautifully orchestrated ecosystem of capabilities with multiple platforms doing what they do best and meeting specific market demands.

Growing up, what next for the startups

As the startups in Category 3 mature and scale, I see this as a typical sequence of events:

- The early years: As a new startup, most founders I know build their own tech stack, and do a bloody good job of it. They are unbound by legacy, free from data, customers, partners and all the other the things that often get in the way, and give you the benefit of a clean sheet of paper. This is enough to prove the concept, business idea, ability to acquire customers and get the seed/series A round under the belt.

- The growth stage: Companies start to hit scale problems and spend energy on places they can truly differentiate in, not reinventing the wheel.

- Serious player: The company has money, scale and lots of customers and wants to grow exponentially, going multi-country, multi-product and much more. Time to deploy the enterprise big guns and get ready for hyper growth or an exit.

They will likely engage the folks in Category 1 and 2 as they mature, creating a market and ecosystem.

See also: So, You Want to Work With Insurtechs?

Is there space for everyone?

Sadly, probably not. I think we will see a whole host of consolidation, with many of the smaller or local players getting together to build longer runways and greater customer bases and drive scale. They will then face their own challenges in combining platforms and technologies. We have already seen some of this in Germany with the likes of Knip and Komparu in 2017.

A timeless debate

If we were to start the industry today, of course we wouldn't design it the way we did 30 years ago. We didn't have the ability back then to adopt a capability-driven and services-enabled approach to plug the necessary components together easily or swap out capabilities quickly and easily. We simply have a better start point today, and this will no doubt continue to improve.

Insurers of the future will be assembled, not built. New platforms are an essential component in the rapid assembly process.

There are, of course, a whole host of other categories across the entire insurance value chain that insurtech has been addressing. Many of these are incremental and address a specific problem area, whether it's making an efficiency play, helping price better, understanding risk differently, leveraging processing power, aggregating new data sources, addressing fraud, etc. We are merely at the tip of the iceberg still.

I would love your perspectives.

- Are the two approaches correct, and do they make sense (left to right and right to left). Have you seen others?

- Does the categorization of startups feel right in the platform space? Who would you add, and to which category?

- Is my outlook for startups in this space correct?

A little more detail

Category 1 — Instanda, for example, has 45-plus clients, from MGAs to insurers, that it has helped launch propositions and products to market in 8 to 12 weeks each, often less. Like everyone in this space, Instanda is cloud-native, sitting on Microsoft Azure, with the ability to spin up and down in a heartbeat. The screenshot below shows the simple, logical flow a business user can follow to create full insurance products, from rating questions and calculations to documents and endorsements. Adding to this, Instanda will quite happily deal with the first notice of loss (FNOL) phase for claims, passing then on to the client's in-house claims or TPA platform.

A little more detail

Category 1 — Instanda, for example, has 45-plus clients, from MGAs to insurers, that it has helped launch propositions and products to market in 8 to 12 weeks each, often less. Like everyone in this space, Instanda is cloud-native, sitting on Microsoft Azure, with the ability to spin up and down in a heartbeat. The screenshot below shows the simple, logical flow a business user can follow to create full insurance products, from rating questions and calculations to documents and endorsements. Adding to this, Instanda will quite happily deal with the first notice of loss (FNOL) phase for claims, passing then on to the client's in-house claims or TPA platform.

Category 2 — Slice not only has a cloud-based platform with ICS for policy and claims, it has the ability to write business in specific states. Built from the cloud down, Slice is outsourcing the speed-to-market challenge and has some great examples.

Category 2 — Slice not only has a cloud-based platform with ICS for policy and claims, it has the ability to write business in specific states. Built from the cloud down, Slice is outsourcing the speed-to-market challenge and has some great examples.

Category 3 — Finally, these folks have been on their merry way solving very specific challenges, whether it's Laka reinventing the business model while solving cycle insurance, or Flock with its head in the clouds with drone insurance or Canopy for Renters or MyUrbanJungle or Buzz or so many others. They have built in most cases an end-to-end platform focused on one line of business or one specific product. There is nothing stopping them leveraging this technology for another line. For example, what else could Flock insure that needed: location, real-time pricing, third-party data and much more? You guessed it: anything in the mobility space. And I probably wouldn't limit it there, either. Have a look at the Flock full insurance stack:

Category 3 — Finally, these folks have been on their merry way solving very specific challenges, whether it's Laka reinventing the business model while solving cycle insurance, or Flock with its head in the clouds with drone insurance or Canopy for Renters or MyUrbanJungle or Buzz or so many others. They have built in most cases an end-to-end platform focused on one line of business or one specific product. There is nothing stopping them leveraging this technology for another line. For example, what else could Flock insure that needed: location, real-time pricing, third-party data and much more? You guessed it: anything in the mobility space. And I probably wouldn't limit it there, either. Have a look at the Flock full insurance stack:

My view is that those in Category 3 are more likely to (will need to?) pivot into Category 1 or 2 in the search of scale, unless, of course, the business segment they have gone after is large enough. I would ask: How can I turn my platform and capability to broader and greater use?

Solving business challenges

I see insurers leveraging any number of these platforms depending on what their specific business challenge is to address new market pressures very quickly, whether they want:

My view is that those in Category 3 are more likely to (will need to?) pivot into Category 1 or 2 in the search of scale, unless, of course, the business segment they have gone after is large enough. I would ask: How can I turn my platform and capability to broader and greater use?

Solving business challenges

I see insurers leveraging any number of these platforms depending on what their specific business challenge is to address new market pressures very quickly, whether they want: