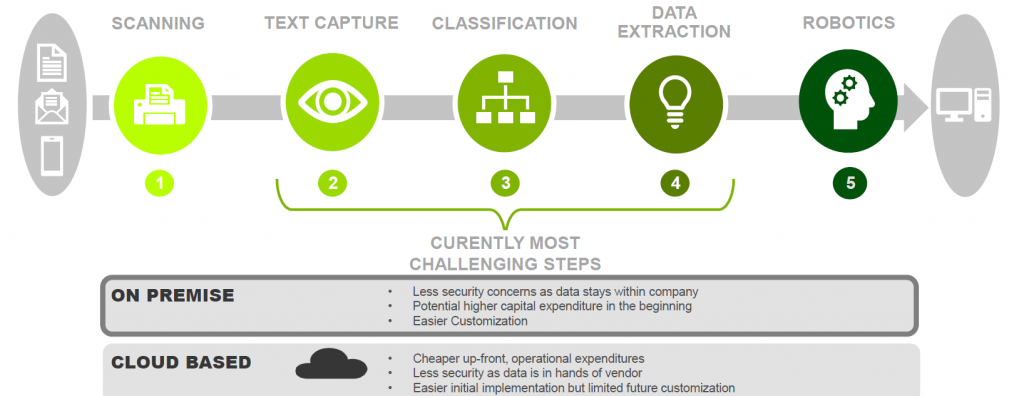

How do you increase the efficiency of your underwriting processes? In this post, I will showcase a solution for a fully automated underwriting process consisting of roughly five steps—solving major challenges in structuring, extracting and analyzing unstructured data.

In this series on how to boost your AIQ, I’m exploring innovative ways to apply artificial intelligence to the insurance value chain. In my first post, I spoke about the artificial intelligence quotient (AIQ), which consists of these key ingredients: technology, data and people and the ability of an enterprise to invest significantly in their in-house AI capabilities and collaborate externally. To achieve success, insurers need to develop these capabilities: both in-house and collaboratively. In my second post, I explained how insurers should start with carving out a clear AI strategy to be able to understand which use cases can be most relevant and conducive to achieving their strategic goals, and focused on the application of AI-related technologies to boost sales and distribution. In this post, I’ll explore how insurers can leverage AI in underwriting and service management. How can insurers use AI in underwriting and service management? Sixty-eight percent of insurance employees expect intelligent technologies to create opportunities for their work, and 63% of insurance executives believe AI will transform the industry. In underwriting and service management, we see several relevant use cases for which insurers could leverage AI-related technologies:- Extraction of insights from multiple data sources (including unstructured)

- Automated demand analysis and generation of new product offerings

- Enhanced pricing and policy rating and personalization

- Natural language question answering for employees.

- Efficient and lean underwriting processes — robo-advisers streamline the process of customer interaction and data gathering, while data analytics helps insurers to make better-informed decisions.

- Improved hit and retention ratios — owing to better insight derived from data analytics and machine learning.

- Increased risk evaluation quality — smart technology increases not only the quantity of information that underwriters and risk managers need to make decisions, but also the quality of the decisions.

From this diagram, we can see that everything in the journey from data input to output can be automated using a selected set of AI-related technologies. This doesn’t mean that there’s no place for humans in this journey; the workforce will likely need to pivot to become trainers, explainers and sustainers (for more about these roles see our Future Workforce Survey for Insurance ). As AI pervades the insurance industry, "raising" and training intelligent machines to function efficiently and responsibly will become a critical role and a significant creator of jobs at different skill levels.

See also: Insurers: Start Boosting Your ‘AIQ’

“Next best action” guidance —how to leverage data insights for your clients’ needs

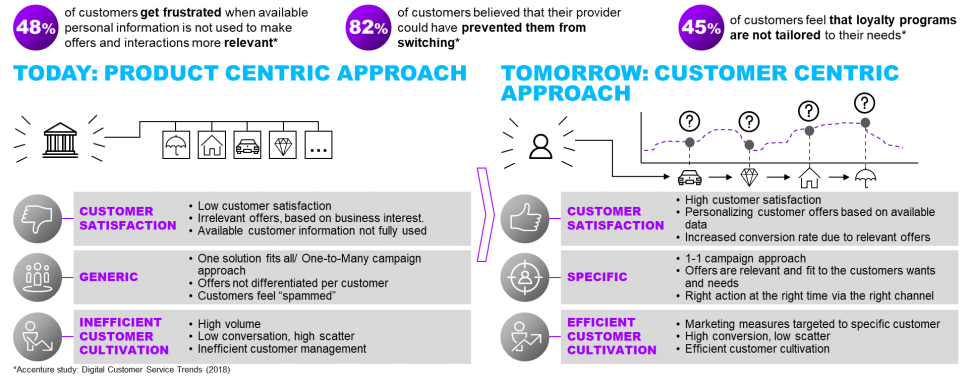

So you’ve structured your unstructured data, and you have more information about your customers’ needs. Many insurers fail to capitalize fully on their data – how can you use it optimally to deliver personalized products and services along the appropriate channels?

