The world has entered recession and is witnessing a paradigm shift in how we interact with each other and how businesses operate with the massive #stayhome and social isolation campaigns.

We are looking into a New Normal – a VUCAV world (VUCA+Virtual), where companies and people must interact virtually and in an environment with high rates of unemployment and financial crisis.

Insurers need to prepare for this. They need to radically change the ways they think of interacting with the customers and how they manage their processes internally. If not, they won't stay relevant in the New Normal.

This whitepaper explores how insurers can reinvent themselves as virtual and create an insurer ready for success in the New Normal

COVID-19 has left the world in uncharted waters and in many areas forced a digital acceleration of companies’ product and service delivery processes and distribution channels.

The massive #stayhome efforts have fueled this further with virtual meetings and digital ways of collaborating – the methods and tools used are not new, the massive scale of which they’re used is.

We’re witnessing what can be best described as a paradigm shift – our old ways of working, our beliefs of what’s possible to do digitally and the conviction of some meetings require physical presence are no longer the way we work. We are all virtual.

This has massive implications for almost all industries, and one of the more exposed industries is the insurance industry. Famously known as rigid and lacking behind digital development, a whole industry is now forced to face digital – immediately.

Facing digital right now is one thing; preparing for what’s post-COVID is another. When the virus has been contained, the world will slowly gravitate back to a new equilibrium, a New Normal.

It’s extremely important to realize that we will not be returning to a state like what was before the outbreak – too many things have changed permanently for us and the world to return to what was before. We must prepare for the New Normal.

The New Normal's effects, broad and wide

We’ve already entered a world-wide recession; this is not a new situation, and usually governments have financial instruments to minimize the impact of the falling economic growth, typically stimulants for organizations making it easier to run and grow businesses – but as long as there is no one to run the business, as we’re all staying home, these instruments will have less effect than normal.

At the time of writing, the world is yet to see the full effect of layoffs across all industries and sectors, which will only add to the extent of the recession – the massive layoffs will most likely result in wide-spread depression among people, as there will be extreme competition for the jobs available, and many will see their ability to support their families seriously challenged.

Staying home, doing business, has forced us all to go digital. This has developed our virtual meeting skills and our online shopping savvy and forced us to be used to handle our daily tasks and administration work online – we’re looking at a seismic shift of everyone’s readiness for digital products, services and ways of doing business.

The virtualization of the way we live, work, shop and interact directly affects the future demand for products and services, and people skills and competencies – we will see jobs, products and competencies becoming obsolete as the virtual ways no longer require them. As a result, both companies and people will need to redefine who they are and what they offer.

Just think of 3D printing; when physical distribution is cumbersome, why don’t we just download the specifications for what we need and print it ourselves? That’s how they get spare parts to the International Space Station, so it’s here already.

See also: 10 Moments of Truth From COVID-19

The insurance customer is no longer the customer the industry has been used to. Customers have been forced to manage their transactions from home by themselves, or with minimal support from virtual agents (brokers, call centers, etc.) – and because they’ve also been forced to meet their friends and families online, as well as doing all their shopping virtually, they have become used to it.

Their – and our – virtual habits have changed profoundly, so companies must adapt to serving customers virtually. Now and post-crisis.

This obviously has significant implications for most insurers, as they have to rethink their digital products, services and distribution channels. The majority of insurers are working on these elements, but few are ready to deliver a complete virtual customer product and service offering. Even fewer are ready to do so in the current environment.

Responding to a VUCAV world

Insurers must find a path forward if they wish to stay (become?) relevant in a New Normal post COVID-19. The path must deliver products and services in a virtual setting and be capable of running large parts of their operations virtual as well – all this at lower costs than today.

Navigating a company in the "old" VUCA world was complex enough, with new business models emerging, constantly shifting consumer trends and unstable economies and political environments around the world.

Adding the virtual element to the VUCA world, VUCAV, complicates the matter, but this is the New Normal so insurers – and all other firms for that matter – must accept it and act on it.

Failure to do so will put the company at risk of going out of business.

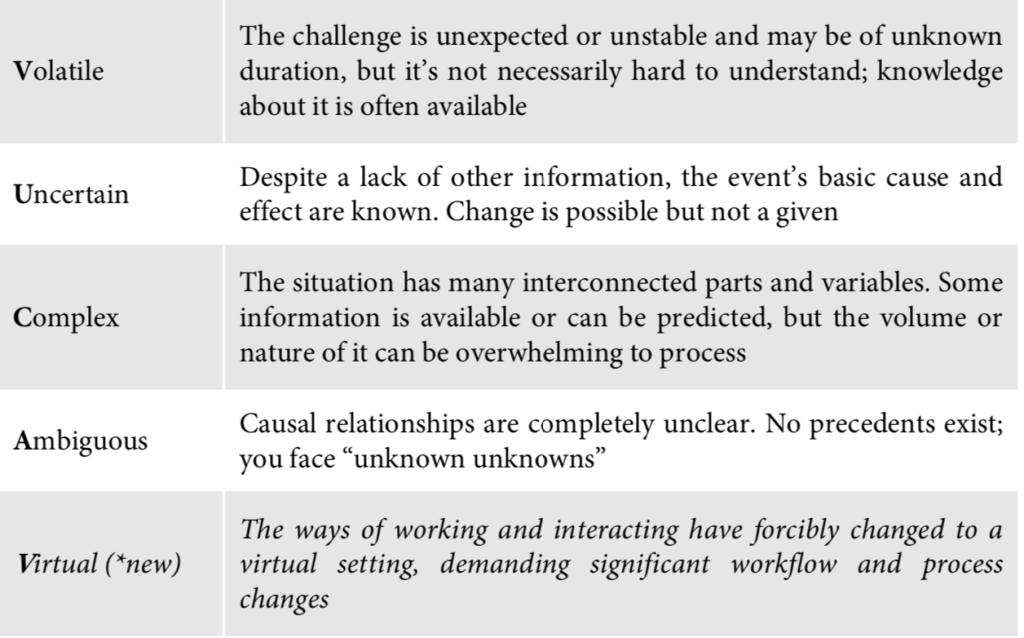

Source: Own development and Harvard Business Review January-February 2014

The virtual insurer – Phoenix rising

The basic foundation for building a virtual insurer – or transforming an incumbent to a resilient and competitive company – builds on a set of guiding principles. Key principles – the foundation:

Minimize fixed costs

A vital part of creating a resilient company is to reduce the fixed costs to an absolute minimum, as this will provide the firm with greater flexibility to adjust and adapt to sudden changes in the market conditions.

Fixed costs such as long-term rent agreements, permanent employees and capital investments will stay in the balance sheets for a long time and reduce the financial flexibility of the insurer.

Future investments should therefore be seen in the above light, keeping long-term obligations at an absolute minimum, and the current fixed assets as well as permanent staff should be analyzed to gain a better understanding of how to increase financial flexibility.

