As consumers, we know that digital has transformed the way we discover, engage and transact with businesses in every industry. From ordering coffee on our mobile devices to running our smart homes on voice-command, we expect all of our experiences to be fast and seamless.

The insurance industry has gone through its own digital transformation over the past five years. With a general acceptance that digital is here to stay, most insurers have incorporated digital into their organizations, implementing ad hoc capabilities to make their business faster and cheaper, creating online tools to further engage their distribution channels, and implementing table stakes technology in areas such as marketing, digital portals, customer self-service capabilities, and automation of some back-end processes.

As we move into 2018, digital is continuing to reshape the way insurers do business. The ecosystem of available capabilities has grown exponentially and industry leaders are starting to leave behind the “fast-follower” mentality, reallocating their investments into core capabilities that give them a more customer-centric view, as well as ways to differentiate themselves in the market.

Industry leaders are starting to leave behind the “fast-follower” mentality, reallocating their investments into core capabilities that give them a more customer-centric view, as well as ways to differentiate themselves in the market.

From our perspective, insurers will take one of two paths:

- Continue as followers, investing in only select digital capabilities that support their existing business model. This is a bottom-up, project-driven approach that identifies select digital capabilities within different parts of the value chain.

- Take a digital-first mindset by better understanding the end-to-end customer experience and how business models need to evolve in order to increase growth and reduce costs. This is a top-down organization transformation with the goal of becoming a digital and data-driven organization which can continuously reassess the business and operating model.

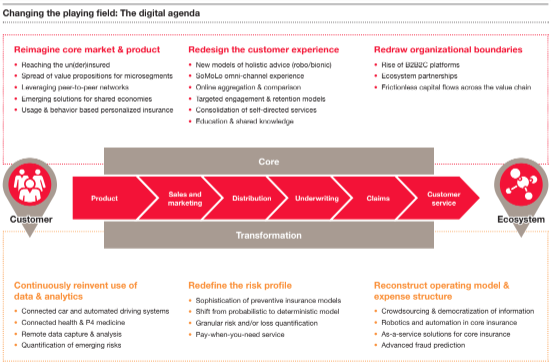

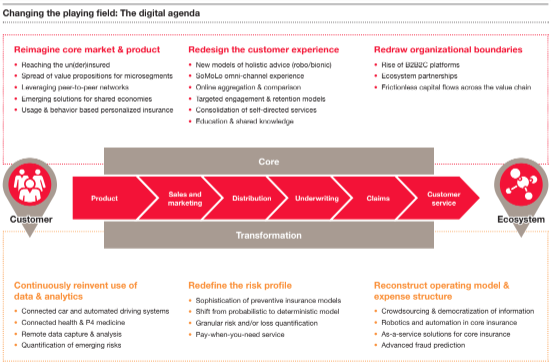

As the graphic opposite illustrates, taking a digital-first approach and synchronizing investments across functions and processes will promote success by enabling a digital strategy that is a “North Star” that guides continuously improvement rather than just a point in time assessment.

See also: Digital Insurance 2.0: Benefits

The companies that develop a meaningful competitive advantage will design and implement digital platforms that can handle disruption and positively change cost structures. They will:

- Build scalable systems, even for niche offerings,

- Deliver an end-to-end customer experience, and

- Change their business models to foster a test and learn environment that helps them improve how they go to market. These leaders will be the most likely to quickly adjust and grow as the industry continues to become more digital.

Building a digital platform

Building a digital platform

Although we tend to understand digital transformation and modernization of technology platforms as sequential, multi-year events with multi-million dollar price tags, finite delivery dates and fixed realization periods, true modernization requires a foundational

shift in the organizational culture, operating model, and underlying architecture that enables business flexibility and agility.

Building a digital platform that will take your company into the future — not just respond to current needs — is critical to prolonged success.

Insurers are currently enabling access to data across various domains and dimensions, but the companies going the extra mile to design a futuristic platform architecture are the most likely to benefit in the long term. Future-oriented platform architectures should be able to:

- Enable more granular services,

- Provide flexibility when reacting to traditional demands and responsiveness to disruptive emerging products,

- Support business models and technology needs beyond now standard core platform capabilities (e.g., policy, billing and claims systems).

- Feature consumer-centric architecture built on the core guiding principles of atomic components and services vs. monolithic applications,

- Enable reusability across constituent groups and processes vs. process-centric solutions,

- Assemble best-of-breed technologies, capabilities, and/or service models vs. being just a broker of services.

Enabling your digital platform

Gone are the days of a simple buy/build/rent conversation where companies could seek to house all capabilities within their own walls. Now, everything from insurtech incubators to white-labelled products are revolutionizing the way insurance is bought and sold. The rise of flexible, digital B2B2C platforms is giving rise to faster, better, and previously unconsidered partnerships across the insurance and retirement spectrum.

Industry leaders are identifying how they can extract value from partnerships in all areas of their organization, whether by providing newer customer engagement models, adding revenue streams, or reducing cost structures, all while building digital ecosystems that can easily integrate with these strategic partners. These partnerships are enabling companies to respond more nimbly to changes in market trends, consumer expectations and nascent technology, creating frictionless capital flows across the value chain.

Better know your customers by serving them better

While many insurers have been actively investing in customer facing digital capabilities for the past several years, the industry as a whole is not yet fully realizing customer and economic value. As insurers continue to respond to constantly evolving customer expectations, a holistic, data-driven approach that drives a detailed understanding of the customer and the contribution of digital initiatives to actual business value will be critical to meaningful ROI.

Developing a detailed understanding of customers and their end-to-end journeys is necessary to improve customer value. Knowing your customers – not just as segments but individuals – will help you pinpoint opportunities and effectively optimize their experience across all channels and throughout their lifetimes. Tying these digital initiatives to measurable business value from the beginning is critical to justifying the case for investment and creating a framework for measuring the effectiveness and impact of various initiatives.

With a strong, flexible framework in place, companies will be able to re-focus time and money into revenue-driving capabilities like external partnerships, invest in data-driven digital capabilities to improve customer value, and build back-end processes to support platform scalability.

Don’t forget about back-end processes

All the recent hype about insurtech and customer interactions has shifted attention away from digital considerations beyond technology and customer experience. However, leading companies’ back-end processes will support a digital environment. In a rapidly advancing industry, the companies out in front are transforming their processes to automate repetitive, business rule-driven work; this is rapidly reducing costs, improving controls, enhancing quality, enabling scalability, and facilitating effective 24/7 service.

Future profitability and ROI hinge on being extremely responsive to business and market conditions and making business processes digital. The market leaders of the future will have fully digitally enabled operating models that feature a low cost profile, increase automation and efficiencies, offer an easy end-user experience. All of this will help them accelerate innovation and invent the future of insurance instead of just reacting to it.

See also: Digital Playbooks for Insurers (Part 1)

Where we’re headed

The world of insurance has already become digital. Whether you are a personal lines insurer assessing digital sales and service platforms or a life insurer trying to understand interactions with your end consumers, most of the industry has adopted digital agendas and many companies are is seriously trying to become digital-first organizations. Current frontrunners are redirecting their roadmaps and investments to high-priority business areas differentiate them in the market.

Over the next five to ten years, all insurers will be able to take advantage of a broader ecosystem of available tools, leveraging test and learn capabilities that promote innovate in an industry that has not been reinvented for quite some time. Anyone still waiting on the sidelines is in jeopardy of falling so far behind recovery will be extremely difficult. Don’t blink and miss your chance.

Most of the insurance industry has adopted digital agendas and many companies are seriously trying to become digital-first organizations. If you aren’t doing the latter, you risk falling behind; if you haven’t done the former, you may never catch up.

Implications

- Industry leaders are starting to leave behind the “follower” mentality, reallocating their investments into core capabilities that give them a more customer-centric view, as well as ways to differentiate themselves in the market. Whether you are a “fast- follower” (as opposed to just a follower) or a market innovator, you are likely to share essentially the same approach to establishing an agile organization.

- The companies that develop a meaningful competitive advantage will design and implement digital platforms that can handle disruption. They will build scalable systems, deliver an end-to-end customer experience, and change their business models to foster a test and learn environment that helps them improve how they go to market. These leaders will be the most likely to quickly adjust and grow as the industry continues to become more digital.

- With a strong, flexible framework in place, companies will be able to re-focus time and money into revenue-driving capabilities like external partnerships, invest in data-driven digital capabilities to improve customer value, and build back-end processes to support platform scalability.

This article was written by Jamie Yoder, Tom Kavanaugh, Juneen Belknap and Alex Jaeger. Building a digital platform

Although we tend to understand digital transformation and modernization of technology platforms as sequential, multi-year events with multi-million dollar price tags, finite delivery dates and fixed realization periods, true modernization requires a foundational

shift in the organizational culture, operating model, and underlying architecture that enables business flexibility and agility.

Building a digital platform that will take your company into the future — not just respond to current needs — is critical to prolonged success.

Insurers are currently enabling access to data across various domains and dimensions, but the companies going the extra mile to design a futuristic platform architecture are the most likely to benefit in the long term. Future-oriented platform architectures should be able to:

Building a digital platform

Although we tend to understand digital transformation and modernization of technology platforms as sequential, multi-year events with multi-million dollar price tags, finite delivery dates and fixed realization periods, true modernization requires a foundational

shift in the organizational culture, operating model, and underlying architecture that enables business flexibility and agility.

Building a digital platform that will take your company into the future — not just respond to current needs — is critical to prolonged success.

Insurers are currently enabling access to data across various domains and dimensions, but the companies going the extra mile to design a futuristic platform architecture are the most likely to benefit in the long term. Future-oriented platform architectures should be able to: