We have

previously evaluated and discussed the financial performance and operating results of the insurtech trio Lemonade, Root and Metromile. Based on the analysis of the last available data, we think that:

- There is a pricing war

- The trio is missing an edge and story with respect to gaining a sustainable competitive advantage

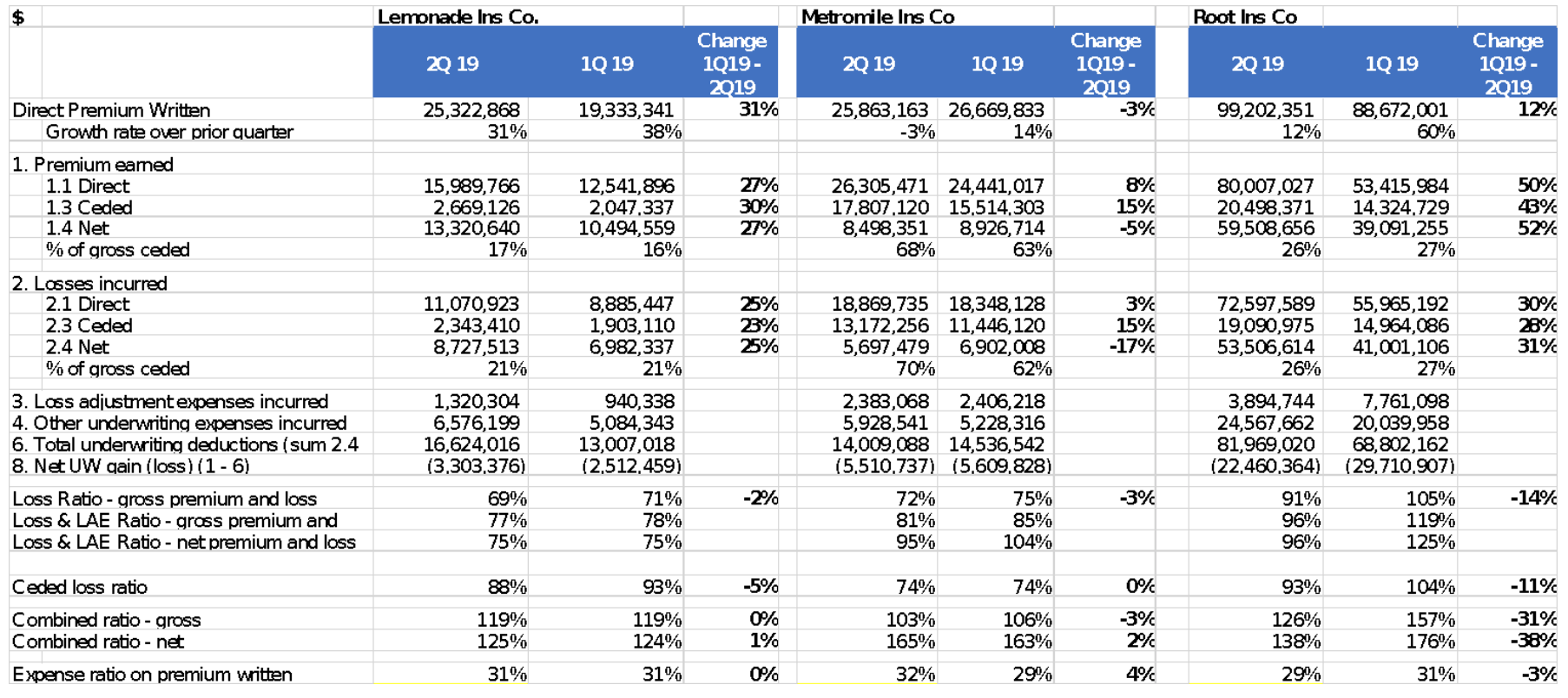

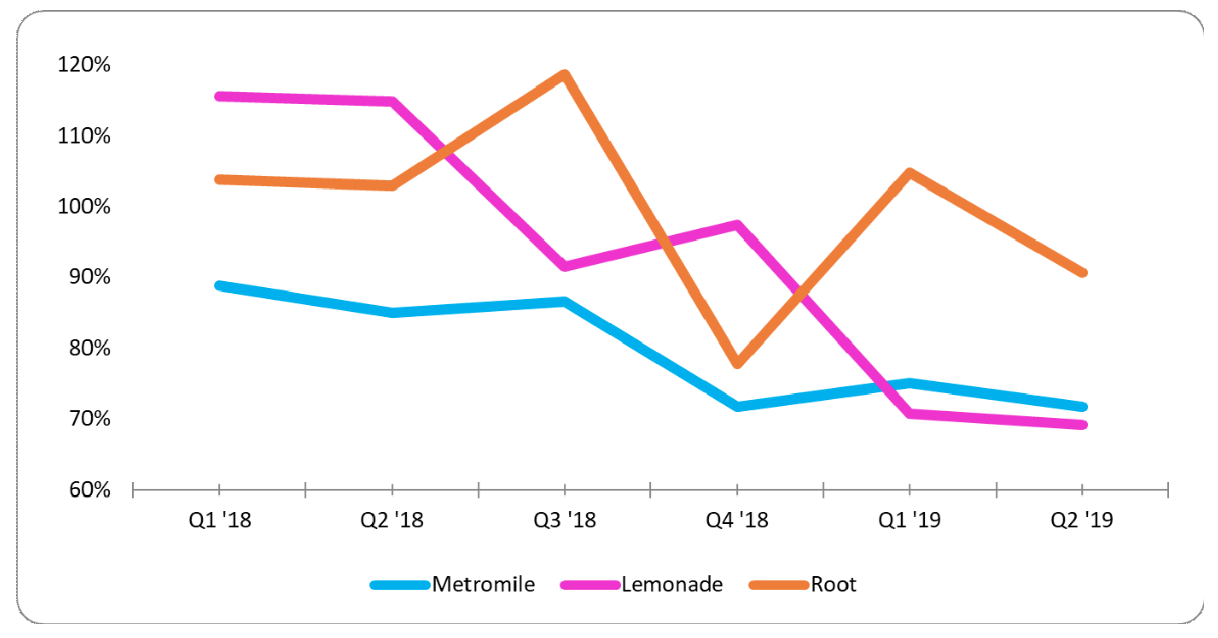

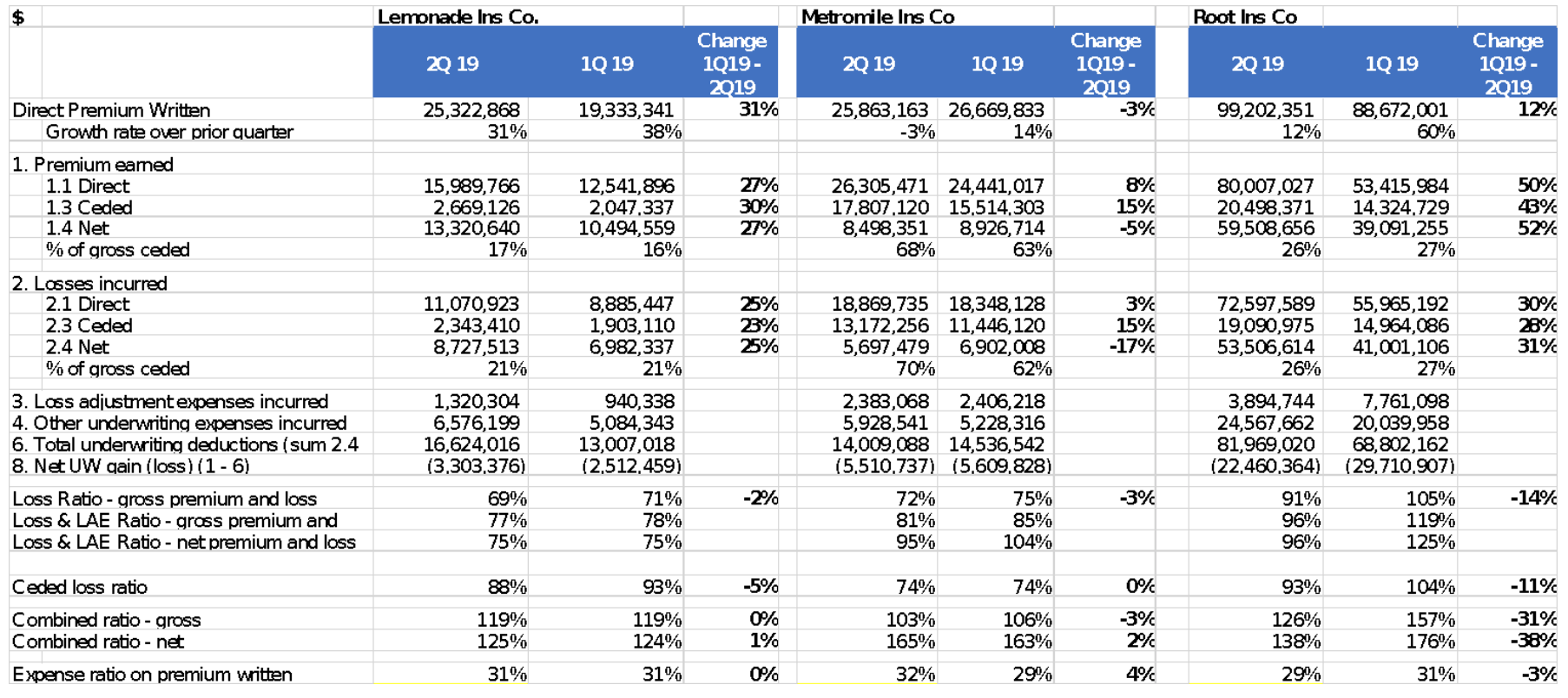

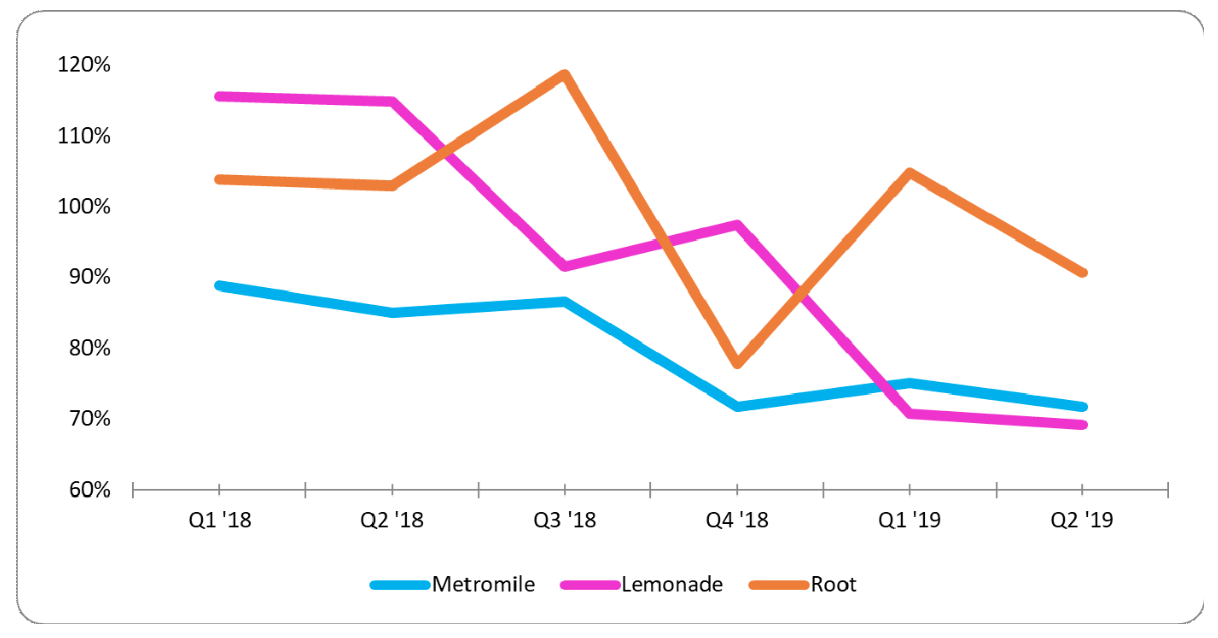

At first glance, it appears that all three firms are focusing heavily on containing and improving their loss ratios. Metromile and Lemonade continue to have a relatively stable loss ratio, while Root has drastically improved compared with the prior quarter. At 91%, Root delivered a better result compared with the 105% in Q1-19 but still has some distance to go before getting closer to Lemonade or Metromile in terms of quality performance.

Note: The expenses ratios are not significant because part of the expenses are paid by the parent companies and not reported on the Yellow Books.

There is a pricing war

Note: The expenses ratios are not significant because part of the expenses are paid by the parent companies and not reported on the Yellow Books.

There is a pricing war

We believe the insurtech trio is facing a pricing war. We find three data points in support of this view:

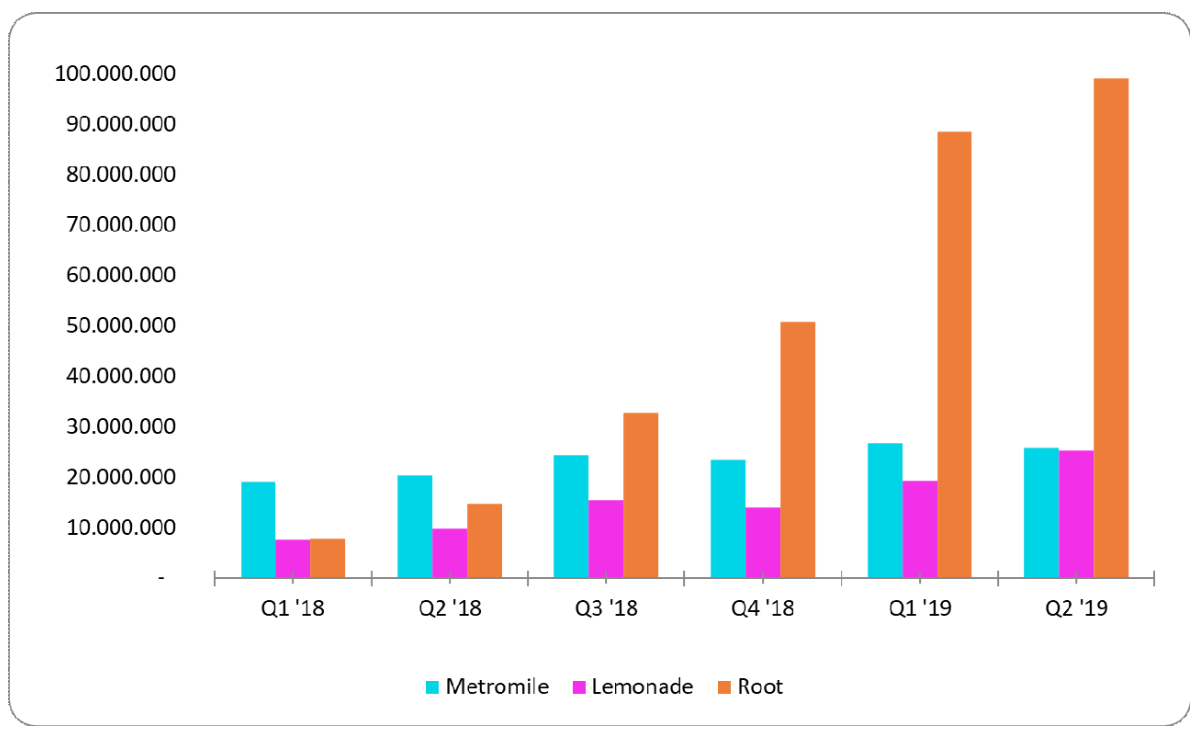

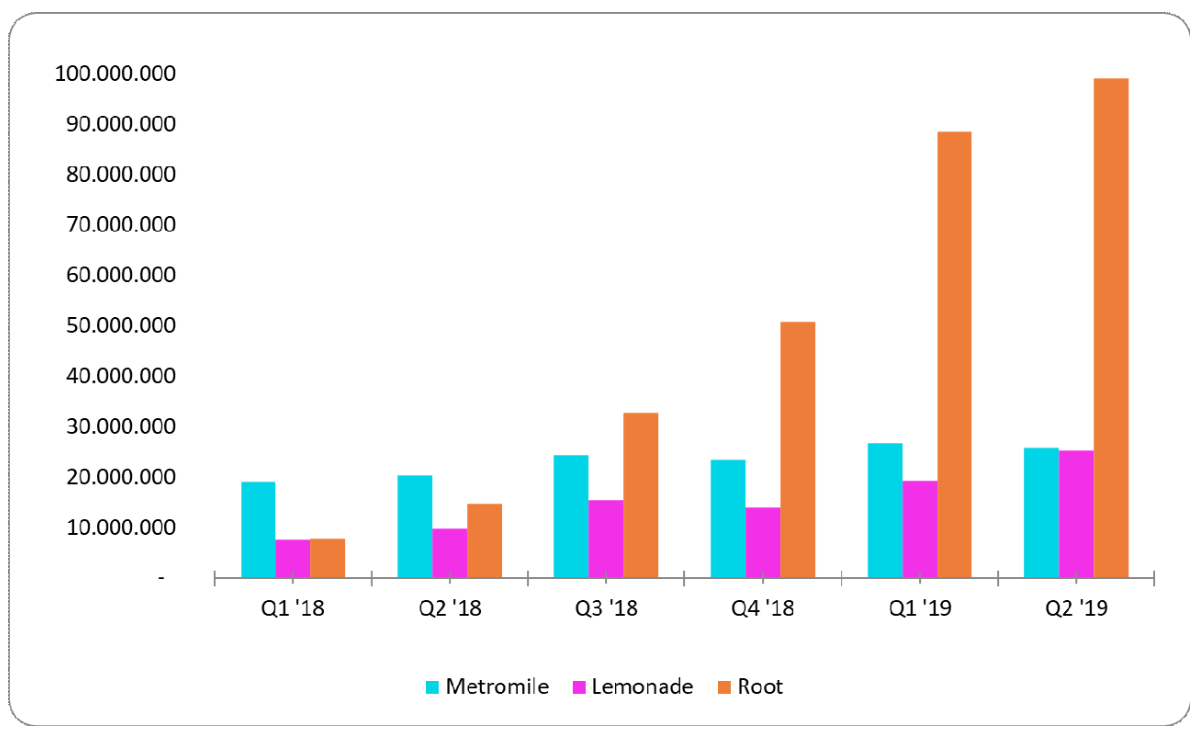

- Viewed through the lens of growth rate, after a robust Q1-19 for all three players, Q2-19 presents a different story. We find the most interesting perspective by looking at the performance over the last year and half. Clearly, the premium evolution of Metromile is the less exciting story, as I previously wrote. The pay per mile doesn’t seem particularly effective in attracting customers. The “pay per mile” model introduces an element of uncertainty for segments of customers who want to save money and know what insurance coverage will cost them. The only comfortable customers are those who almost never use a car. (We will cover the customer experience and expectations for usage-based insurance in future articles.)

- Lemonade has shown consistent growth in the last two quarters and appears to be on target to meet the $100 million annual revenue target. This revenue target is a far cry from the “massive disruption effect” that was expected during its debut. The revenue curve is not yet showing the vaunted hockey stick.