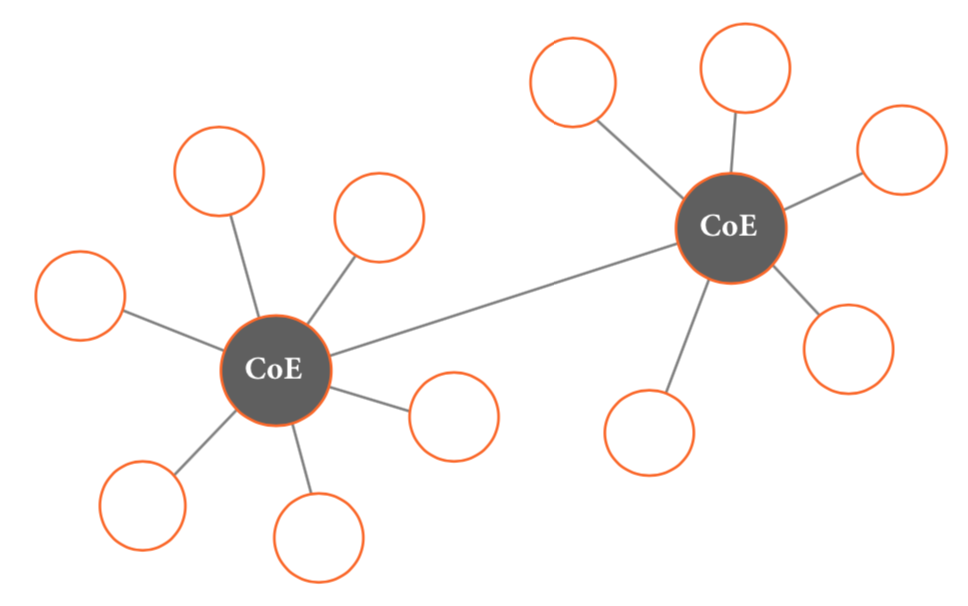

A way of increasing flexibility in the workforce is to create centers of excellence within the company, all leading external teams of experts within specific fields, but outside the core competences of the insurer.

This will ensure that key intellectual property is kept at the insurer while specific, more generic tasks and work is outsourced on flexible engagement contracts, allowing the company to scale up or down as required.

Think of permanent staff as the organization’s nerve centers, coordinating all vital functions with external teams.

Maximize virtual

Following the reduction of fixed assets and permanent employees is an increased need for remote work and business development, which is also a consequence of the COVID-19 crisis and a part of the New Normal, where the world has been forced to manage most of their daily tasks virtually.

A key principle for the virtual insurer is therefore to ensure that virtual is permeating all units, processes and systems of the company, including the more difficult tasks of establishing new business between new partners remotely – apart from being a necessity at the moment, this also drastically improves the insurers’ responsiveness in the New Normal.

It does require a continued reskilling of the workforce (and partners) to better deal with being virtual and having more difficult meetings virtually, too – it used to be common practice that tough negotiations and difficult employee talks required physical meetings.

The virtual organization will increase overall speed, as meetings can be held instantly with no transportation required – it’s a more effective way of working and meeting.

Eliminate resource trapping

Resource trapping is what happens when resources are assigned to specific projects in an organization and stay within the unit even after the project has finished. They stay as there are still tasks related to the project, so there’s still a job for the resource to work on, maybe not full time, but there is no real value-add anymore.

As business unit leaders typically are reluctant to give up resources within their organization, there’s little incentive for the unit to free the resource, so the resource is trapped within the unit.

This drains resources, or adds resources unnecessarily, and slows the overall performance and flexibility of the organization. It must be avoided when creating a resilient, virtual insurer prepared to tackle a VUCAV world.

It is therefore vital that being aware of, and eliminating, resource trapping is a key principle to follow when creating a virtual insurer to avoid inflexible costs that are difficult to adjust to market changes.

See also: COVID-19: Moral Imperative for the Insurance Industry

Process alignment – enabling the business

While the key principles should be the building blocks of the virtual insurer, following these only will not create the agile and fast-moving virtual entity required for successful navigation in a VUCAV world. Creating a responsive organization requires alignment and digitization of the processes and workstreams in the company.

