The second-worst-kept secret of the year, after the launch of Google Compare in the U.S., is Berkshire Hathaway announcing its plans to sell insurance directly to business owners over the web. Quelle surprise.

I recently spoke with a C-suite exec who told me that "direct" is a dirty word.

Perception is reality.

In reality, though, "direct" is a lousy term that doesn't do justice to the implementations that today's technology has to offer that are often in direct alignment with an insurance company's business model.

The conversation becomes uncomfortable to some once the word "middlemen" is introduced. It doesn't have to be.

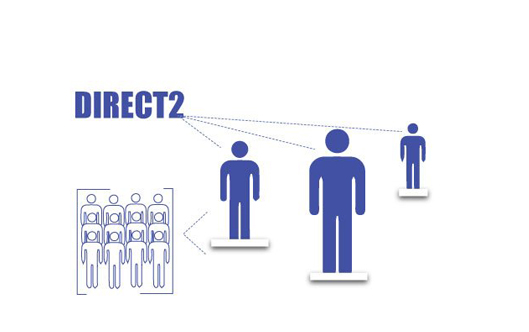

There are two primary outcomes to direct selling: (1) eliminating the middlemen or (2) empowering them. For visualization purposes, consider the following three brands:

Quotemehappy.com occupies the left extreme of selling directly to consumers. A spin-off of Aviva since 2011, the online insurer only provides phone support if a customer has a claim. For all other inquiries, there is browsing. Then there are the Geicos of the world, where insurers offer the convenience of buying on the web with the assurance of speaking to an agent, when needed. To the right extreme, Plymouth Rock provides an example of an insurer that has a patent-pending technology that matches online quotes to agents either pre- or post-purchase. There are several other players occupying the comfortable middle with direct-to-consumer models that offer varying degrees of human interaction.

Typically the outcome is determined by the company's original distribution channel: whether offline, web or mobile. The table below further illustrates how versatile "going direct" can be:

- Geico, Policy Genius and Cuvva are examples of insurance companies that implemented a direct-to-consumer strategy from the get-go; here, direct is a no-brainer.

- Plymouth Rock and Quotemehappy.com via Aviva signal companies that implemented a direct-to-consumer strategy in an attempt to address a change in the market.

- Allstate acquired Esurance to buy its way into the direct market, and so did AmFam with the acquisition of Homesite.

- Also, AmFam invested in insurance comparison site CoverHound.

When all is said and done, direct selling is first and foremost a marketing channel that empowers the consumer. Sans proper marketing and messaging, the online insurance journey is transactional at best, and players risk commoditizing their product.

"Commodity." Now there's a dirty word for you.