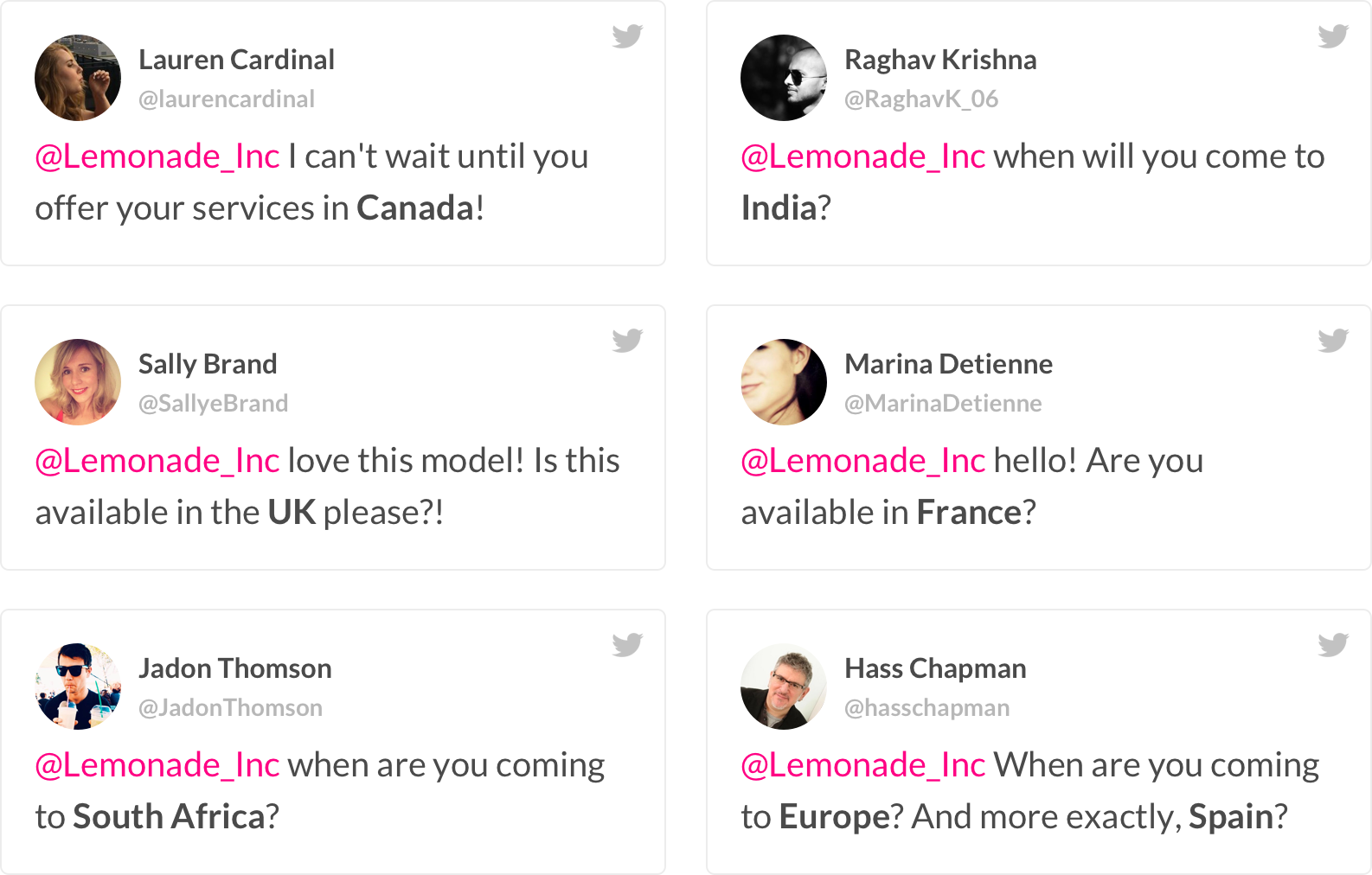

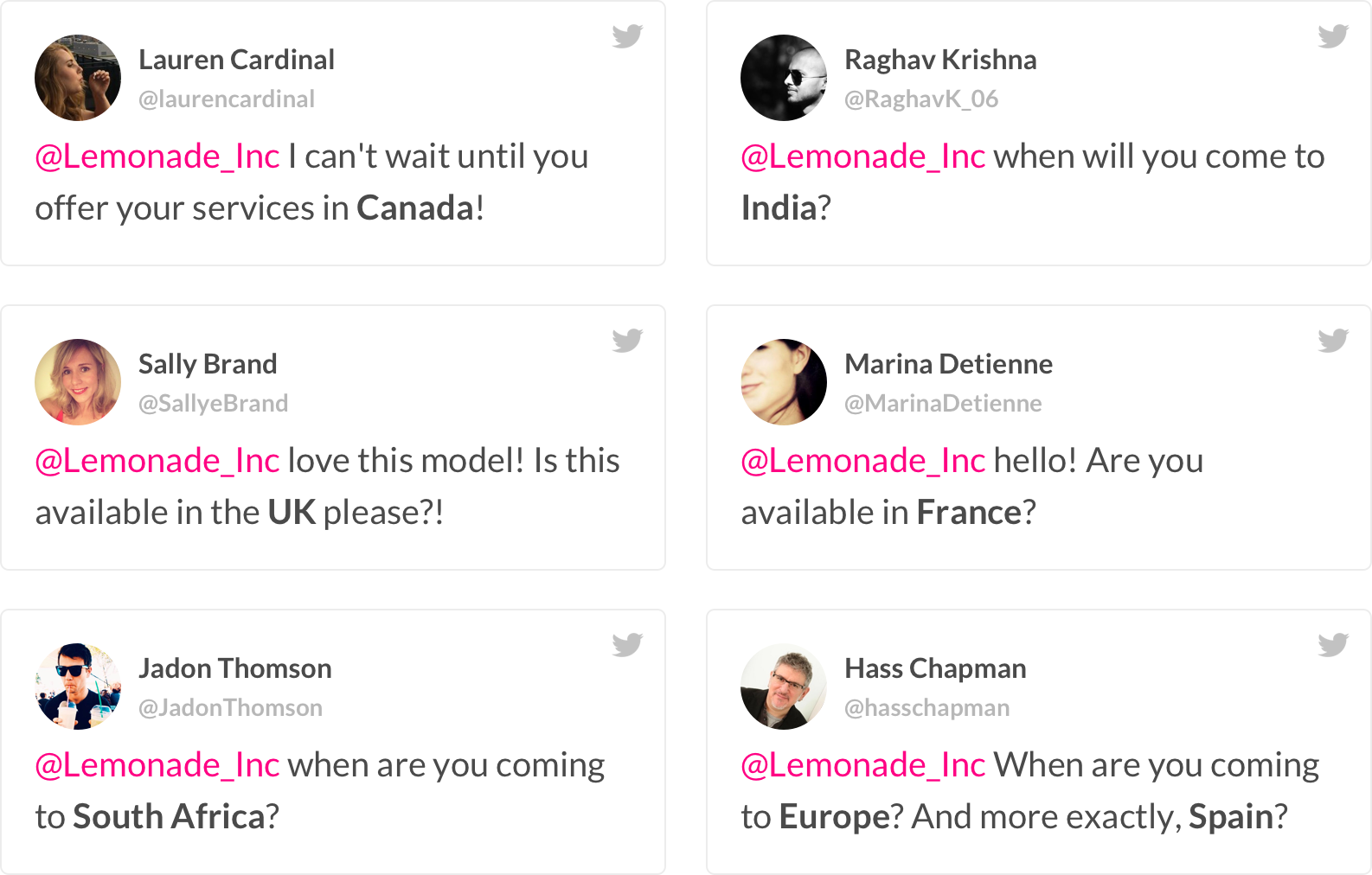

Digitally enabled folks have a common denominator: They tap to get a ride, order a meal, get groceries delivered, find a soulmate… and they’d readily do the same to get insurance. We may be divided by international borders, but our connectivity is so intertwined that it has become the natural fabric that weaves us together.