As-is versus to-be

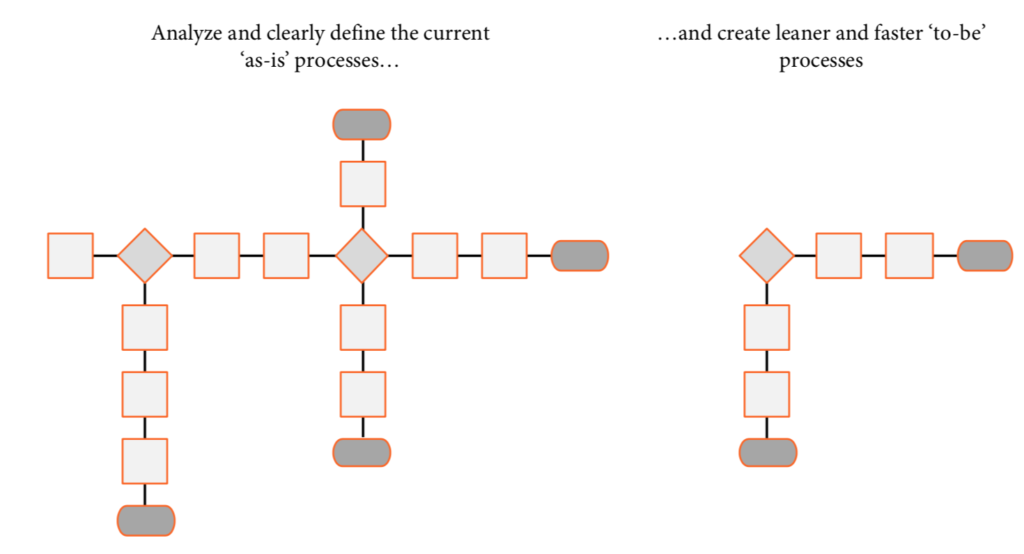

There’s a clear need for introducing new ways of working, heavily supported by technology. This is most often done by mapping out all the current (critical) processes in the organization, bearing in mind that a critical process can be anything from a customer support process to a small, internal process that significantly impedes the daily workflow.

Based on this mapping, the teams will work together to draw out the new, "to-be" processes focusing on how to make this adjusted process as fast and smooth as possible, both for the users of the process and for the customers (which can be internal or external customers).

When implementing the to-be processes, it’s imperative that the processes are digitized to the maximum extent possible. Use digital workflow tools and electronic signatures to ensure a virtual workflow – do not let connection issues to legacy database systems stop this process. Move fast and efficiently.

Think robots, think artificial intelligence

The process optimization work will identify tasks or work streams that for all practical purposes can only be done manually. However, it’s important to analyze to what extent these manual processes are repetitive as repetitive work streams can be outsourced to robots and hence completed faster and much more cheaply as part of the new to-be process.

Deploying robots to handle manual workstreams makes the processes more effective and faster, but the nature of implementing robot process automation will require a clearly defined and documented process, that further improves the overall process sturdiness.

Processes requiring specific knowledge, for example underwriting, should also be looked at, as even underwriting can be automated to a certain extent. Underwriters are already setting the premiums based on formulas, and it’s worth analyzing to what extent it’s possible to automate this process, as well.

If artificial intelligence (AI) – or machine learning – is made part of the (new) underwriting processes, the systems will learn underwriting criteria by themselves and over time become capable of automating more and more increasingly advanced underwriting processes.

Aside from underwriting and process optimization, artificial intelligence can be used to predict changes in consumer behavior early, enabling the virtual insurer to react fast and be ready for the changes even before they are happening.

Working extensively with external partners can further be improved by AI with respect to resource allocation – this would typically be assigning resources in call centers and shared services such as finance, administration and claims management.

In short, adding artificial intelligence greatly improves the insurer’s innovation capabilities, helps optimize operations and greatly support the company in becoming truly virtual.

New ways of working

It should follow from the discussion so far that a virtual insurer requires new ways of working; employees have to get used to working virtually, and performance management systems have to be rewritten too.