- Root is the only of these three players with exponential growth in revenue. However, something happened in the second quarter, and growth slowed significantly as the loss ratio improved. As mentioned in our last article, insurtech D2C seems to be a “price game.”

Let’s go back to look at the top-line numbers. Root and Lemonade registered a net increase in direct premium written compared with Q1-19. Metromile, on the other hand, registered a marginally lower DPW than in Q1-19.

Having looked at the top line, let’s switch our attention to the loss ratios. For an insurance carrier, the loss ratio is really the litmus test that assesses the strength and quality of the top-line numbers. Loss ratio is a fundamental insurance number, and the fact that all three players have improved this crucial metric is a sign of increased maturity for the “not so” fast-growing trio.

All three improved compared with the prior quarter. This bodes well for the trio. Of the three, Root continues to have the highest loss ratio at 91%, suggesting that between new sales and renewal it is still under-pricing risks.

See also: An Insurance Policy With Some ‘Magic’

The Q2-19 loss ratios are significantly better than what the three firms exhibited in Q2 of 2018, when Lemonade had a loss ratio of 120%, Metromile was at 95% and Root at 112%. The loss ratios are still far higher than the

respective market segments.

Missing an edge and story with respect to gaining a sustainable competitive advantage

Missing an edge and story with respect to gaining a sustainable competitive advantage

In

our last article talking about insurtech direct-to-consumer (DTC) as a “price game,” we highlighted how the companies have not been able to make customers fall in love with anything other than “saving money.”