It’s not only the technology that makes international prospects so enticing. We believe our mission of trust and transparency is universal, too.

Through his behavioral economics research, our Chief Behavioral Officer Dan Ariely reminds us that the way the insurance system is designed brings out the worst in us humans. Whether you’re in New York or Paris or Tokyo, that inherent conflict between insurance company and its customers brings out bad behavior from all sides. Bad behavior is rooted in the same human nature all over the world.

See also: Lemonade Really Does Have a Big Heart

So we’re not stopping at the water’s edge. We believe that being built on AI and behavioral economics means that, at a profound level, we’re building something with universal appeal. The world is flat; it's time insurance was, too.

Digitally enabled folks have a common denominator: They tap to get a ride, order a meal, get groceries delivered, find a soulmate… and they’d readily do the same to get insurance. We may be divided by international borders, but our connectivity is so intertwined that it has become the natural fabric that weaves us together.

It’s not only the technology that makes international prospects so enticing. We believe our mission of trust and transparency is universal, too.

Through his behavioral economics research, our Chief Behavioral Officer Dan Ariely reminds us that the way the insurance system is designed brings out the worst in us humans. Whether you’re in New York or Paris or Tokyo, that inherent conflict between insurance company and its customers brings out bad behavior from all sides. Bad behavior is rooted in the same human nature all over the world.

See also: Lemonade Really Does Have a Big Heart

So we’re not stopping at the water’s edge. We believe that being built on AI and behavioral economics means that, at a profound level, we’re building something with universal appeal. The world is flat; it's time insurance was, too.The World Is Flat; Insurance Is Round

Lemonade says that, being built on AI and behavioral economics, means that they’re building something with cross-border appeal.

Digitally enabled folks have a common denominator: They tap to get a ride, order a meal, get groceries delivered, find a soulmate… and they’d readily do the same to get insurance. We may be divided by international borders, but our connectivity is so intertwined that it has become the natural fabric that weaves us together.

It’s not only the technology that makes international prospects so enticing. We believe our mission of trust and transparency is universal, too.

Through his behavioral economics research, our Chief Behavioral Officer Dan Ariely reminds us that the way the insurance system is designed brings out the worst in us humans. Whether you’re in New York or Paris or Tokyo, that inherent conflict between insurance company and its customers brings out bad behavior from all sides. Bad behavior is rooted in the same human nature all over the world.

See also: Lemonade Really Does Have a Big Heart

So we’re not stopping at the water’s edge. We believe that being built on AI and behavioral economics means that, at a profound level, we’re building something with universal appeal. The world is flat; it's time insurance was, too.

Digitally enabled folks have a common denominator: They tap to get a ride, order a meal, get groceries delivered, find a soulmate… and they’d readily do the same to get insurance. We may be divided by international borders, but our connectivity is so intertwined that it has become the natural fabric that weaves us together.

It’s not only the technology that makes international prospects so enticing. We believe our mission of trust and transparency is universal, too.

Through his behavioral economics research, our Chief Behavioral Officer Dan Ariely reminds us that the way the insurance system is designed brings out the worst in us humans. Whether you’re in New York or Paris or Tokyo, that inherent conflict between insurance company and its customers brings out bad behavior from all sides. Bad behavior is rooted in the same human nature all over the world.

See also: Lemonade Really Does Have a Big Heart

So we’re not stopping at the water’s edge. We believe that being built on AI and behavioral economics means that, at a profound level, we’re building something with universal appeal. The world is flat; it's time insurance was, too.