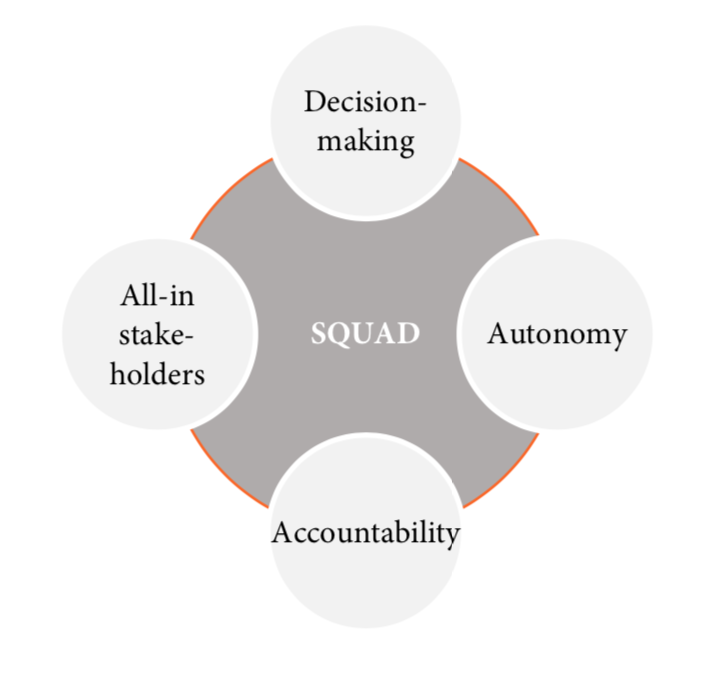

Implementing the agile methodology in managing the workstreams and projects significantly increases the flexibility of the company, as the working squads will work independently and autonomously toward their set targets, reducing the need for daily alignment and control.

A project squad can be likened with a holistic, autonomous project team in the sense that the squad represents everything that is required to secure proper project progress.

The squad is created as a competent unit, capable of making the required decisions to move forward. This significantly reduces outside dependencies and speeds up the administration parts of the project.

Of course, some decisions like major purchases or changes that involve other parts of the organization or customers/partners, cannot be expected to be taken within the squad – in these cases, the squad completes all necessary preparations for approvals to move ahead, so, once the changes are submitted for approval, there should be no iterations.

The squads work best when they are assigned ownership and not tasks – empower the teams to take full ownership and control of the project.

The right tech architecture

Very few, if any, incumbent companies have the luxury of being able to start all over building their tech architecture – most are to some extent still dependent on legacy IT systems that are very complex to adapt and adjust to changing internal and external requirements. This has historically been the single-most influencing factor stopping insurers – and others – developing digital products and services.

In the New Normal, it is necessary to have a tech architecture that can cope with rapid deployments of changes to both internal and external systems – changes in consumer behavior must be dealt with quickly, and new and smarter processes should be implemented immediately.

Replacing the existing systems will for almost everyone be impossible – it would be too expensive and too time-consuming, and the company risks operating at significantly lower efficiency while the changes are going on.

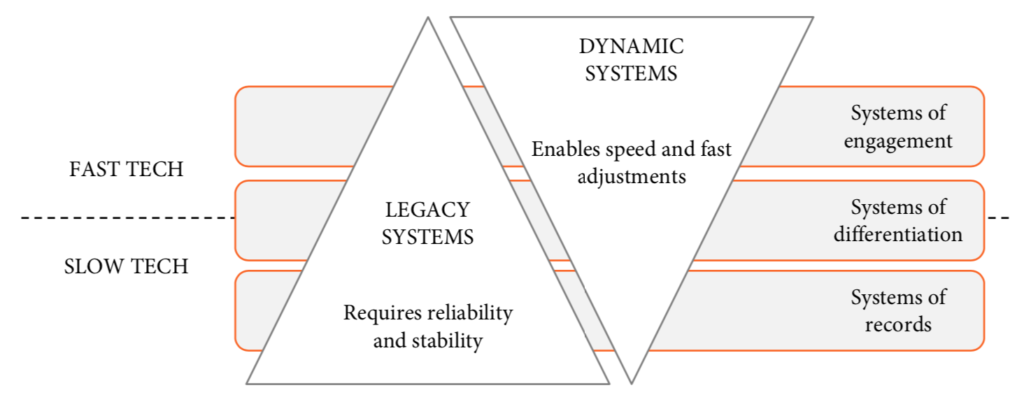

Gartner introduced the notion of pace-layered architecture that was later dubbed "two-speed IT," illustrating how legacy IT systems can work with new, fast-paced development without losing what is core to the business; the transactional data.

It is possible to expand an existing tech architecture to support two-speed IT, which will greatly improve the virtual insurer’s ability to act fast on market changes.

Build vs. buy

When expanding the tech architecture, the important questions of build vs. buy comes up, aiming at whether the company should build the applications in-house or buy ready-made software solutions. The discussion typically revolves around application customization vs. price vs. implementation time.

For a virtual, flexible and agile insurer, there should be no doubt that standard solutions, ready to implement, are the right way forward in almost all instances. However, it is necessary to define the market positioning of the virtual insurer first, so the tech architecture can be designed to create a competitive advantage in the selected market and customer segment.

The buy vs. build depends on where the layer of differentiation is chosen to be, and most practices would suggest that the core differentiation should be built to keep the intellectual property in-house.

But differentiation can also be in the way standard software applications are connected. No matter what, it’s important that the areas of differentiation are decided so the new tech architecture can be built to accommodate that. Examples of differentiation can be within:

- Underwriting, bundling of products, special covers or terms and conditions, segment-based pricing, etc.

- Customer experience, ease of buying, embedded in other products (part of a TV price, travel tickets, etc.) or simple claims processes, etc.

- Products/services

- And much more. Bear in mind that even areas of differentiation aren’t guaranteed to last long in the New Normal, so the tech architecture must be structured in a way that makes it possible to rearrange the technical building blocks very easily.

Thoughts on virtual organization

Carrying on the discussion on building the virtual insurer with agile teams and avoiding resource trapping, an organization operating in the New Normal, VUCAV world should avoid the traditional silo structure, as this traditionally hinders fast decision making and reduces the organization’s overall readiness and preparedness for change.

Instead, the virtual company should structure itself around teams, all (most) created for specific priorities, as this will ensure a constant focus on what’s important right now and avoid the building of siloes and internal kingdoms. These teams mostly will be staffed with permanent employees and will also be responsible for managing the outsourced and shared services discussed earlier.

The teams – and the organization – should embrace the principles from Peter Senge’s Learning Organization with a specific focus on a shared vision and personal mastery.

The shared vision supports the agile teams by setting a North Star for the company as a whole, that all agile squads should calibrate their individual goals toward – this creates consistency and unison in the virtual company’s ways of working.

The New Normal and the need for navigating in a VUCAV world requires a new skill set and competencies for employees to perform optimally – it is therefore vital that the organization provides tool and support for the employees to reskill themselves and build the competencies and knowledge required for personal mastery of their tasks.

Key areas of personal reskilling worth highlighting include:

- Ability to work effectively virtually – including staying mentally and physically fit

- Extreme adaptational skills – ready to adjust and adapt to changing job tasks and environments

- Tech savvy – a virtual company requires virtual and digital competent employees

- Skilled in digital conflict management – virtual meetings are a common part of the New Normal, so even tough talks must be mastered virtually

From a management perspective, it’s imperative that all teams are working as autonomously as possible with a maximum amount if authority. This will ensure employee commitment and process ownership, which will greatly improve the overall team – and hence organizational – flexibility.

There’s no doubt that insurers – and most other companies, for that matter – are facing a series of very difficult and tough choices around cost optimization, reorganization and how to design the company of the future. And there are no shortcuts. It’s difficult and hard work all the way.

Nevertheless, it is hard work that has to be done. Now. The consequences of not acting now will be fatal.

Stay safe, and good luck.