We would like to share some thoughts on the business models of these three full-stack carriers, investigating where and how their approaches might both enable and impede them in terms of gaining a sustainable competitive advantage. What might be the proverbial sling that the “insurtech Davids” can use against the entrenched Goliaths of State Farm, Geico, Progressive, Allstate, et al? Let’s explore.

If we consider the economics of an insurer, there are three areas where you can obtain a competitive advantage that can allow financing this kind of “pricing war”:

- Investment income

- The loss ratio

- The administrative expenses

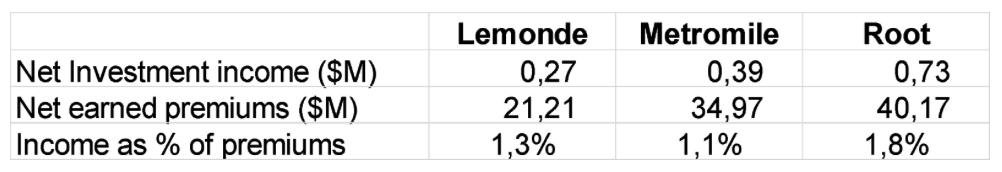

Investment income

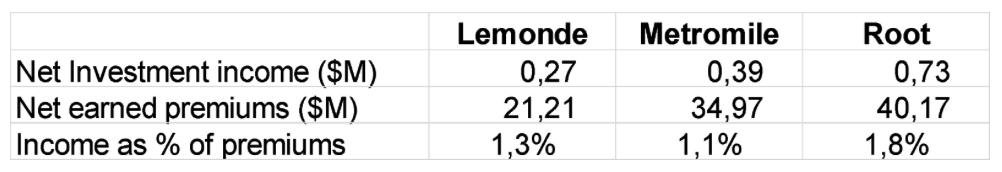

Investment income even in the current market conditions characterized by low interest rates represents the main source of profit for U.S. P&C insurers. A

recent report by Credit Suisse has pointed out how, “over the last five years, approximately 90% of the industry’s profits have been generated from the investment income (float) component of the income statement.” In 2018, U.S. P&C insurers generated

$53 billion net investment income, which accounts for 8.6% on the premium written. Well, all three insurtech carriers were far from this investment performance in the same period.

Probably, hidden in the parent companies income statements, there is some additional investment income obtained investing the cash received by their investors.

However - as of today - the return obtained investing the floating is clearly a competitive disadvantage for the insurtech players.

Loss ratio

As explained in a

previous article, the loss ratio is the key measure of the technical profitability of an insurance business . The U.S. P&C market showed

$366 billion net losses incurred, which means almost 61% loss ratio (net of loss adjustment expenses). Can any insurtech element allow Metromile, Root or Lemonade to have a competitive advantage on the loss ratio?

Metromile and Root are telematics-based auto insurers. Matteo is a fan of the usage of telematics data on the auto business and an evangelist of these approaches through his

IoT Insurance Observatory, an international think tank that has aggregated almost 60 Insurers, reinsurers and tech players between North America and Europe.

Based on the Observatory research, four value creation levers have been the most relevant in telematics success stories:

- The telematics approach has demonstrated around the world a consistent ability to self-select risks. Simply said, bad drivers don’t want to be monitored;

- Some players such as UnipolSai and Groupama have achieved material results by improving claims management through telematics data;

- Some other players have been able to change drivers’ behaviors, e.g., the South African Discovery and the American Allstate;

- Many players have been able to charge fees to customers for telematics-based services, providing a revenue stream.

Metromile and Root are mainly using telematics for pricing purposes. Root is currently using a try-before-you-buy approach that allows potential customers to generate a driving score in a couple of weeks and obtain a tailored quotation. If consumers buy the policy proposed by Root, they will not be monitored anymore. This usage of a driving score at the underwriting stage could represent a way to price better the risk (if the price is settled at the right level), but the absence of further telematics data doesn’t allow Root to extract any value from the value creation levers above mentioned.

By contrast, the Metromile pay-per-mile approach is constantly monitoring the driver for the duration of the policy, which is the necessary foundation for those telematics value creation levers. As of today, the only area where Metromile seems to exploit the value of telematics data is

claims management. The biggest limit for Metromile seems to be the nature of the pay-per-mile business, which has found only a limited market fit (niche nature of the mileage-based approach).