From this diagram, we can see that everything in the journey from data input to output can be automated using a selected set of AI-related technologies. This doesn’t mean that there’s no place for humans in this journey; the workforce will likely need to pivot to become trainers, explainers and sustainers (for more about these roles see our Future Workforce Survey for Insurance ). As AI pervades the insurance industry, "raising" and training intelligent machines to function efficiently and responsibly will become a critical role and a significant creator of jobs at different skill levels.

See also: Insurers: Start Boosting Your ‘AIQ’

“Next best action” guidance —how to leverage data insights for your clients’ needs

So you’ve structured your unstructured data, and you have more information about your customers’ needs. Many insurers fail to capitalize fully on their data – how can you use it optimally to deliver personalized products and services along the appropriate channels?

We have developed a 360-degree customer view for insurers to offer the right product via the right channel through "next best action" recommendation engines.

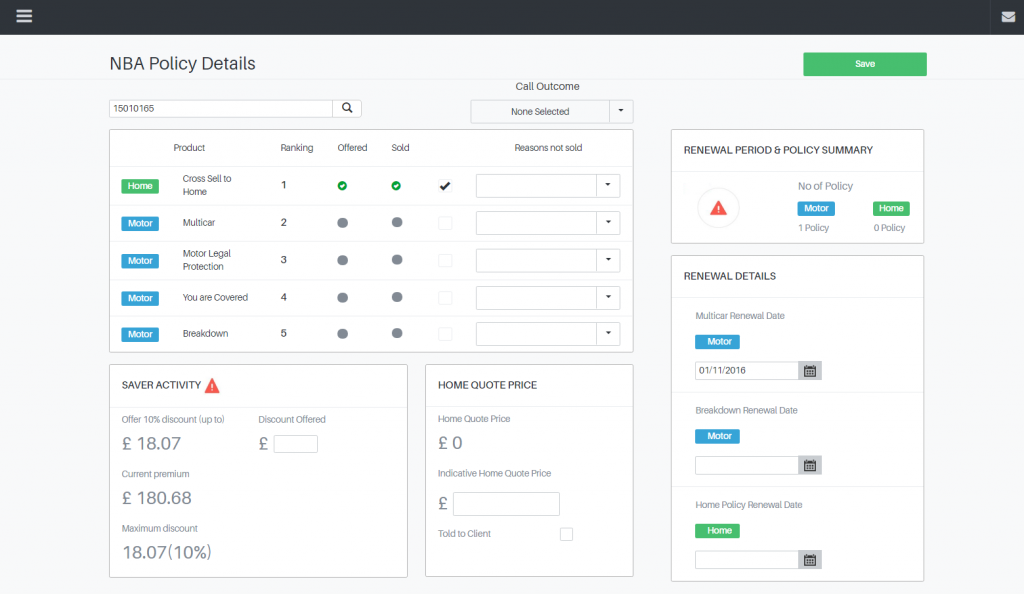

The Accenture Next Best Action (NBA) app shows how insurers can deliver personalized offerings that cover the customer’s predicted growing insurance needs and wants. NBA empowers businesses with a real-time and customized decision-making service that provides relevant and timely offers to drive value. NBA is a data analytics-based marketing solution that provides inbound and outbound touch points with a customer recommendation engine to drive additional revenue.

We have developed a 360-degree customer view for insurers to offer the right product via the right channel through "next best action" recommendation engines.

The Accenture Next Best Action (NBA) app shows how insurers can deliver personalized offerings that cover the customer’s predicted growing insurance needs and wants. NBA empowers businesses with a real-time and customized decision-making service that provides relevant and timely offers to drive value. NBA is a data analytics-based marketing solution that provides inbound and outbound touch points with a customer recommendation engine to drive additional revenue.

NBA has been shown to achieve a 30% to 45% increase in cross-sell and up-sell. How? The recommendation engine draws on available data to present insurers with a full overview of the best actions to be pursued, allowing them to respond to the needs of customers across a wide range of situations.

What is NBA?

NBA has been shown to achieve a 30% to 45% increase in cross-sell and up-sell. How? The recommendation engine draws on available data to present insurers with a full overview of the best actions to be pursued, allowing them to respond to the needs of customers across a wide range of situations.

What is NBA?

- A decision paradigm uses a combination of predefined business rules and advanced analytics to recommend a next best action.

- For each interaction, NBA identifies the best proposition to be presented to the customer with an acceptable degree of predictability about the behavior or response.

- Integration of all communication channels, inbound and outbound, ensures a consistent customer experience.