So, we think that both the players are still far from telematics best practices, currently represented by a few incumbents. However, the evolution of their telematics approaches can generate some competitive advantages against many incumbents that are less advanced.

About the possible capability of Lemonade to generate a better loss ratio than other renter insurers, the game is around its famous focus on behavioral economics and the attempt to influence behaviors with the iconic giveback. Everyone (among insurance executives) remembers Lemonade for the fixed percentage of premium it charges —

the iconic slice of pizza — while all the rest is used to ensure the company will always pay claims; whatever is left goes to charities. As of today, nothing in the loss ratio shows benefits from this approach. Would you avoid submitting a claim or resisting the urge to file an inflated claim (an unfortunate reality in our industry) because “whatever is left goes to charities.” We find it hard to believe that the fundamental economic incentives will move from individual gain to community gain. Ancient Latins were saying

homo homini lupus. (Man is wolf to man.)

Moreover,

a recent comment by Lemonade CEO Dan Schrieber suggests that “AI may have played a role in higher loss ratios.” The increase of straight-through processing combined with a vast reduction or elimination of legacy checks and balances can increase the risk of fraud. Sri and his team at

Camino Ventures, an AI/ML fintech, believe that this is a natural phenomenon with respect to AI/ML adoption. Ilich Martinez, co-founder and CEO at Camino Ventures, says, “Companies need to take a holistic view of AI/ML integration into business processes and business rules. Piecemeal or spotty inclusion of advanced AI/ML capabilities can be akin to installing a Tesla induction motor on a gas guzzler. It simply does not work.”

Sri expects to see a spurt in fraudulent claims in certain domains where autonomous claims management is introduced or expanded. As bad actors try to game the system, it is imperative that insurance companies expand the fraud detection models and be willing to enter a phase of continuous and strenuous test-and-learns. Eventually, usage of AI/ML can be crucial to achieving better administrative cost positions, but the path to that destination will not likely be a straight line.

See also: The Dazzling Journey for Insurance IoT

Administrative costs

The U.S. P&C markets

showed costs that represent 37% of the written premiums on 2018 (of which 10% was loss adjustment expenses). Unfortunately, we are not able to see any more the real costs of Root and Lemonade; part of the costs are on the income statement of their parent companies, and we can only enjoy the results of their goal-seek. Efficiency – if it will ever be achieved by these insurtech startups -- can be a way to compete and to sustain a pricing war, but the scale matters.

We ask whether the AI-driven approach of a player such as Lemonade will become a key competitive advantage against the current established incumbents. Can an early, extensive and immersive adoption of AI/ML provide insurtechs a competitive edge? Will incumbent leaders be fast followers or late adopters in a domain as critical as AI/ML?

We are already seeing the incumbents make early and deliberate moves to gain an AI/ML capability advantage. From domains like telematics to computer-vision-enabled image processing for claims, we see the Goliaths not waiting to be left behind. They are quickly moving from a “test and learn” approach to wide-scale adoption of numerous AI/ML capabilities and are finding early success. This adoption is accelerated by nimble, agile fintech and insurtech enablers like Camino Ventures that help industry leaders quickly move from opportunity to outcomes. Given these market conditions, we believe that advanced AI/ML capabilities would give insurtech an edge only against incumbents that are less focused, capable or invested in integrating insurtech solutions into their value chain.

*****

We believe the current business models are not yet showing any clear competitive advantages that can make the pricing war sustainable for the three full-stack insurtech carriers. However, they have a lot of cash combined with highly talented teams that can experiment and find new ways to build moats and forts to gain competitive advantages.

Note: The expenses ratios are not significant because part of the expenses are paid by the parent companies and not reported on the Yellow Books.

There is a pricing war

We believe the insurtech trio is facing a pricing war. We find three data points in support of this view:

Note: The expenses ratios are not significant because part of the expenses are paid by the parent companies and not reported on the Yellow Books.

There is a pricing war

We believe the insurtech trio is facing a pricing war. We find three data points in support of this view:

Having looked at the top line, let’s switch our attention to the loss ratios. For an insurance carrier, the loss ratio is really the litmus test that assesses the strength and quality of the top-line numbers. Loss ratio is a fundamental insurance number, and the fact that all three players have improved this crucial metric is a sign of increased maturity for the “not so” fast-growing trio.

All three improved compared with the prior quarter. This bodes well for the trio. Of the three, Root continues to have the highest loss ratio at 91%, suggesting that between new sales and renewal it is still under-pricing risks.

See also: An Insurance Policy With Some ‘Magic’

The Q2-19 loss ratios are significantly better than what the three firms exhibited in Q2 of 2018, when Lemonade had a loss ratio of 120%, Metromile was at 95% and Root at 112%. The loss ratios are still far higher than the respective market segments.

Having looked at the top line, let’s switch our attention to the loss ratios. For an insurance carrier, the loss ratio is really the litmus test that assesses the strength and quality of the top-line numbers. Loss ratio is a fundamental insurance number, and the fact that all three players have improved this crucial metric is a sign of increased maturity for the “not so” fast-growing trio.

All three improved compared with the prior quarter. This bodes well for the trio. Of the three, Root continues to have the highest loss ratio at 91%, suggesting that between new sales and renewal it is still under-pricing risks.

See also: An Insurance Policy With Some ‘Magic’

The Q2-19 loss ratios are significantly better than what the three firms exhibited in Q2 of 2018, when Lemonade had a loss ratio of 120%, Metromile was at 95% and Root at 112%. The loss ratios are still far higher than the respective market segments.

Missing an edge and story with respect to gaining a sustainable competitive advantage

In our last article talking about insurtech direct-to-consumer (DTC) as a “price game,” we highlighted how the companies have not been able to make customers fall in love with anything other than “saving money.”

We would like to share some thoughts on the business models of these three full-stack carriers, investigating where and how their approaches might both enable and impede them in terms of gaining a sustainable competitive advantage. What might be the proverbial sling that the “insurtech Davids” can use against the entrenched Goliaths of State Farm, Geico, Progressive, Allstate, et al? Let’s explore.

If we consider the economics of an insurer, there are three areas where you can obtain a competitive advantage that can allow financing this kind of “pricing war”:

Missing an edge and story with respect to gaining a sustainable competitive advantage

In our last article talking about insurtech direct-to-consumer (DTC) as a “price game,” we highlighted how the companies have not been able to make customers fall in love with anything other than “saving money.”

We would like to share some thoughts on the business models of these three full-stack carriers, investigating where and how their approaches might both enable and impede them in terms of gaining a sustainable competitive advantage. What might be the proverbial sling that the “insurtech Davids” can use against the entrenched Goliaths of State Farm, Geico, Progressive, Allstate, et al? Let’s explore.

If we consider the economics of an insurer, there are three areas where you can obtain a competitive advantage that can allow financing this kind of “pricing war”:

Probably, hidden in the parent companies income statements, there is some additional investment income obtained investing the cash received by their investors.

However - as of today - the return obtained investing the floating is clearly a competitive disadvantage for the insurtech players.

Loss ratio

As explained in a previous article, the loss ratio is the key measure of the technical profitability of an insurance business . The U.S. P&C market showed $366 billion net losses incurred, which means almost 61% loss ratio (net of loss adjustment expenses). Can any insurtech element allow Metromile, Root or Lemonade to have a competitive advantage on the loss ratio?

Metromile and Root are telematics-based auto insurers. Matteo is a fan of the usage of telematics data on the auto business and an evangelist of these approaches through his IoT Insurance Observatory, an international think tank that has aggregated almost 60 Insurers, reinsurers and tech players between North America and Europe.

Based on the Observatory research, four value creation levers have been the most relevant in telematics success stories:

Probably, hidden in the parent companies income statements, there is some additional investment income obtained investing the cash received by their investors.

However - as of today - the return obtained investing the floating is clearly a competitive disadvantage for the insurtech players.

Loss ratio

As explained in a previous article, the loss ratio is the key measure of the technical profitability of an insurance business . The U.S. P&C market showed $366 billion net losses incurred, which means almost 61% loss ratio (net of loss adjustment expenses). Can any insurtech element allow Metromile, Root or Lemonade to have a competitive advantage on the loss ratio?

Metromile and Root are telematics-based auto insurers. Matteo is a fan of the usage of telematics data on the auto business and an evangelist of these approaches through his IoT Insurance Observatory, an international think tank that has aggregated almost 60 Insurers, reinsurers and tech players between North America and Europe.

Based on the Observatory research, four value creation levers have been the most relevant in telematics success stories: